There was an analysis done in 2017 showing that 2 percent of VC capital went to startups founded by women...

Machine learning and predictive analytics have started to make a real difference in the VC world when it comes to finding investments; VC’s typically traveled a lot and met with thousands of companies to find a few investments; by using machine learning to break down troves of data, like job postings or performance in the App Store, investors can find potential gems without the same laborious effort; VC firms are investing in tools to help them refine searches and comb through thousands of companies quickly; increased computing power and cheaper ways to rent server capacity has really helped VC’s, even the small firms, use these techniques every day. Source.

[Update: The webinar replay is now available here.] This Wednesday LendIt and Innovate Finance are teaming up with some the leading...

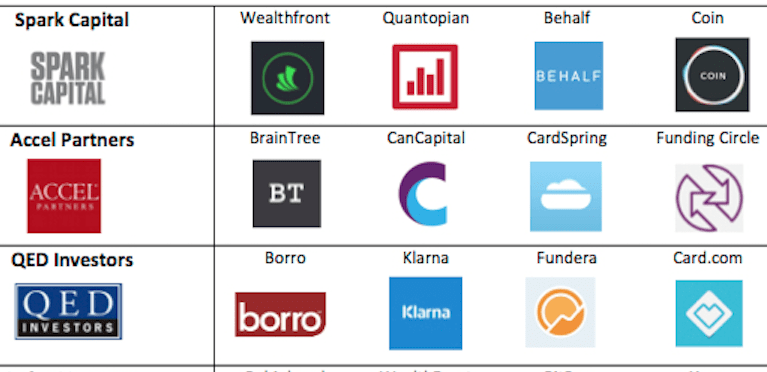

There are no shortage of VC firms who have allocated dollars to various fintechs throughout the world. But for individual...

Upstart is gearing up for growth. One of the newer marketplace lenders announced some big news today. They have closed...

Last year was a record year for fintech funding with VC-backed fintech companies raising close to $40 billion globally; there...

CB insights has compiled a list of the top European venture capitalists by country based on the number of portfolio companies they have backed; the list focused on the most active investors of the last five years and included VCs, corporate VCs, growth equity firms and super angels. Source.

Fintech companies are always looking for the right type of venture capital for their business; at LendIt USA 2017 we hosted a panel that featured a diverse group of leading venture capitalists in the fintech space; the panel was a great mix with a seed stage investor, an international investor, a nonprofit fund looking to grow jobs and the fintech sector in New York, a credit fund who has moved into venture capital investing and a strategic investor at a key Wall Street bank; panelists discussed their investment strategies when evaluating companies and when they look to invest during a company's lifecycle; panelists also discussed key areas where money is currently being invested and what areas of fintech are oversaturated with capital. Source

[Editor’s note: This is a guest post from James Alexander, an experienced marketplace lending executive who has been following this industry...

·

China’s P2P lending industry is the next big thing. It fills a critical need that the existing state-owned banking industry...