In our latest guest post, direct response marketing veteran Mike Gunderson discusses the seven ways voice marketing enhances digital banking;...

Many predict that Amazon will introduce a payments system for Alexa; American Banker looks at whether Amazon is really ready for to make this a reality; one of the biggest problems relates to the ability to authenticate transactions; Alexa isn’t able to distinguish whether a person is who they claim to be; article also shares the banks that are currently leveraging voice technology with some of the early adopters being US Bank, USAA, Ally, Capital One and TD Bank. Source

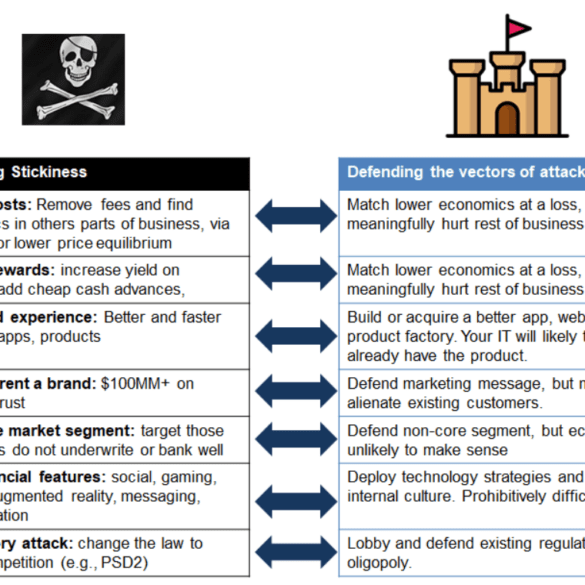

JP Morgan just shut down its neobank competitor Finn, targeted at Millennials in a smartphone app wrapper. Several other traditional banking incumbents have similar efforts, from Wells Fargo's Greenhouse, Citizens Bank's Citizens Access, MUFG's PurePoint and Midwest BankCentre's Rising Bank, as well as most of the Europeans (e.g., RBS competition to Starling called Mettle). These banks have every advantage -- from product infrastructure, to balance sheet, to regulatory licenses, to physical footprint, to relationships with the older generation. So how is it that players like Chime, MoneyLion, Revolut, and N26 are all able to get millions of happy users and the incumbents are failing?