Five Questions with Fifteenth during tax week

It’s Tax Week in America, and as the IRS contemplates its next moves — amid funding battles, free-file experiments, and more — the board is shifting. Meanwhile, market volatility has turned the everyday pain of paying the tax man into a high-stakes game of strategy, with timing, structure, and precision mattering more than ever.

Earlier this year, Fifteenth announced it was entering the fray with $8.25 million in seed funding. The firm is betting that this underserved middle of the market — people too complex for TurboTax but too small for Andersen to care — is ready for something better. Fintech Nexus caught up with Fifteenth co-founder Ankur Dahiya to talk about the state of tax prep, the role of AI, and what it takes to build something people trust.

The following has been edited for length and clarity.

It is interesting to see a wave of earlier-stage companies continuing to enter the tax management space insofar as there are two private-sector giants, and then there’s also the creeping potential for some sort of publicly provided service for taxes. So there are lingering questions: What’s the market opportunity that still exists? And how long will that market opportunity exist?

There’s a huge spectrum. At one end, you have people who have simple taxes, just a W2, maybe some 1099s. And these people today go to like H&R Block, TurboTax, FreeTaxUSA, the free filing stuff. Credit Karma has a free or free-ish tax service. Cash App has another. There’s a bunch of startups who are also providing this as a service, and in your app, you can embed free taxes using their SDKs. So all of these players are playing at this end of the market, where taxes are simple.

And then there’s the other extreme of the market, which is literally billionaires, who are hiring Deloitte and PwC, and who pay millions of dollars every year to do their taxes. One step below that is firms like Andersen, Moss Adams, Apercen, where it’s a lot of experienced, expert CPAs who are doing your taxes, but these guys have like, $10, $20, $30K minimums.

And then there is a huge spectrum in the middle of the segment, which is served by Mom and Pop CPAs — one- to five-people shops where five CPAs get together, they start a company, and they do taxes for people. This is where we are playing. Our clients are high-net-worth — a million to, like $50, $70 million in net worth. Our average is thousands of dollars per year.

These folks have a lot of complexity. They have, let’s say, stock options, K-1s, rental properties, businesses. This complexity requires this human CPA expertise. And their tax needs are year round. They’re not just doing their taxes in April. A lot of them need to do quarterly estimated taxes. A lot of them just need tax advice throughout the year. That area, I feel like, is underserved. We have surveyed a lot of people in that area who are not happy with the services they’re getting from these CPAs. People who even go to Andersen, they pay $25K and Andersen just doesn’t reply to their emails in a timely manner, because they are focused on the people who are paying them $100K.

The bottom of the spectrum has intense competition, and I wouldn’t even want to go there. If someone comes to us where they’re like, I just have a W-2 income, I just have some 1099s, we just tell them, This is not a fit. I cannot justify you paying $1,000 when you can go to these sites and get it for free or for $100. And I think that’s what is at risk from IRS pre-filing the most. Eventually, it’s possible, if the government really puts all resources in, they could automate everything. Theoretically, they could do it even for the billionaires, right? Like, all the bank data should just flow to the IRS, and you just need better systems, better algorithms. Then technically, you can do most of it.

You still can’t do some stuff where people are making choices: Do I want to take this deduction, or do I want to structure it in a different way so those choices? I don’t think the IRS can decide for people, but still, you can do a lot with free filing if you really put your mind to it, but I feel like we are very far from that.

So this disruption will start at the bottom end. If I was the IRS, I would try to solve it for the simple taxes first, and eventually, like, maybe they do start going up. But I feel like this middle is where you start running into people who need year-round tax advisory, who need to make these decisions where it’s just hard to do it in an automated way, if that makes sense.

So you’re hiring CPAs, and the number-crunching part is what you would technologize.

Exactly. That’s what we’ll probably end up doing for the next few years. But I do want to leave the door open for AI getting better. All these AI CEOs are going around saying, We will build AGI, and it will be as smart as humans. If they do build it, I will inject it more in every single place, because this space is underserved. I just can’t hire enough CPAs. So assuming AI keeps getting better and better, we will be able to move beyond number crunching.

We recently launched a product, which is more of an experiment, where it looks at a tax return and tries to act like a CPA and give you advice. We have heard really good feedback from it, but it’s not always perfect. My CPAs say eight out of 10 are really good. The other two don’t really make sense.

So I don’t think the current state of AI is there, but if you buy into the idea that it will keep getting better and better, I feel like a lot more of the CPAs work could be automated through this. I do think there’ll always be a room for these human CPAs, because this is such a high-trust thing, right? If you’re a 10-million-net-worth person, for you to trust Fifteenth doing your taxes, you need to have that human connection.

So I do think there’s always room for these CPAs, but there’s so much of their workflow that’s just like monotonous that they also hate, by the way.he reason we are able to hire these amazing CPAs from Andersen, which is like the best-paying CPA firm out there, is because we give them this promise that you won’t have to do number crunching and you can instead focus on what you love doing, which is strategy and planning.

How about the acquisition side of things? I’m wondering how you convert people to Fifteenth. Are you poaching them from elsewhere? Is it an SEO play — are you one of the 97 Google ads when you try and find a tax solution?

