It is perhaps unsurprising that the United Kingdom embraced the development of the financial sector into fintech.

With its exit from the European Union, the UK now stands alone in its fight to maintain its global competitive edge as a major financial center, its success in part resting on the continued development and innovation of the finance sector.

Historically, the UK is no stranger to financial innovation. The first paper banknotes were created here, the first regulated stock exchange was formed, and the first ATM was installed.

It was also here that in 2015 the Financial Conduct Authority launched the first regulatory sandbox for fintech innovation, consequently catapulting the UK market into the forefront of the field.

Fintech unicorns such as Monzo and Revolut found their footing in the UK’s historically strong financial services sector.

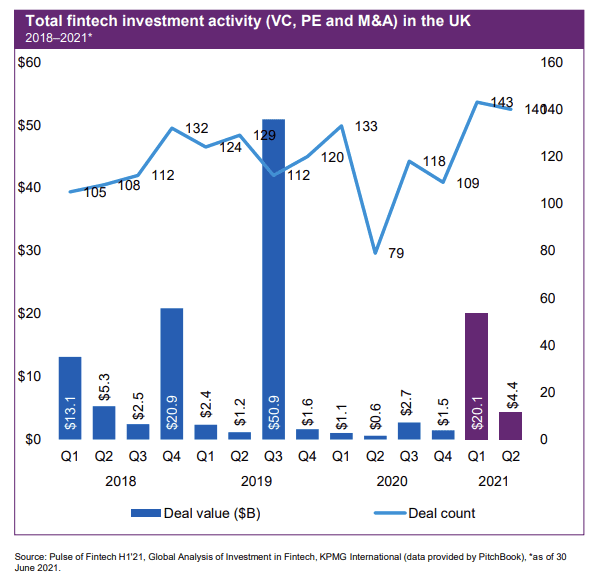

They were met with additional support and advice by the Bank of England and the Financial Conduct Authority’s New Bank Start-up Unit. Since 2016, investment into UK fintech has been prolific, with $128.3 billion invested between 2018 and H1 2021, according to KPMG/Pitchbook 2021, the most significant amount from all European financial centers.

Due to this heavy investment, the region nurtures extensive innovation, combining fintech with big data, AI, and quantum computing.

Since that significant innovative step, the rest of the world has leveled up, with major markets such as the United States offering increasingly attractive environments for fintech startups and development.

The Kalifa Review of February 2021 focused on assessing the UK’s fintech sector at a time said to be “an inflection point of opportunity -and risk.”

The combined challenges of Brexit, causing regulatory uncertainty, Covid, which accelerated global digitalization, and increasing investment rates by competing countries, meant it was a critical time for assessment and recommendations for future steps.

At the time of writing (June 2021), the UK represented 10% of the global market share with just under $15 billion in revenue, with investment into fintech at $24.5 billion, more than the following five European countries combined.

This report and others, such as the City of London Corporation’s Global City report of January 2022, continue to assess the UK’s progression on a global scale and its competitiveness in the future.

The future success of the UK in a global context hangs on a few factors, including :

- International reach

- Regulation and innovation

- Data sharing

- Access to skills

Reach of financial activity

The international reach of the UK’s fintech market is robust, with global activity key to boosting the sector to levels that can compete with the vast markets such as that of the US, despite the small domestic market size of the country.

The cross-border banking sector is one of the largest globally, with more than 15.2% (amounting to more than $5.4 trillion) of the outstanding value of international bank lending owed to banks located in the UK at the end of 2020.

This stat puts the UK ahead of major centers such as France, with 12.6%, Japan, 12.1%, and the US, 9.5%. Although this is promising, the UK did lose market share between 2016 and 2020, with France gaining five percentage points.

The UK’s market share in asset management is also one of the largest globally, growing by 18.6% with $8.6 trillion managed, half of which are for international clients. Comparatively, the second-largest market in the European area, that of France, experienced a 17% increase to $6.7 trillion. The US tops this, although only experiencing a market increase of 13%, bringing its total asset management value from $56.9 Trillion to $64.5 trillion.

In addition to this, a solid foreign exchange market is present in the UK, facilitating international trading and investment. In 2019 the UK accounted for 43% of global foreign exchange (FX) turnover, more than the US, Singapore, Hong Kong, Japan, France, and Germany combined. The average daily FX turnover has continued to grow, increasing by $110,000 million between 2019 and 2021.

