Data sharing is becoming increasingly critical for the further development of the fintech sector. As the power of open finance in supercharging innovation becomes more evident, a need to create secure ways of sharing grows.

However, the world of data sharing is unclear. Cookie tracking permission pop-ups litter the internet, many with a proverbial small print that takes control of the users’ data out of their hands. According to the Internet Society, 75% of consumers mistrust how their data is handled.

Customers concerned with privacy and a lack of transparency in sharing their data may be pleased to hear of the development of vehicles such as user-permissioned data sharing.

The need for consumer-permissioned data sharing

Many experts have agreed that the traditional “walled garden” approach to data handling does not optimize innovation and competition in an increasingly digital age, finding more potential in open data. This has translated to open banking within the finance sector, allowing access to only basic account data and open finance.

Although open banking has been regulated in many jurisdictions, limiting the amount of data shared, open finance has not yet received the same treatment. The prospect of consumer permissioned data could be the critical key to heightening consumer control.

User-permissioned data is transactional and account-level information that a consumer gives a business permission to access on their behalf. In return, consumer-permissioned data empowers individuals to leverage their financial data to apply for loans and other services.

“We’re trying to disrupt the whole model of reselling consumer data for the benefit of the resellers, versus us being able to directly tie our transactions to the benefits that the user gets. We don’t exist if the consumer doesn’t benefit because we don’t aggregate data and then resell it,” said Elan Amir, CEO of MeasureOne.

A survey conducted by Banking Perspectives found that 99% of respondents using fintech services were concerned about how their data was aggregated and resold. Of these, 34% were extremely concerned. Only 20% felt certain about which third parties receive their data.

Consumer permissioned data could resolve this issue, in theory, improving transparency around data exchange.

“We act on behalf of the consumer that is being incented by a business in an organization to share that data,” said Amir. “Only at the point of that incentive do we get directly or indirectly engaged with the consumer.”

Measure One aims to improve trust

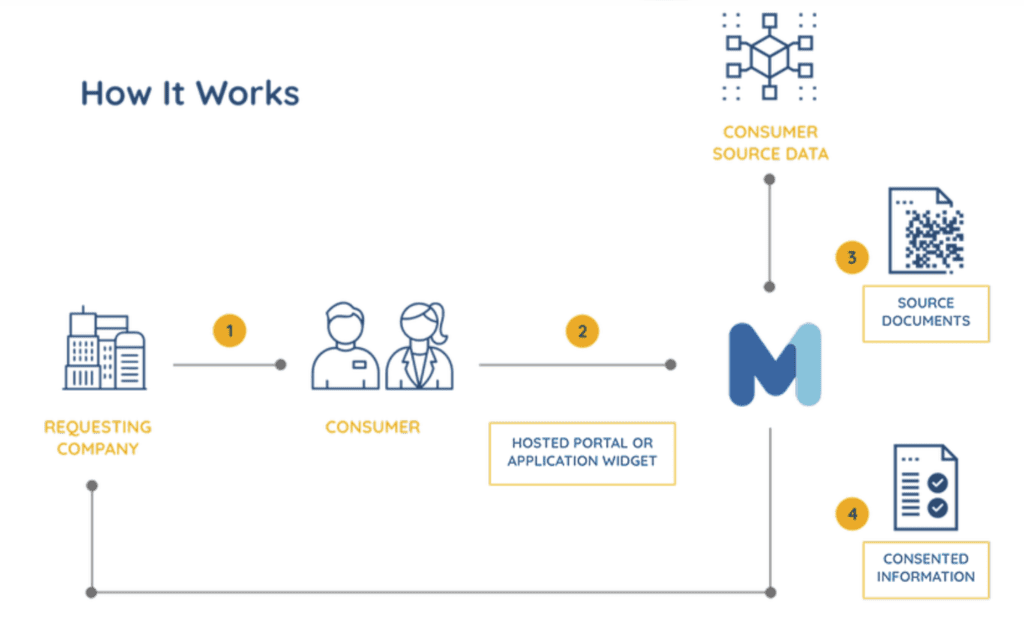

MeasureOne is a third-party data handler focused on consumer permissioned data responding to specific interactions between consumers and financial services for consumer data requests.

“The needs for data have, I would say, gone faster than the availability of that data,” Amir continues. “Data is at the core of the financial industry. For them to develop insights, underwriting models, and innovative products comes from data and knowledge about that consumer.”

Consumers grant MeasureOne access to the requested data, and the company handles it, making it accessible to the financial institution for the specific request.

“This could be anything from income to employment data,” he said. “We sit in the middle of this transaction, facilitating the exchange of data and the sharing of data by consumers being the trusted party for both the consumer and a financial institution that’s looking to gain access to that data.”

This guarantees that the data requested is limited to specific transactions. The company aims to be as transparent as possible to improve the trust relationship of the consumer in data sharing.

“Our end goal here is to turn consumer permission data and how it operates into the primary way consumers share data. There’s no disadvantage to the user, or the requesting business, in doing it this way. And from a privacy standpoint, it is a much more transparent, better model of sharing that allows everybody to know where the data is.”