Most people likely assume their funds are kept in a traditional bank to be drawn upon when transacted because — let's be honest — no one reads the terms and conditions.

Walia sees plenty of activity in BNPL, beginning with brands partnering with banks to introduce their BNPL capability.

Venmo announced late last week a new feature called Business Profiles; the feature allows SMBs to have a profile on...

Square’s Cash App and PayPal’s Venmo has seen a surge in usage during the pandemic as people are finding new...

A new study by J.D. Power says midsize banks should be using email a lot more when communicating with customers;...

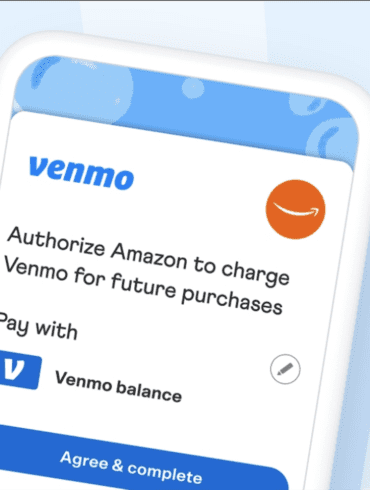

Amazon's deal with Venmo has the potential to set a new standard for payment tenders in general, and other brands are likely to follow in its footsteps.

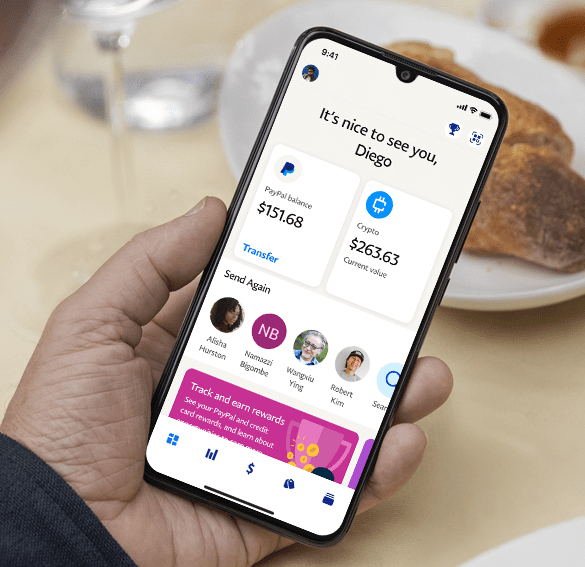

PayPal just launched what it calls a super app. It has a cash account with a 0.40% interest rate, direct deposit, money movement, bill pay, and remittance features. It also integrates shopping functionality with rewards and cash back. In this analysis, we compare this offering with Google Pay and Square Cash App, as well as trace the DNA of PayPal to understand whether such an offering will succeed where others failed.

Why Relationships Still Matter: How Community Banks Saved The Country During Covid-19 Republic’s First Three Real Estate Offerings Have Already...

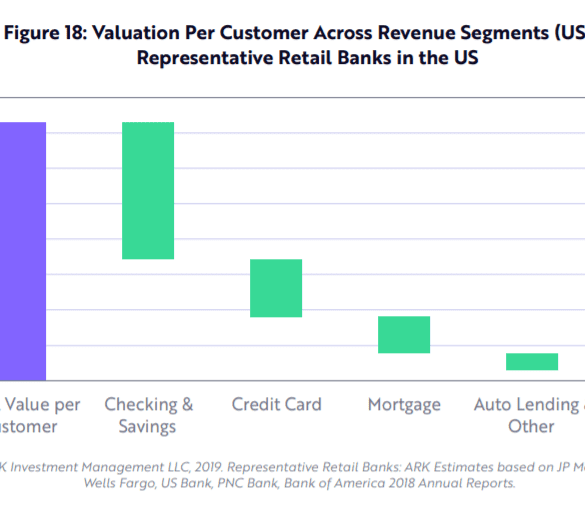

Welcome back to the Fintech Blueprint / Rebank podcast series hosted by Will Beeson and Lex Sokolin. Max Friedrich is a fintech analyst a ARK Invest, a public markets investment manager focused on disruptive technologies including autonomous tech, robotics, fintech, genomics and next generation internet. Max recently published a report on digital wallets, including Venmo and Square’s Cash App, which is available for download on ARK’s website. In this conversation, we explain why Cash App has seen exponential growth.

2019 was a banner year for mobile banking with finance apps accessed more than one trillion times and registrations growing...