This Forbes piece digs into how financial services companies might be impacted by the Coronavirus; both Visa and Mastercard have...

ChargeAfter operates in the point of sale space, connecting merchants and lenders to provide more options for consumers; the strategic...

Talking with Karen Webster of PYMNTS, NovoPayment CEO Anabel Perez said that banks will find it difficult to match the...

Visa and Mastercard currently rank 7th and 11th on the S&P 500; their stock prices have increased around 50% over...

Writing his weekly column in Forbes Ron Shevlin of Cornerstone Advisors talks about a few different points of view when...

The year has started out strongly for fintech M&A with four significant deals announced in just the first two months;...

Visa is making big changes to the rates that merchants pay to use their cards; the interchange rates will now...

Venmo continues to pay dividends for PayPal with the p2p payments app growing payments volume by 56 percent in the...

Fintech platform SoFi has struck a new exclusive partnership with card issuer Mastercard to be the sole issuer for SoFi...

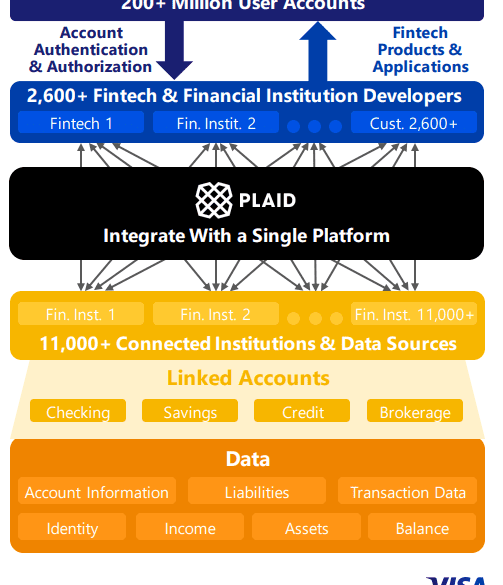

I dig deeply into the $5.3 billion acquisition of data aggregator Plaid by $500 billion payments network Visa. We examine why this deal is worth 25-50x revenue, while Yodlee's sale to Envestnet was priced much lower. We also look at how Plaid could be an existential threat to Visa, and why paying 1% of marketcap to protect 200 million accounts may be a good bet. Broader implications for product manufacturers across payments, investments, and banking also emerge -- the middle is getting carved out, and infrastructure providers like Visa or BlackRock are moving closer to the consumer.