Just a few days ago we learned of Visa buying Plaid and now they have invested in another fintech company;...

Yesterday it was announced that Visa is planning to buy Plaid for $5.3 billion, double the valuation of Plaid’s 2018...

China’s central bank as accepted Amex’s application to start a bank card clearing business, but they still need to receive...

Facebook plans to reveal their crypto plans next week and now they count a group of impressive backers to support...

Fintechs owned 1 percent of unsecured lending in 2010, they now account for 40 percent; Visa estimates that 5 percent...

The $5.3 billion acquisition of Plaid has created excitement in the fintech community and some believe this is only the...

Fintech companies continue to attract interest from traditional financial institutions and now we have a significant acquisition to start off...

I look at the similarities between the NYSE building out direct listing products to augment or replace IPOs, and Central Banks considering launching consumer-facing digital currencies. In each case, the value chain of the respective financial sector is compressing, as the underlying manufacturers of financial product move closer to the consumer. I also highlight how a few blockchain-native alternatives to trading and rebalancing software are developing, and the reasons to get excited about things like Set, Uniswap, and Aragon.

New York City’s Metropolitan Transit Authority has partnered with Visa to launch a tap to pay system for subways and...

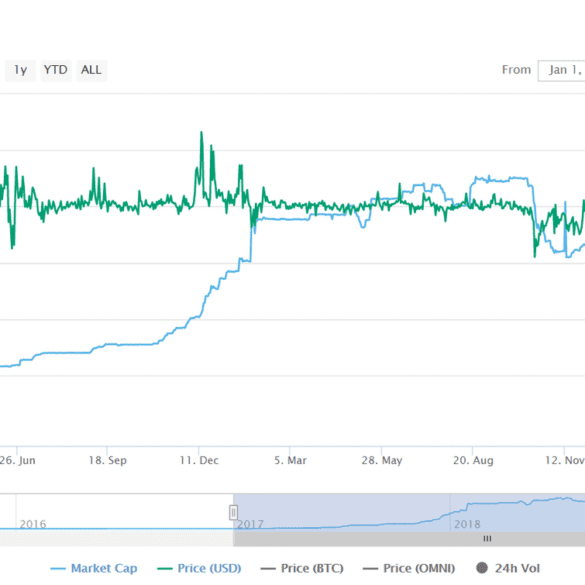

There is poetry in the symmetry of this situation. Bitfinex is looking to raise $1 billion in capital to support the most popular stablecoin Tether, which it controls. Facebook is reportedly looking to raise $1 billion in capital from First Data, Visa and Mastercard and other payments companies to shore up its own stablecoin asset. Poetry is where the similarities end, and all these devils are in the details.