Last year SoftBank agreed to make a €900mn investment into Wirecard; as part of the deal they were going to...

Supreme Court strikes down CFPB leadership structure Experian’s Rob Haslingden: “Open Finance has the potential to fuel the growth of...

Accounting firm Ernst & Young failed to request bank statements from the Singapore bank that the fintech claimed to have...

WhatsApp, Brazil Central Bank In Talks To Restore Payments Service Volcker Rule reforms expand options for raising VC funds CMG...

The Financial Times put together a detailed timeline of Wirecard’s history as they rose to be considered one of the...

Consumers and small businesses in the UK have been hit by the Wirecard scandal as the UK’s Financial Conduct Authority...

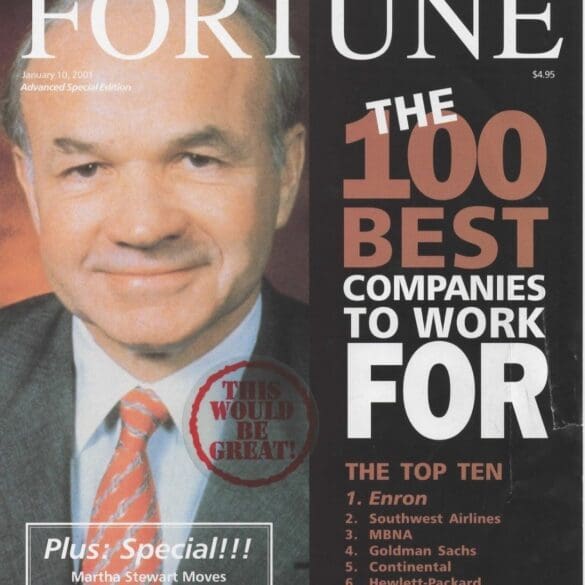

This week, we consider the impact of financial infrastructure collapse and who really gets hurt through the lens of Wirecard, Enron, and Lehman Brothers. Yes, there are investors in the entity that will lose value. But there are also clients and counterparties of Wirecard, like Curve, Revolut, and Crypto.com. In the case of Lehman, there was a $40 trillion derivatives notional amount that took twenty years to wind down. We also consider the most recent $500,000 hacking in DeFi of an automated market maker to see if there are common threads to be drawn between the two worlds.

With Wirecard causing major headaches for European fintech companies Revolut is one company poised to take advantage of the situation...

WhatsApp launches payments in Brazil and is unceremoniously shut down by the central bank a week later, MasterCard buys Finicity to protect itself against Visa’s recent acquisition of Plaid, Checkout.com continues its largely silent meteoric rise in payments, Softbank-backed and DAX 30 index component Wirecard “loses" $2 billion from its balance sheet and files for insolvency, Upgrade raises $40 million at a $1 billion valuation to extend its personal credit offering.

Today, the UK financial regulator, the Financial Conduct Authority, has suspended the activities of Wirecard’s UK subsidiary; this is having...