Although this position as a center of foreign exchange and global business transactions is currently strong, it could in the future be put to risk with continued disregard of a Central Bank Digital Currency (CBDC) by the House of Lords.

In 2020 the Bank of England published a discussion paper on CBDCs, initiating their assessment of the viability of a Digital Pound. Although they are yet to decide, their task force, in conjunction with HM Treasury, is in discussions with industry representatives about the risks and opportunities of implementing a CBDC.

In the accompanying panel discussion of the Global City Report, David Craig commented, “If London is going to continue as the main player of where the money comes in and out and international trade we have to solve the frictional cost of money transfer, a CBDC is a way of doing that.”

CBDCs are only part of the picture, which could damage innovation and competition within the financial services sector without balance.

Innovate Finance’s Head of Policy, Adam Jackson, as a member of the Bank of England’s CBDC Engagement Forum, provides some insight.

“The UK has the opportunity to be the leading G7 country in digital finance and digital currencies. Part of that is the CBDC, alongside regulated asset-based stable coins…. central banks inevitably have to move to have a digital currency as part of their armory; therefore, the risk is that they do that at the expense of the private sector and innovation. It’s got to be done in a way that promotes competition.”

According to Jackson, the UK is positioned well for this on a global scale, “I’m not sure any country has set out a clear vision on how those parts work together… I’m slightly more optimistic that the UK and the Bank of England are looking at the right components, but I think there’s work for everyone to do and in terms of bringing them together.”

Regulation and innovation

With the UK’s release of the first regulatory “sandbox” for fintech, the industry had a head start in fostering the development of fintech, with policymakers supporting the way. This effort has created a robust environment for innovation that is recognized internationally.

In 2021, a total of $37.3 billion was invested into UK fintech, second only to that of the United States.

“Growth (in terms of investment) has seen a 210% increase year on year in London and 230% in the rest of the UK,” commented Janine Hirt, CEO of Innovate Finance, in the panel discussion regarding the Global City report.

More than 50% of this investment was from international investors, showing a strong interest globally in the UK fintech market. This figure also presents an opportunity to increase domestic institutional investment in innovation to boost the industry further.

The government and regulators in the UK over the past year have continued efforts to address issues and drive innovation in financial services. 31% of senior executives surveyed by Duff & Phelps named the UK as the most favorable regulatory regime for financial services, bringing it ahead of the US and Singapore.

In 2020 Britain’s Financial Conduct Authority (FCA) introduced the world’s first regulatory, digital testing environment in the form of the ‘digital sandbox’ and the additional ‘lawtech sandbox .’ Both initiatives provide additional support to innovators, with the latter fast-tracking ideas, services, and products that address the legal needs of business and society.

In an interview with Ouarda Marrouche, Professor of Economics at Université Paris Nanterre and co-author of the Bank of International Settlements’ research paper Inside the regulatory sandbox: effects on fintech funding, Marrouche stated the importance of sandboxes for the future development of fintechs, “Our research showed that in the UK and European context, where venture capitalism is less developed than in markets such as the US, the sandbox is very important… It showed that compared to those firms not included in the sandbox, firms that entered into the sandbox received 50% more funding.”

The creation of the Global Financial Innovation Network (GFIN) in 2019, after the FCA proposed a global sandbox, initiated the sharing of data and experience between international regulators to provide firms with accessible regulatory contact and an environment to provide an environment to test cross-border solutions.

“If there is more transparency on a regulatory basis (in other markets as well as the UK), it will permit mature fintechs to expand abroad and create more competition,” adds Merrouche.

However, there is a need for development to support future innovation and maintain the UK’s competitive advantage in this area.

Other countries give open access to firms, as opposed to the UK’s selection process, which levels the playing field and provides an opportunity for more innovation.

“Sandboxes are proven to be very important (for continued investment and encouragement of innovation in fintech), so regulators have to think more about how the effect can be developed and expanded so that more firms can participate…the issue with this is cost and use of public money, a solution would be to fund using the private sector (who benefit primarily from this) or publishing results and lessons learned from the sandbox, which will benefit other firms,” Merrouche stated.

Developments of the UK regulatory sandbox have included a move to an ‘always open’ approach to providing continuous support for firms and using the latest synthetic data.

On asking a representative of the FCA what they had planned for future development with the sandbox, they responded, “Going forward, the FCA is undergoing an ambitious transformation project that will support our aims to be a more agile, innovative, and data-led regulator.

