Thin-file consumers can make a good credit bet

Fintechs have touted the importance of cashflow data in underwriting. This week, the CFPB published their evidence to support the approach.

In this episode we chat with Pankaj Kulshreshtha, the CEO and founder of Scienaptic about advanced underwriting technology and why AI is key to their solution

In episode 364 we talk with Kareem Saleh, the CEO and Founder of Fairplay where we discuss fairness in underwriting models and why we have to do better as an industry in eliminating bias

After coming out of 'stealth' with a $31 million Series B in August, the embedded lending architecture fintech jaris announced a partnership with HoneyBook.

The CEO and Co-Founder of Stratyfy, Laura Kornhauser, discusses how advanced AI underwriting models are now becoming more widespread in the banking system.

In this episode we talk with the CEO of Zest AI, Mike de Vere, about using artificial intelligence in underwriting and why it is now an essential tool for all lenders today.

This year has already seen some major shifts in focus for the BNPL market- should banks be concerned about the B2B focus?

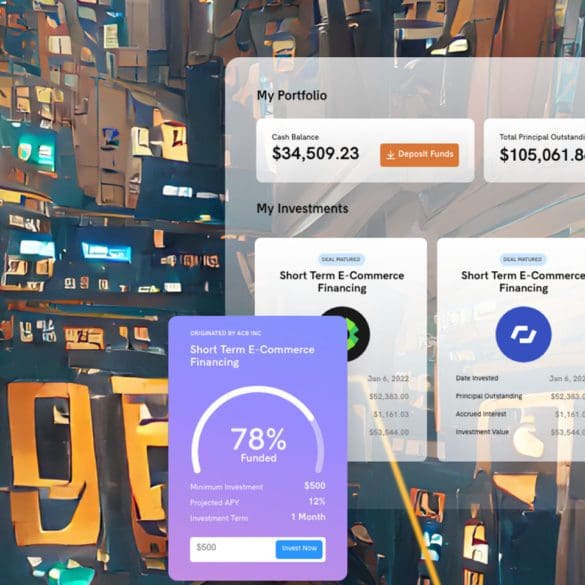

Taking on the estimated $9 trillion private credit market, Percent recently launched an all-in-one platform to help anyone underwrite in the private credit space.

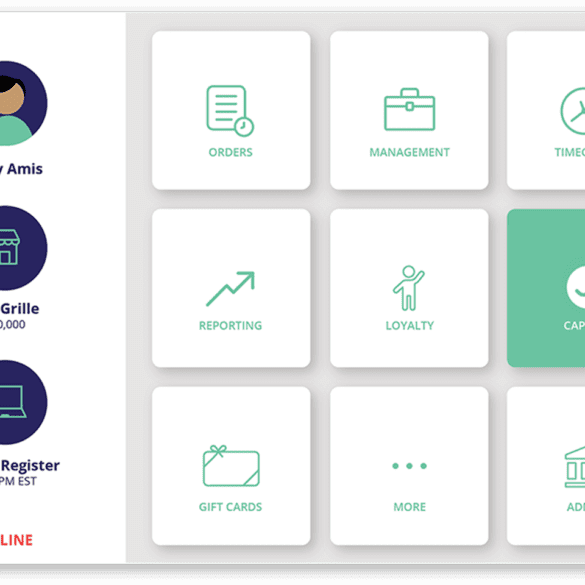

There are more than 5,000 credit unions in the United States according to the NCUA. Most of them are small...