When writing about Central Bank Digital Currencies (CBDCs), digital identity is one of the most heavily debated aspects.

Many are outraged by the concept, believing implementation will spell the end of “freedom,” birthing a widespread surveillance state. Others see these concerns as “unnecessarily alarmist.”

It is agreed by experts that to have a CBDC, digital identities are critical. In the retail use case, this could mean each individual must have a digital identity to access the system. The central bank would carry out KYC protocols, onboarding, and identity checks.

In the case of wholesale, commercial banks would be tasked with distributing the digital currency, likely using existing KYC procedures.

Controversial issues surrounding digital identity

The proposed digital identity ideas pose two main issues which have caused controversy.

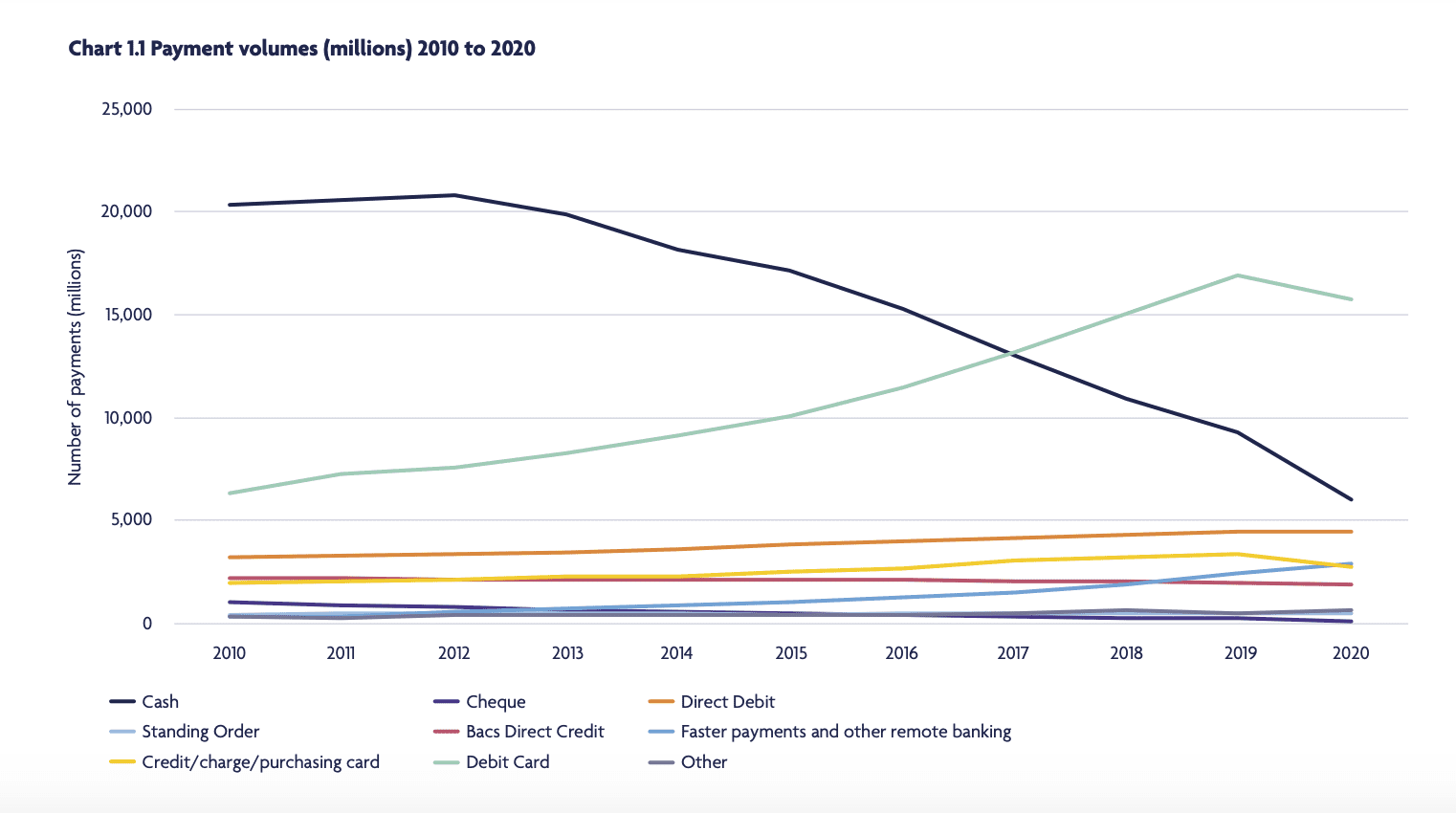

First is the issue of financial exclusion. There continues to be a demographic of people who still heavily rely on cash economies. Although digital payments are increasingly used in the UK, there continues to be an estimated 1.2 million people who mainly rely on cash for payments, many of which are in vulnerable communities.

