A few weeks ago the World Bank released the triennial Global Findex Database for 2017. We covered the release on Lend Academy touting the progress the world has made towards more financial inclusion, particularly in developing countries. Now, the Center for Financial Inclusion, part of Accion, have released a follow up report digging into the Findex data and the picture is less rosy than what was highlighted in the World Bank’s initial report.

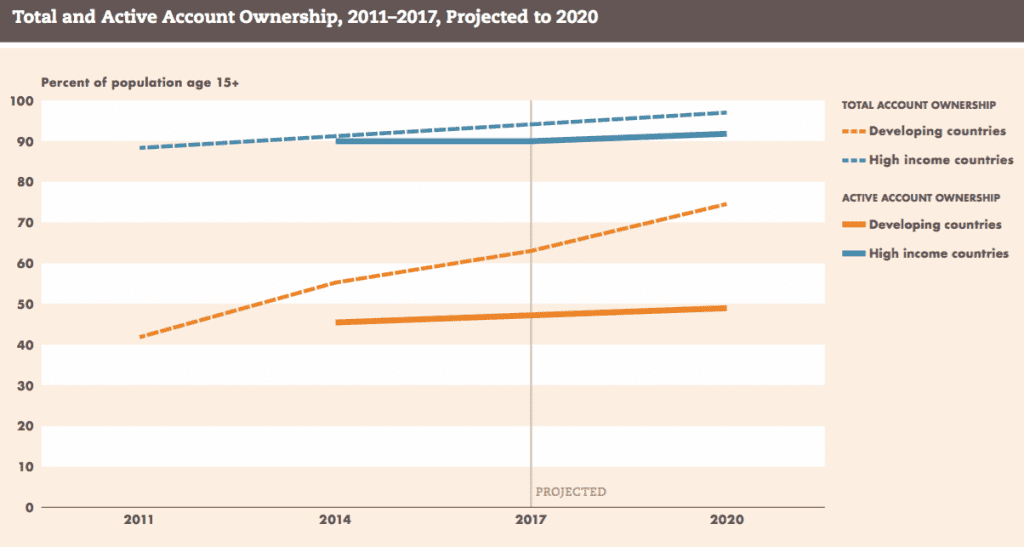

On the surface it looks like the world is making good progress towards financial inclusion with the Findex report showing that 68% of adults globally having some kind of bank account versus 61% in 2014 and 51% in 2011. That is rapid progress.

But CFI found a different story when just focusing on active accounts, those accounts that had some kind of transaction in the past 12 months. This takes the percentage down to 55% and what is worse the gap is widening between total accounts and active accounts indicating a growing number of people who open an account but never use it. This is true for both developing and high income countries but the gap is getting much wider in developing countries as shown in the graphic below.

For true financial inclusion to materialize we need to focus on account usage not just total accounts, that much is clear. But there are hundreds of millions of people now with inactive accounts. From the report:

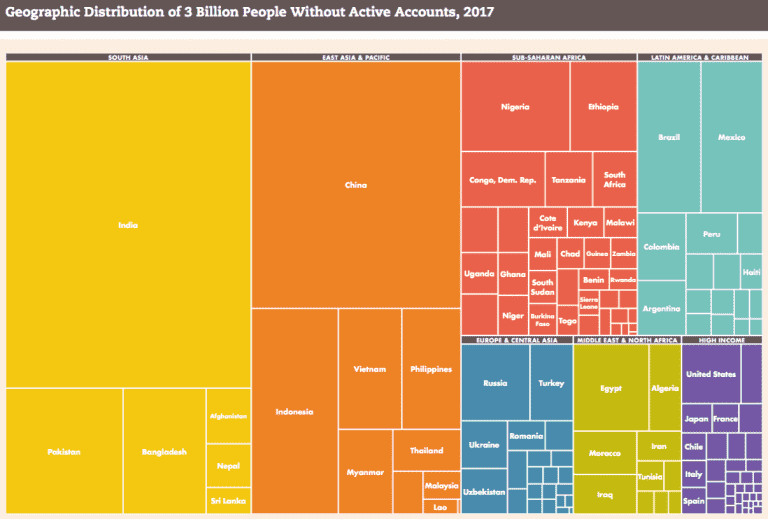

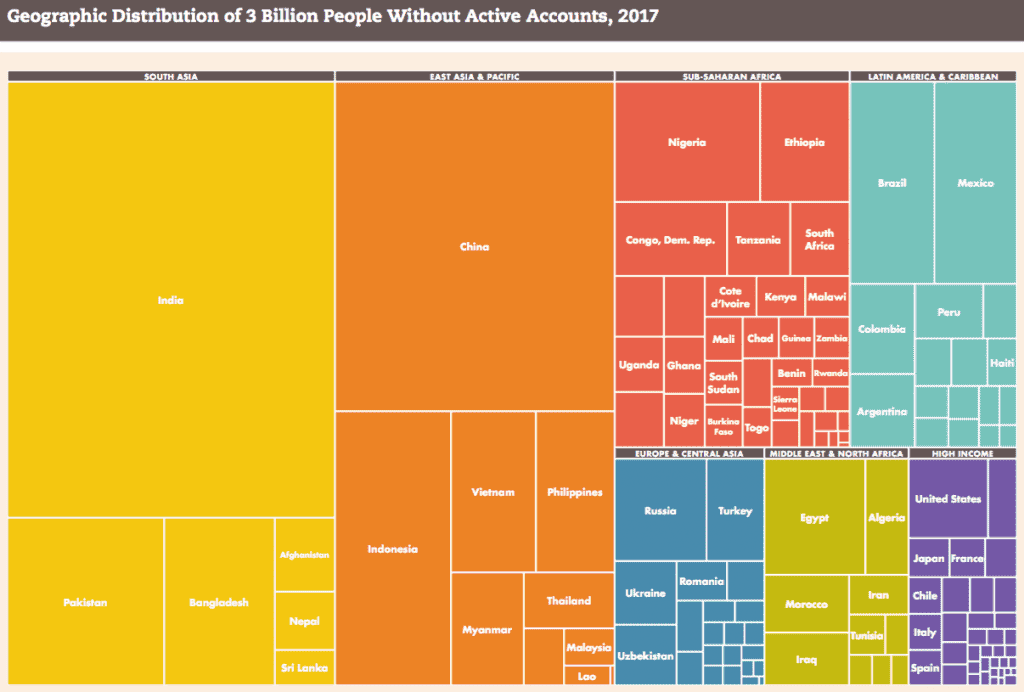

Across the world as a whole, nearly 740 million people have accounts they have not used in a year. While the largest number of these inactive accounts are in India (roughly 300 million) and China (roughly 100 million), significant account dormancy appears in many countries. In 29 countries, the accounts of more than 20 percent of the population sit completely idle.

It is not all bad news. There are several developing countries, such as Senegal and Tajikistan, that showed amazing growth in account ownership from the single digits in 2011 to over 40% in both countries in 2017. In fact, many African countries have shown significant progress over the last six years due to the high penetration of mobile accounts.

When it comes to credit the trend is also not encouraging. Basically, borrowing is flat or declining in developing countries. This despite the tremendous inroads in big data, mobile technology and new underwriting methods. The reality is that these advances are not moving the needle yet in developing countries. Those who do borrow money do so informally through family and friends.

The bright spot in the report is the use of digital payments in developing countries. In 2014 just 32% of adults reported making a digital payment, in 2017 the percentage was 44%. I expect this number will keep rising as the mobile money initiatives in many developing countries continues to expand.

My Take

One of the great things about the Global Findex Database is that they make the raw data available for anyone to analyze. I appreciate that organizations like CFI take it upon themselves to dig into the numbers and glean some real intelligence. I think we can all agree initiatives focused on opening bank accounts are pretty much useless if they don’t also focus on access and encourage account usage. I still remain optimistic that real improvements will occur and I keenly anticipate the 2020 Global Findex Report and hope that CFI will continue their good work here.