While most of the crypto industry has been shaken by regulators’ recent offensive, a significant target has been staking services.

The first murmurs of a “crypto crackdown” were heard in February 2023, when Kraken announced the closure of its staking service for US customers and paid $30 million in penalties.

While the company neither confirmed nor denied the SEC’s allegations that they were offering unregistered securities to customers, it set the stage for accusations against other crypto companies allegedly doing the same.

At the time, Coinbase co-founder and CEO Brian Armstrong tweeted about concerns that it was a sign of the regulators stifling innovation.

“Regulation by enforcement doesn’t work. It encourages companies to operate offshore, which is what happened with FTX,” he wrote. “We need to ensure that new technologies are encouraged to grow in the US, and not stifled by lack of clear rules…Staking is a really important innovation in crypto.”

A few months later, he, too, was served with his own Wells notice for, among other areas, Coinbase’s staking service, Coinbase Earn.

Despite many agreeing with Amstrong that staking is an important innovation in crypto, it continues to be at the eye of a storm of enforcement actions. The outlook in the US isn’t looking good.

Staking – an overview

Staking, in layperson’s terms, is a way for crypto users to earn rewards for keeping coins within the ecosystem. It allows them to engage in the running of blockchains, thus dispersing the control throughout the network.

RELATED:

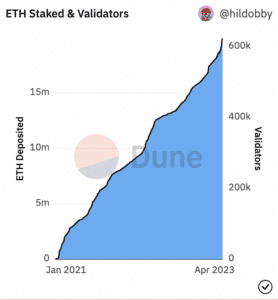

Last year, staking made headlines as ethereum, the ecosystem’s second-largest blockchain, shifted from a Proof-of-Work (PoW) consensus mechanism to Proof-of-Stake (PoS). Aside from significantly reducing the blockchain’s carbon footprint, the change made staking an integral part of its process.

The decision threw ethereum into hot water, with the SEC revisiting the idea that the cryptocurrency was a security. This classification lies at the center of many SEC’s movements against crypto companies. The centralization of the blockchain also came under scrutiny when the shift to PoS showed staking activity concentrated within the US.

RELATED: Merge happened; now what?

Eight months later, it has been described as one of the “most important” to happen to crypto in 2023, ethereum executed its Shanghai (Shapella) upgrade. The upgrade, while having many technical benefits, fundamentally allowed stakers to withdraw their coins. In the aftermath, the coin experienced a bump in trading activity and increased staking.

Although staking can be conducted independently, much of the DeFi community uses staking services or pools to engage in the activity. As well as being easier to use, staking services and pools allow users to become validators without staking high amounts of their assets, therefore gaining rewards.

The blockchains benefit from increased numbers of validators as higher numbers improve the chain’s security, decentralization, and running.

While engagement in staking continues to increase, the SEC’s conviction that staking services violate securities laws becomes ever more fervent. Coinbase is one of many that has been in the regulators’ firing line for their staking services in recent months.

“It pushes institutions outside the U.S.,” said Laszlo Szabo, Co-founder and CEO of Kiln. “It’s not the best environment for any crypto institution to stay in the U.S. right now because of the SEC.”

However, the U.S. continues to be an influential market, and many have opted to stay for now, leaving staking ripe for innovation to remain in keeping with the SEC’s unclear guidelines.

On-chain technology providers

“We have to make sure all of our offerings are SEC compliant, even if it’s hard to have clear guidelines at the moment,” said Szabo.

Kiln was created from a need to provide staking services for crypto custodians. Focused toward institutions such as Binance.US and Ledger Enterprise, the company provides the framework for stand-alone institutions and their customers to engage in staking within the guidelines of the SEC.

“We are noncustodial providers, which is quite important,” Szabo continued. “Everything we do is either around smart contracts or API. We never have the custody of the funds.”

He explained that Kiln’s processes were all carried out on-chain, increasing transparency within the staking process.

“In addition to this, we won’t do things like early liquidity. All the yields from the staking come from the yield itself, not from market making or lending on the back end.” He explained that to do this, bonding periods are kept in line with the times determined by the blockchain itself. “We stay as close to protocol as possible with the bonding periods linked to the protocol,” he said.

“In these two ways, it’s a very different staking service to what Kraken was doing.”

Increasingly considered one of the safest options for institutions to engage with staking, third-party partnerships that separate custody from staking services could allow them to navigate out of the SEC’s warpath. This approach has attracted companies to partner with Kiln, hoping to continue providing staking services within the unstable U.S. regulatory environment.

“With all of our products, we have to come to the lawyers to assess how would it be received,” Szabo explained. “We are pretty confident in our compliance with the SEC because we do everything on-chain.”