I just signed up for the Apple Card. I have been fascinated by this partnership between Apple and Goldman Sachs ever since we learned about it last year. So, when it went live earlier this month I knew I had to get it.

While I may not be a true Apple fanboy I use many of their products including a Mac, iPad and iPhone. The Apple Card is designed to work seamlessly with the iPhone, in fact you must have an iPhone 6 or later to be able to apply for the Apple Card. There is no web-based application, you have to do it from inside the Wallet app.

I like to play the mileage and points game so I have several Chase and Amex credit cards and I regularly (2-3 times a year) apply for new cards. It never ceases to amaze me that, despite all the credit cards these companies issue, the online application process always feels clunky and unfriendly. They could and should make it much more simple.

The Card Application Process Felt Like Visiting the Future

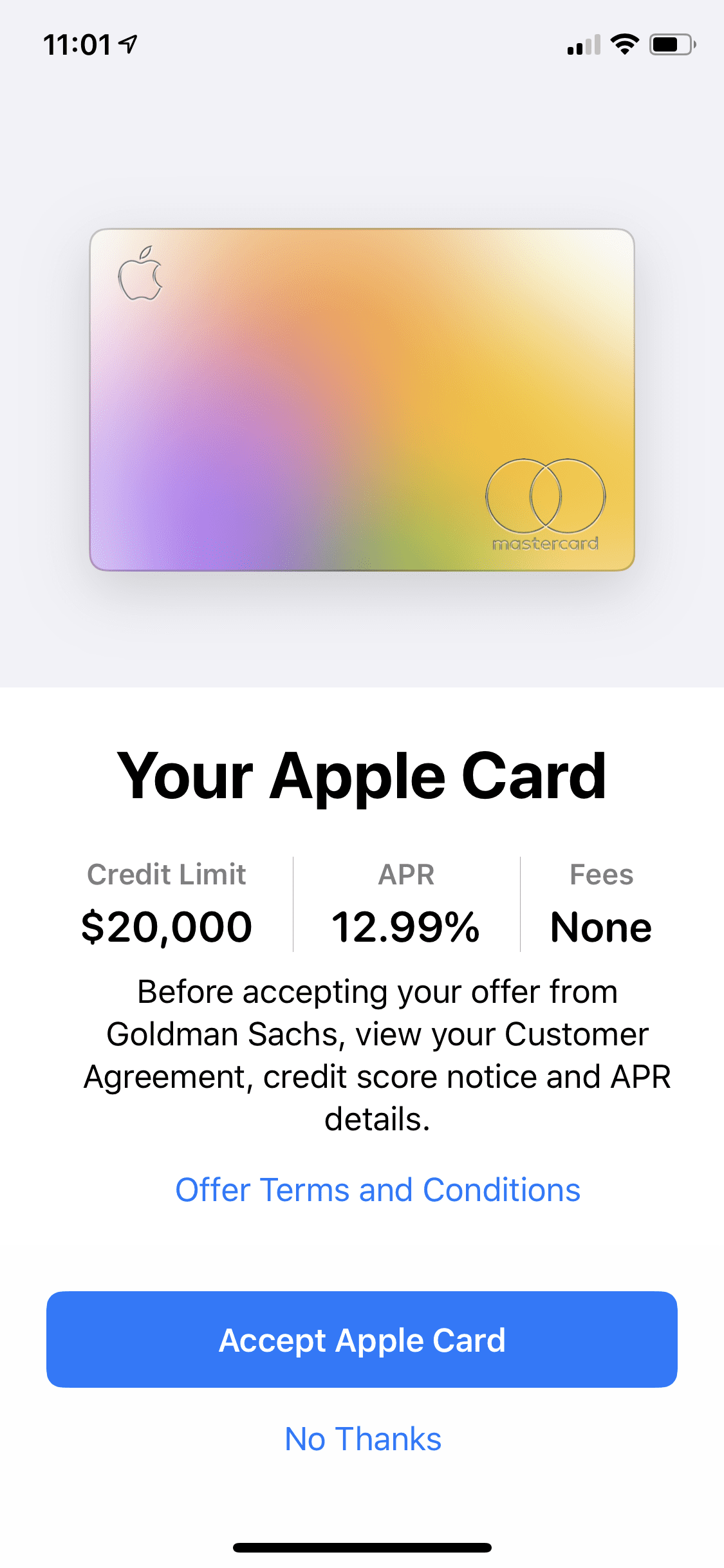

This is what Apple has done. The user experience in the application process is simply superb. They have clearly thought long and hard about ways to reduce friction, especially considering you are applying on your phone. Here are some screenshots of the process:

The entire process took me less than 5 minutes, I probably could have done it in half that time if I wasn’t taking screenshots and paying attention to every little detail. The only data points I had to enter was my date of birth and a photo of my driver’s license. It was without doubt the easiest card application I have ever experienced and one that others should seek to emulate. As you can see in the right screen shot above I was approved instantly for a $20,000 credit line and once I tapped on Accept Apple Card, within seconds I had my card in Apple Wallet ready to use. An hour later I was able to buy lunch at my local sandwich place using this new card.

While my titanium Mastercard will be arriving soon, I will rarely, if ever use it. As I said, I am a miles and rewards enthusiast and I will primarily be using this card for purchases with Apple where you get 3% cash back. Since this card has no annual fee there is little downside in keeping it in your wallet.

Payments Are Going Mobile…Right?

I actually use Apple Pay quite a lot because I have a large number of credit cards and I don’t like carrying them all with me so they are all loaded in my Apple Wallet. I have noticed more and more retail outlets offering Apple Pay and the company now reports nearly 1 billion transactions a month. Of course, we will have a long way to go before mobile payments are ubiquitous, at least in this country, but Apple seems to be doing all it can to spur more activity here.

