Analysts at asset manager, Bernstein, believe the future is bright for robo advisors; in a recent client memo the firm concluded that BlackRock and Fidelity will eventually incorporate them into their business and technology giants Google and Facebook could be their main competition; though the current disruption from robo advisors is minimal, the largest one has $60 billion AUM as compared to Fidelity with $5.1 trillion AUM, the technology is what will be most useful for the wealth management industry; you have already seen big names like Deutsche Bank and UBS launch robo advisors, while BlackRock and Invesco have made acquisitions of the technology. Source

[Editor’s note: This is a guest post from Tharon Smith, Managing Director of LendIt China. Tharon is an expert in...

There was an article published in American Banker yesterday titled, Bank Branches Don’t Die, They Evolve. For those who don’t...

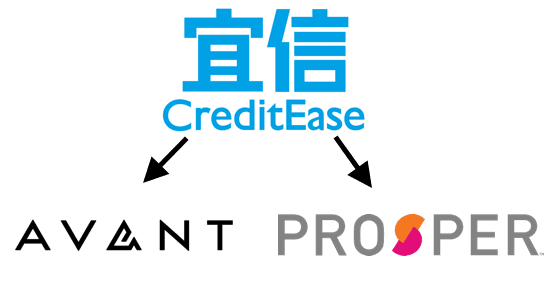

I first became aware of CreditEase back in June 2013 at the inaugural LendIt conference in New York. We met...

No More Content