We do webinars, we do SEO, we do Facebook ads, Google ads.

But if you think about how people currently find their CPAs — at least people in this segment — it’s mostly through word of mouth, or it’s through reference from other service people you’re working with. Wealth advisors, your trust guy, your attorney — you get it from them or you just ask your friends. Longer term, I do feel like that is going to be the big vector, and that’s why we focus on giving them a phenomenal experience, building a modern product, making sure the CPAs they are talking to are amazing.

When we started off, we had to do a lot of networking. I had to literally call all my friends and get some of them to sign up. But now we are already seeing this large wave of referrals. We have a bunch of wealth-advisor partners who keep sending us clients. And our clients work at companies like Figma, Databricks, Stripe, Nvidia, Google, OpenAI, X.

With all these companies, you get one client from there, you give them a great experience, and the next day, they’re at the lunch table, and everyone is talking about, Hey, we just had a tender offer. What are you guys doing for taxes? And so we get one person who leads to, like, five or 10 people from those companies. So that’s starting to become more and more of our strategy.

My belief is, if you do build something exceptional in this space, this word of mouth and network will just take you very, very far.

We are focused exclusively on tech people right now, because it’s a word of mouth game. So I want to just double down on one community and build word of mouth there. But we have grown from like zero clients to hundreds of clients, and we are six months old. So I think that does prove there is this underserved audience, and that’s what we are building for

Something that’s interesting about the high-net-worth individual spaces is that it’s B2C, sure, but you might be dealing with someone with an S-corp. It seems as though there’s the potential for a decent amount of almost scope creep. The technology infrastructure that you have in place probably requires you to build on quite a few sort of niche workflows for very specific people. I’m wondering how you allocate resources with that complexity in mind.

Right now we try to stay away from that. So we will tell them that we’ll do your personal taxes, and we have some partners who will do your business bookkeeping and taxes, and we have integrations with them so that it’s a very smooth process for you.

But that is an easy way for us to expand. If they have other entities, other businesses, we could provide support for that as well. But I think that’s pretty far in the future for us.

What we are building is a human-in-the-loop service. We don’t have to be 100% feature-complete, right? Like, I could just build the 80% things, and the rest are done by humans.

If you go back to when the first TurboTax was announced, they probably had to build so many features, because there’s no human in the loop. When we started on day one, our first few clients, we signed without writing like a single line of code. There was no technology, no platform. And then we can just incrementally, keep adding more and more technology, and that makes the clients’ life better, and the CPAs’ life better.

Tax season 2025, there are major changes on the regulatory front. I know a lot is changing, at least politically at the IRS. To what extent are those things that you need to be keeping an eye on?

Tax changes don’t just happen suddenly. They’ll say, this applies starting the next year. So there are some crypto changes that are happening in 2025, but they don’t apply right now. In 2024, there were changes around which state has given an extension to everyone given natural disasters.

And there are changing thresholds, values, etc. We get a feed of these changes, and we make sure all of our team is trained on it. So I don’t think it’s any different than how things have been before. You have always had to keep up to date.

There was potentially going to be a big thing around the 2017 JOBS Act, and I think that was supposed to expire in ‘25, but the recent chatter I’m hearing is that they are extending it.

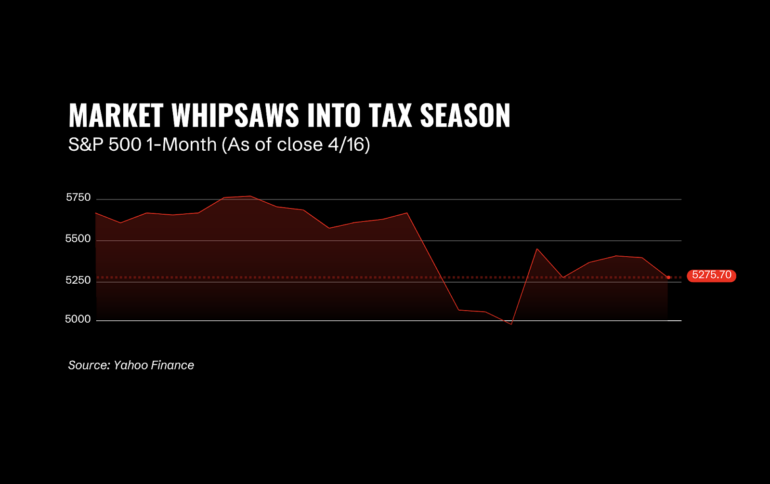

The market having wild swings before the tax period can be really detrimental to people, because a lot of people, especially in tech, they’re all invested in the market, and they have to liquidate assets to go and do this. So a bunch of people were really anxious about that — like, Okay, when do I sell?

There’s a lot of activity in the market, a lot of tender offers, mergers, IPO filings. So there’s a lot of activity here. Which means all these, all the employees of these companies are suddenly looking for tax advice, because overnight, they now have millions of liquid money. So that’s been interesting for us to see that as the market picks up, there’s a lot more demand for good tax services.