A new survey by Cornerstone Advisors examined six questions about consumers primary financial institution and found some interesting trends amongst...

The Student Borrower Protection Center released a report which digs into how education data in underwriting may be causing educational...

Asset management divisions within big banks have always been a solid revenue source but recently they have taken on greater...

A 2019 survey by Cornerstone Advisors found that 44 percent of millennials banked with Bank of America, JPMorgan Chase and...

JPMorgan Chase plans to block fintechs from screen scraping as they believe the practice is putting the bank at greater...

Wells Fargo said their APIs were called more than 1.5 billion times last year as the bank looks to increase...

Plaid CEO Zach Perret is in favor of banks allowing customers to have control over access of their data; Plaid...

With most of the large banks reporting earnings this week one trend has become clear; as the loan books have...

Wells Fargo was one of the first banks to use online banking back in the 1990s but now finds itself...

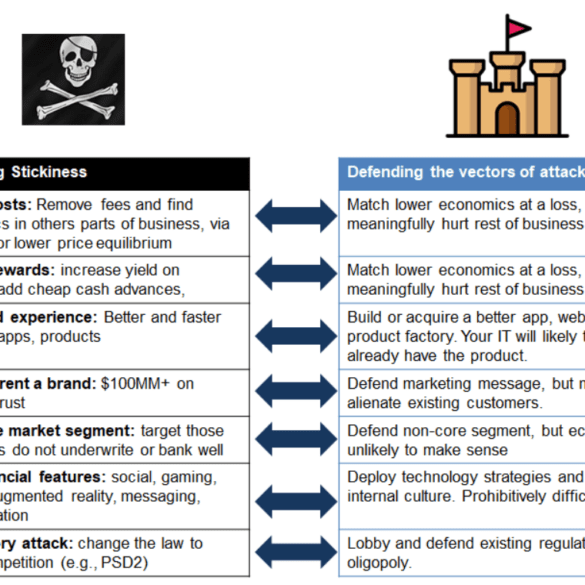

JP Morgan just shut down its neobank competitor Finn, targeted at Millennials in a smartphone app wrapper. Several other traditional banking incumbents have similar efforts, from Wells Fargo's Greenhouse, Citizens Bank's Citizens Access, MUFG's PurePoint and Midwest BankCentre's Rising Bank, as well as most of the Europeans (e.g., RBS competition to Starling called Mettle). These banks have every advantage -- from product infrastructure, to balance sheet, to regulatory licenses, to physical footprint, to relationships with the older generation. So how is it that players like Chime, MoneyLion, Revolut, and N26 are all able to get millions of happy users and the incumbents are failing?