In the midst of enforcement action and complaint filing against some of the biggest names in crypto, EDXM launched, announcing the backing of some of the financial sector’s biggest names.

With the likes of Charles Schwab, Sequoia, and Citadel Securities all very publicly giving their seal of approval, the exchange has set out to apply the “best practices” of traditional financial markets. With a focus on security and risk management, the company states it was built to address the needs of both crypto firms and global TradFi in trading digital assets.

“EDX’s ability to attract new investors and partners in the face of sector headwinds demonstrates the strength of our platform and the demand for a safe and compliant cryptocurrency market,” said Jamil Nazarali, CEO of EDX, at the announcement of the launch. “We are committed to bringing the best of traditional finance to cryptocurrency markets, with an infrastructure built by market experts to embed key institutional best practices.”

Currently, the exchange only offers four cryptocurrencies but has said they will soon be launching an additional product. EDX Clearing will settle trades matched on EDX Markets, using The Clearing House to facilitate.

“Looking ahead, EDX Clearing will be a major differentiator for EDX — and resolve an unmet need in the market – by enhancing competition and creating unparalleled operational efficiency through a single settlement process,” continued Nazarali.

It could bridge the gap between traditional financial markets and the decentralized world, potentially bringing increased liquidity and broader market access to the DeFi ecosystem.

A significant shift in mainstream adoption?

The announcement of its launch comes at a time that Blackrock is seemingly taking the SEC’s stonewalling of the space head-on, and leaders are vocalizing their thoughts on DeFi’s potential.

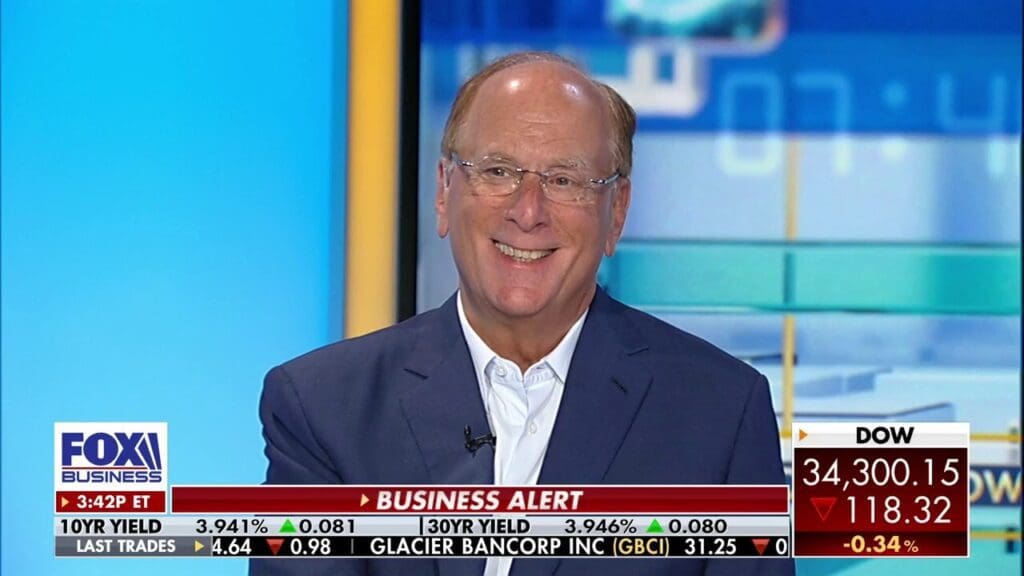

“Cryptocurrency is digitizing gold. Instead of investing in gold to protect against…the devaluation of your currency, Bitcoin is an international asset, and it can represent an alternative,” said Larry Fink, CEO of Blackrock, on Fox News. A stark contrast to the “index of money laundering” he referred to in 2017.

The entry of Wall Street into the DeFi space through approaches like EDXM and Bitcoin ETFs could have implications for mainstream adoption.

Aside from the very public declaration of their confidence in the assets, the presence of big financial names could bring an element of credibility to the space. While relatively new crypto businesses have gained significant success, knocks in confidence brought about by last year’s multiple failures have taken their toll.

EDX’s approach follows that which SEC chair Gary Gensler has outlined in multiple enforcement actions, stating that exchanges should be registered with the SEC, following regulatory guidelines. While these guidelines have been far from clear, EDX has leveraged a traditional finance approach, attempting to keep aligned with relevant regulations.

“EDX’s main competitive advantage comes from a regulation perspective,” said Farhad Huseynli, Analyst for the Fintech Blueprint. “Even before the tokens-equals-securities drama went mainstream, the exchange mentioned it would only focus on 100% non-securities, such as Bitcoin.”

“It also aimed to avoid any potential regulatory issues by offering clients crypto via their traditional broker-dealer rather than via a crypto exchange. This is because the SEC stated that exchanges should separate the roles they play in the capital markets value chain.”

“Overall, EDXM will appeal to institutional partners of Schwab, Fidelity, etc., potentially affecting the game for US centralized exchanges like Coinbase.”

What does this mean for DeFi?

EDXM is marketed as benefitting both crypto-native companies and traditional institutional investors.

One of the challenges faced by DeFi platforms is the availability of sufficient liquidity across various markets. The exchange “is focused on bringing liquidity to the crypto markets” by leveraging the resources and networks of traditional financial institutions. If successful, EDXM may contribute to deeper liquidity pools, potentially reducing slippage and improving the overall trading experience for users.

However, the introduction of TradFi into the crypto trading space could drastically change the face of DeFi.

EDXM may have found a way to function within the US’s crypto regulatory quagmire, and traditional institutions’ involvement highlights an important shift in the acceptance of digital assets into the financial fold. But a blanket application of traditional structures could overshadow the emergence of new ones, and a balance to preserve DeFi’s core principles of openness and decentralization within regulation is still critical for the sector’s growth.

RELATED: DeFi integration – Why TradFi may be the missing piece

CeFi’s transparency problem: how 2022 lifted the curtain