It would be a brave person who would bet against the eventual widespread adoption of mobile payments. China has the highest rate of mobile wallet usage today by far but other countries, including the US, are expected to increase their usage substantially over time.

The Apple Card is About User Experience

Apple has a history of taking what exists and improving the user experience dramatically. They did that with the iPod, iPhone, iPad and now they are trying to do that with the Apple Card. With a credit card there are a handful of things you can do to make the user experience much better:

- Make the application process super easy – as I described above they have certainly achieved that.

- Eliminate the burdensome fees that most other credit cards charge – the Apple Card has no annual fees, foreign transaction fees, over credit limit or late payment fees,

- Helpful tools to help with budgeting and financial management – they have introduced a simulation wheel that helps with payment planning and shows exactly how much interest you will be charged. It also has color coded categories for spending that allows you to see what you’re spending at a glance.

- Better security and privacy features – Apple has thought long and hard about security with no card number on the physical card and the ability to generate a new card number whenever you want.

- Simple card activation – to activate the titanium card you just hold your phone near the packaging and an Activate button appears on your phone.

There are certainly negatives about the Apple Card. You cannot export data to apps like Mint, the interest rates are nothing special, there is no ability for multiple users or sharing cards, and the rewards are not best in class.

The Technology in Apple Card Will Be Widely Available Soon

The beauty of the Apple-Goldman Sachs partnership is that neither had an existing product with legacy business to defend. It was a clean slate for both companies and in some ways a perfect marriage. Goldman Sachs have been building up their consumer banking business with Marcus and this gives them their highest profile consumer product to date. Goldman CEO David Solomon said recently that, “Apple Card is big, but it’s also a beginning.” He pointed out that because they have no legacy card business Goldman is in a position to innovate unlike many others in the industry.

While Goldman Sachs have an exclusive agreement with Apple for now Mastercard have said that any other bank will be able to use some of this new technology for their existing cards within a matter of months. This is where we can expect banks to take some of the most popular features of the Apple Card and apply it to their own credit cards. I expect within 12 months we will see many of these new features that the Apple Card has pioneered to be become standard offerings from other banks. Maybe soon an application experience like the Apple Card will be coming to your new Chase or Amex card.