Supporting innovation will position us to understand risk rapidly and assess the potential for consumer or market harm… We have also implemented several recommendations from the Kalifa Review. Through our GFIN network and broader international collaboration, we continue to learn from market participants, both in the UK and globally, to continue to maintain the UK’s competitive position as an attractive location for Fintechs.”

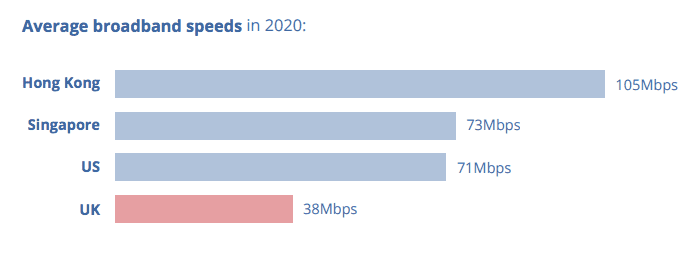

An area that has been found in dire need of development and risks future innovation is the UK’s internet connectivity, with broadband speeds at the lowest of all financial centers, despite increasing 129% since 2017.

This finding runs in opposition to further development into fintech and the increased investment of the UK’s industry into cloud computing.

In December 2021, the House of Commons published a briefing paper on the government’s gigabit-broadband targets and policy to support the broadband rollout.

The British government hopes to create access for at least 85% of UK premises by 2025 while seeking to “accelerate roll-out to get as close to 100% as possible.”

With an investment of £5 billion, the UK Gigabit Project aims to bring broadband speeds up to at least 1Gbps, enhancing its competitiveness on a global scale. If successful, speeds will surpass those of Singapore and the US (currently at around 70Mbps) and Hong Kong (105Mbps), providing further support for fintech innovation.

Open banking and data sharing

On a global level, the UK, Germany, and Singapore are most aligned with the Basel III recommendations designed to mitigate risk within the international banking sector, while the US is the least aligned.

The three pillars, Minimum Capital Requirements, Supervisory Review Process, and Market Discipline, provide banks with clear regulatory frameworks, increasing the market’s security and, therefore, its attractiveness to businesses and investors. The UK and Germany have increased capital, leverage, liquidity, and disclosure.

In the future, the UK government has stated it will use its Future Regulatory Framework Review to maintain relevant regulation of the developing finance sector, and the report recommends the increased importance of internationally competitive tax rates, especially in the banking sector.

In addition to the UK’s pioneering progress in ‘open banking’ there encourages innovation, broadening the scope to ‘open finance .’ This involves extending open banking principles to cover other financial services like insurance, consumer credit, and mortgages.

“(Open banking) was introduced to stimulate competition and enable people to switch accounts…it has stimulated innovation but is still limited to payments and banking. It could be expanded to other sectors to drive it forward,” Said Adam Jackson.

The issue with the expansion to date is the speed at which it is developing. The progression of open finance into the Pensions sector has taken more than six years without a finalized solution.

“There’s a strong argument that we could have amazing tech-led solutions if there were a lot more data available,” continues Jackson. According to the sector, the sector-by-sector approach currently adopted by the UK for innovation in Open Finance requires individual systems and initiatives.

“We have to look at ways of accelerating it… To promote innovation, you need to know what types of different information organizations have to work out what kind of innovative products can be developed to work with this data… So what would make a difference is if the UK had a legal requirement for organizations to publish their metadata which would then enable innovators to see what might be possible.”

An example of where the use of data has been implemented to drive change on an individual basis is within the development of fintechs such as Cogo, which relate consumers’ financial data to their carbon footprint by integrating consumer bank accounts so that individual expenditure can be checked alongside company data.

Sustainable finance

Following the UN Paris Agreement of 2015, a global governmental focus has been on climate change. Within the subject of fintech innovation, sustainable finance is a critical factor for the industry going forward, another area in which the UK continues to show strength.

In 2020, the average environmental, social, and governance (ESG) score of the top 100 companies listed on the London Stock Exchange was 70.9, higher than all other major financial centers apart from France, according to the report. In addition, between 2016 and 2020, this average ESG score improved by 11%, faster than in Germany, France, and the US.

Investment in sustainability-focused projects has been a priority in the UK market. It seems to have fueled many green initiatives within institutions and encouraged sustainable startups to grow.

