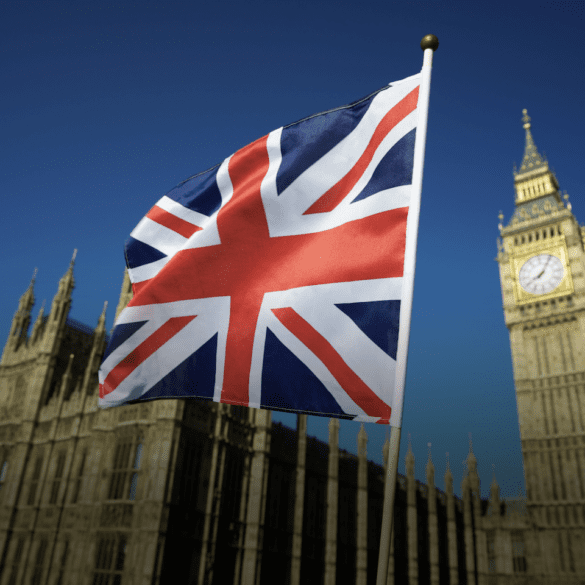

Consumer sentiment is changing towards online banking in the UK. We explore the potential reasons why official figures have shown a downward trend in customers willing to recommend their online bank and banking app over the last 4 years, and how the rise in online fraud is a key contributing factor.

With the heightened cost of living battering UK PSPs, many consider Open banking to be the silver bullet, but with adoption at only 10% of the population, innovation is needed.

Once a leader in fintech, the UK has slipped, losing its lead to the US. Could it slip even further into irrelevance?

Nova Credit UK will assist in improving access to credit products for the nation's growing immigrant population.

Chancellor, Jeremy Hunt presented a vision to make the the UK "the next silicon valley" but changes could stifle fintech innovation.

Preserving singleness of money as stablecoins are introduced are just one of the challenges UK regulators will face in ongoing regulation.

The UK gig economy is underserved by lenders' traditional affordability assessment. A shift to probability of future income could be key.

The approval of the EU's MiCA legislation highlights post-Brexit UK's regulatory shortcomings - could it be boosted?

Jeremy Hunt's announcement today was less a "Big Bang 2.0” and more a conservative nudge to the existing financial system.

As chancellor in 2020, Sunak requested a review of the UK's fintech sector, also known as the Kalifa Review, published in February 2021.