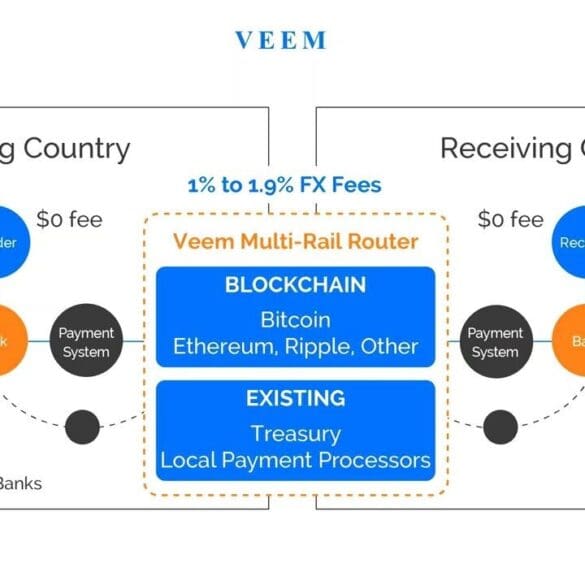

In this conversation, we talk with Marwan Forzley of Veem about how the rampant evolution of the mobile phone spurred his fascination to turn the phone into a business-to-business (B2B) payments network. Additionally, we explore how generations of companies have tried to use correspondent banking to solve for B2B cross border and failed, the intricacies of payment rails and the infrastructure to support them, the impact of COVID on global e-commerce, how the future will blend the distinctions between digital wallets, banking services, and crypto wallets.

America’s Credit Union (ACU) partners with cross border payments company Veem to expand their reach to small businesses; the partnership...

Historically, sending wires is one of the more painful tasks that any business has to do. It has usually involved...

National Australia Bank's (NAB) venture capital business, NAB Ventures has joined in an investment round raising $24 million for Veem, a foreign exchange startup business; Veem provides business to business cross border payment services with blockchain technology; NAB and NAB Ventures have been actively involved in technology investments also investing in Data Republic, Medipass Solutions and Localz; Australia is also taking a lead role in developing blockchain standards globally; it is active in the development of blockchain standards through the ISO/TC 307 and will host the first international blockchain standards meeting for ISO/TC 307. Source