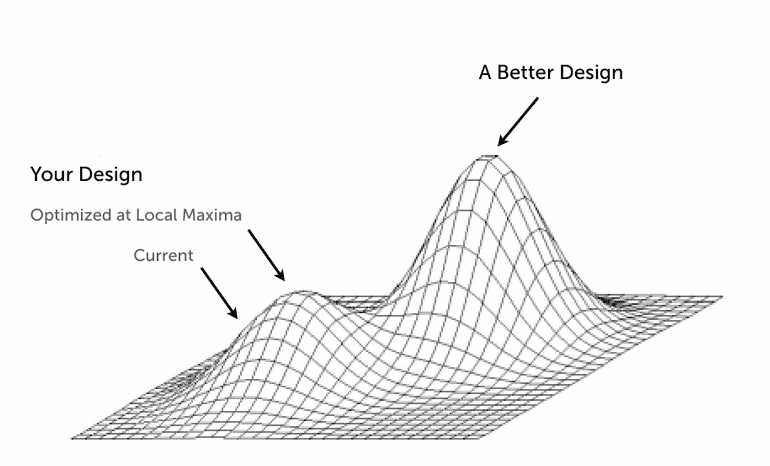

The Securities and Exchange Comission punted again on allowing a passive Bitcoin ETF to enter the market. It failed to approve the VanEck SolidX Bitcoin Trust, instead opting to open a commentary period to address several questions around Bitcoin price formation and the health of the exchanges. A similar outcome faces the Bitwise Bitcoin ETF. You can tell I am not a fan of this waffling, and there are two core reasons: (1) the years-long delay and uncertainty is responsible for financial damage to both traditional and crypto investors, and (2) the premise of the objections misunderstand the environment of the Internet and the way our world is shaping up in the 21st century.

central bank / CBDCcivilization and politicsenterprise blockchainmacroeconomicsnarrative zeitgeistphilosophyregulation & complianceSocial / Communitystablecoinsthings that are not true

·We anchor our writing around the World Economic Forum 223 page report on CBDCs and stablecoins. The analysis highlights the key conclusions across several white papers in the report. We then add a layer of meta analysis around the language in the report, and question what it is trying to accomplish, and whether that will work with the Web3 revolution. This leads us to think about the tension between populism, as represented by crypto, and institutionalism, as represented by banking structures. We discuss theories of cultural and national DNA, and the rise of populism, as difficult problems to solve for any global alignment.