For many experts, CBDCs will improve financial inclusion with designs in place to use smartphones for distribution. However, many who use cash as their primary form of payment do so because they do not have the means to pass standard KYC procedures, posing an issue regarding digital identity.

In the House of Lords’ consultation titled “Central bank digital currencies: a solution in search of a problem?”, this concern was echoed, “For some, not having a bank account is a choice. For others, the technological requirements for CBDC transactions may exclude them from accessing it.”

The second issue revolves around privacy. In the House of Lords’ consultation, the committee stated, “To prevent their use in large-scale criminal activity, any CBDC system could not support anonymous transactions in the same way that cash can be spent anonymously. While design options would provide some privacy safeguards, technical specifications alone may be insufficient to counter public concern over the risk of state surveillance.”

The “state surveillance” risk isn’t a concern constrained to the House of Lords. The ECB has also cited public concern for privacy in various consultations. In contrast, US representatives have already passed a bill prohibiting the issuance of CBDCs, “which could be used as a financial surveillance tool by the federal government.”

A loss of a ‘freedom’ that is already compromised?

“There are those who believe that a digital ID is a road to a loss of freedom,” said Richard Turrin, author of “Cashless- China’s digital currency revolution.” “It’s sort of ironic because we want the convenience of digital services. We want the time saving and money saving of digital services. We want them all, but we don’t want a digital ID.”

“We need digital identity; we have a tremendous amount of theft, stolen identities, and other stuff that happens digitally. And a nationwide digital ID program would stop a lot of this.”

Turrin writes extensively on the fear campaign surrounding CBDCs, reminding readers of the lack of privacy and security around card payments, the sale of data within firms, and governments’ existing right to access data if suspecting criminal activity.

China has bared the brunt of fears surrounding government surveillance through digital identity. Having already implemented a digital ID for all residents, many claim it is used to monitor and maintain control of the public. However, Turrin believes a national digital ID program is not far from existing identification systems. He also explained that the jump to digital identity shouldn’t necessarily cause exclusion due to existing ID systems.

“The question is, will a national ID program be able to serve all citizens? The concept of an ID card is part of most life in the EU. In the UK, they have NHS numbers, and in the U.S., we have the social security idea.”

Although these are not necessarily the traditional forms of identification in KYC, Turrin’s point highlights the existing identification tools for governments to improve inclusion if digital identities were implemented.

Solutions under experimentation

Web3 is believed to be a better option for digital identity in terms of privacy. DeFi identities can be construed pseudonymously, and in many of the underlying organizational structures such as DAOs, this level of identification is enough. However, the KYC and fraud prevention implemented for inclusion within the banking system could be too much for existing pseudonymous structures to be effectively compliant.

Self-Sovereign Identity (SSI) is a concept put forward in the past few years which brings the control of identity information into the hands of the individual. Removing the need to store personal information on a central database could safeguard privacy and give individuals greater control over what information they share.

The EU is among many governments assessing the viability of an SSI structure to address the need for digital identity. Their eSSIF-Lab project that culminates in October 2022 is aimed at reinforcing internet reliability with electronic identities through developing and adopting SSI technologies. The end goal is to advance the broad uptake of SSI as a next-generation open and trusted digital identity solution.

This could continue to pose the issue of financial exclusion, and resulting solutions would have to be designed in a sufficiently accessible way.

The M-Pesa is the poster child of digital financial inclusion, having improved the financial inclusion rate of Kenya by 48.3% between 2006 and 2016. The KYC requirements are facilitated by smartphones and digital wallets, including national identity number, name, and date of birth.

The Sand Dollar, the CBDC of the Bahamas, worked with a sliding scale of KYC requirements, allowing users different access to facilities based on the information provided, prioritizing inclusion.

Exhaustive experimentation needed for effective development

The identity issue of CBDCs is convoluted, with many stakeholders on either side of the fence. Government distrust has set the foundation for fearmongering campaigns, and dystopian scenarios are delicious feasts for the imagination.

That being said, citizens’ right to their data privacy and access to basic financial tools should be taken seriously. The prospect of digital identity has the potential to do so if approached with this in mind, especially in a society in the fray of a digital revolution.

Like many aspects of CBDCs’ potential implementation, many details rely on their designers. The prolonged effort of multiple actors with different drivers in testing and experimenting with the new technology could create an answer to various issues in the current monetary system, as well as problems in the broader economy.