UK asset owners and investment managers lead the assessment on implementing responsible investment for the United Nations Principles for Responsible Investment (PRI). As of October 2021, there were 676 UK PRI signatories with more than £8.8tn assets under management, a number topped only by the US.

“One of the areas that will really determine a leading financial center is really leadership in sustainable finance, and I think that’s where the UK and London has a clear opportunity to succeed,” said David Craig, former CEO of Refinitiv and Co-Chair TNFD (Taskforce on Nature-related Financial Disclosures), in regards to these findings.

This focus is becoming ever more apparent in the UK’s financial sector, marked by the FCA’s development of their approach to innovation in this sector, with the launch of the second phase of their “digital sandbox” aimed at the development of new products in the area of ESG data and disclosure.

Adam Jackson also proclaimed its importance, “A focus on sustainable finance is vital, it is central to the UK’s status as a financial center and fintech will be at the heart of that, it has to be”

The fundamental aspects of financial technology and fintech solutions, namely money and data analysis, are also essential to achieving climate targets.

“Achieving climate targets involves shifting where money is invested the way that you reduce emissions is you divert capital away from carbon-intensive activities and into low carbon activities,” Continued Jackson, “Again it comes back to data – the only way you can do that and ensure that you are directing it to the right things and being able to measure the impact is through data.”

Continued access to skills, talent, and diversity of thought

For continued innovation in fintech, access to skills, talent, and experience is essential and the upskilling of the current workforce.

In the report, Julianne Flesher, CEO of Nossa Data, says, “The academic institutions in the UK are a huge advantage for us. We have definitely been able to find the talent we need, and we intend to recruit our initial team all within the UK because we think all the talent we need exists there.”

42% of all graduates from UK universities graduate from business, mathematics, or information technology programs, many of which are at world-leading universities, providing very highly skilled entry-level talent trained explicitly in areas beneficial to the fintech field. Compared to the rest of the world, the UK is only topped by Singapore (44%) and France (46%)

However, up-skilling efforts, especially in digital skills, do not rate as highly. Generally, Asian financial centers tend to emphasize workforce education, but there are initiatives in the UK such as FutureDotNow that are improving workforce education.

London also continues to attract many foreign, highly skilled personnel. At 38%, London had the highest share of international residents compared to other financial centers, the least global city being Tokyo, with only 3%.

Despite this, factors such as the UK’s withdrawal from the EU and increasing restrictions on immigration have resulted in a dramatic reduction in the attraction of new international residents. At 21%, it stands at the highest rate of decline globally.

After industry feedback shows these findings, the UK government has introduced visa options for highly skilled talent, including the Scale-Up visa, which will be in March 2022.

“We (at Innovate Finance) believe that the scale-up visa is a critical component of making sure we can continue to attract talent from around the world…making sure we see this continued access to that diversity of thought is very critical,” said Janine Hirt.

Lack of diversity within the fintech sector has been highlighted in the Global City report, as it was in the Kalifa report the year before.

The massive deficit in diversity within fintech is a global issue, not just confined to the UK, with gaping holes appearing in the direction of investment, the hierarchical structure of companies, and the general workforce.

“In the UK, of the $11.6 billion invested into fintech (in VC deals), only 9% went to companies led by women in the capacity of CEO or founder. An even lower percentile going to companies with founders from other underrepresented demographics,” said Janine Hirt on the subject.

This figure was lower in the first eight months of 2021, at 2.2%, despite the general increase in investment.

“There is also data that shows female-led fintechs had actually a stronger runway and were more resilient than male-led firms,” Hirt continued.

This finding is in conjunction with data from 2020 that shows that the percentage of women on executive committees of financial services firms is only 26.3%.

Although shocking, the UK rates well globally, with Singapore at only 25.2%, the US at 19.4%, and Germany at 12.7%.

The UK is well-positioned for a strong future in fintech, with industry leaders, regulators, and government officials supporting the way.

Taking full advantage of the backing afforded by this environment, the industry has continued to progress and adapt according to consumer needs and the recommendations of the Kalifa Report of 2021. Going forward, industry experts are calling for even more action.

An open letter from industry leaders published by Innovate Finance on Feb. 20, 2022, read, “In light of the successes…it is now more important than ever that we — industry, government, and the regulators — do not pause, but rather build on this current momentum and commit to cement the UK’s position as the best location in the world to start, build and scale a fintech business.”