Zopa, who specializes in unsecured consumer loans may be looking to expand into secured loans, specifically the auto segment; the company sees a healthy level of demand but a generally poor consumer experience; Zopa's Chief Marketing Officer Amy Miller stated, "People are getting poor deals in that area and end up paying significantly higher annual percentage rates than they would if they arranged their financing before going into a dealership."; the company is also reportedly considering other loan terms, such as 18 month loans as well as a balloon payment loan. Source

The UK's oldest and biggest online lender will be cutting rates by 0.2% across all accounts for the third time in the last five months; Chief Product Officer Andrew Lawson told investors via email that since competitors have been cutting rates they also needed to continue their rate cuts and they could also see this trend continuing; left with a choice of cutting rates or lending to a risky borrower, Zopa opted to cut rates and keep their lending practices static. Source

Zopa provides 2016 year end stats; in total they lent 680 million British pounds ($830 million); helped 20,000 people improve their home and 29,000 buy a car; the company also highlights several awards they won including Most Trusted Loan Provider by Moneywise for the seventh year in a row; the company struck many partnerships including offering phone finance with Unshackled, loans through personal finance app Pariti and a partnership with Airbnb; company also launched three new lending products for investors with varying risk and return profiles; in 2016 we also saw the first securitization of Zopa loans and learned of Zopa's plans to apply for a banking license. Source

After a break in new investor inflows, Zopa has reopened to investors; the firm closed its platform to new investments at the beginning of December; cited an imbalance in borrower versus investor demand; firm is now accepting new investments with a 4.2 million British pound ($5.24 million) platform capacity. Source

P2P-Banking has released its monthly report on loan originations; Funding Circle led originations for the month at 106.1 million euros, also reporting a new monthly high; Zopa and Ratesetter also topped the list; Zopa reported monthly loan originations of 85.3 million euros and Ratesetter had loan originations of 63.9 million euros. Source

Zopa, the industry's first P2P lender, has reached a new milestone, originating over 2 billion British pounds ($2.5 billion) in loans since 2005; according to Zopa the firm has originated 300,000 loans from 246,000 borrowers and has 75,000 investors; in the UK, Funding Circle is also close to reaching the 2 billion British pound mark with cumulative loan originations of 1.92 billion British pounds ($2.40 billion) since its launch in 2010. Source

Crowdfund Insider talked with Zopa about 2016 and 2017; the firm had a successful year in 2016 despite the industry's challenges; highlights from the year included lending over 680 million British pounds ($855.02 million) to nearly 100,000 customers, becoming profitable, securitizing its first loan portfolio and announcing plans to launch a bank; in 2017 the firm plans to build on its success while also beginning plans for launching a bank with deposit accounts and overdraft alternatives by 2018; in its core business products, Zopa CEO Jaidev Janardana says the firm will be looking for new partnerships that support its auto finance, point of sale and personal loan businesses. Source

Since Lending Club announced the first bank partnership in 2013 banks have been increasing their involvement in the marketplace lending...

Zopa has announced it plans to apply for banking licenses; company will be the first alternative finance platform to seek licensing as a bank; CEO Jaidev Janardana wrote to clients on Wednesday with details on the company's plans; Zopa will seek to offer deposit accounts and new lending products; requires Prudential Regulation Authority and Financial Conduct Authority licenses which the company expects to take 15 to 24 months. Source

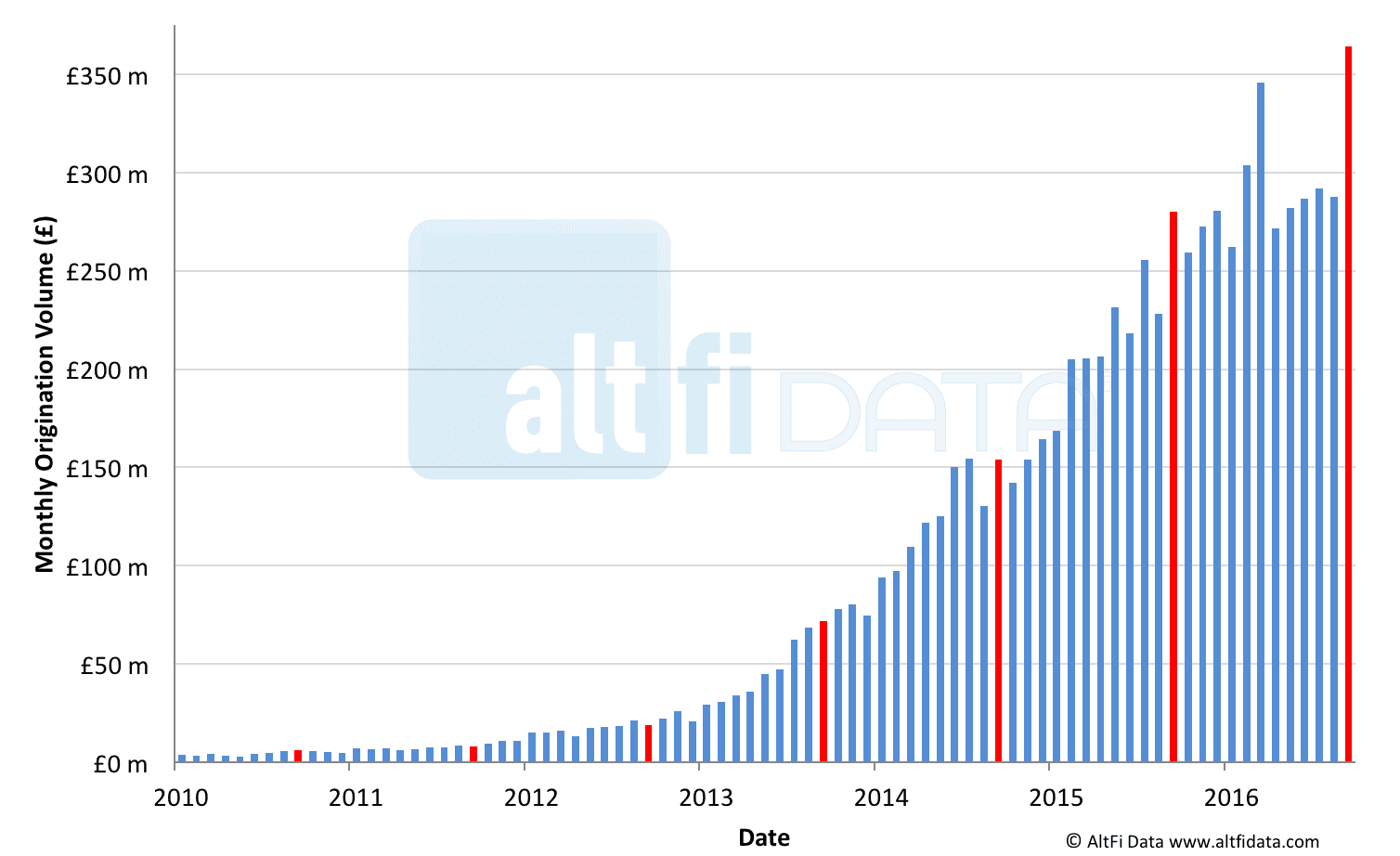

According to the Liberum AltFi Volume Index, September 2016 originations for online lenders hit £364m in the UK. September was...