It took Stan Druckenmiller mere seconds to hire Toggle co-founder Jan Szilagyi.

When Szilagyi told Druckenmiller he’d found a way for investors to leverage the reams of data out there and possibly gain strong returns, it proved to be a conversation worth having.

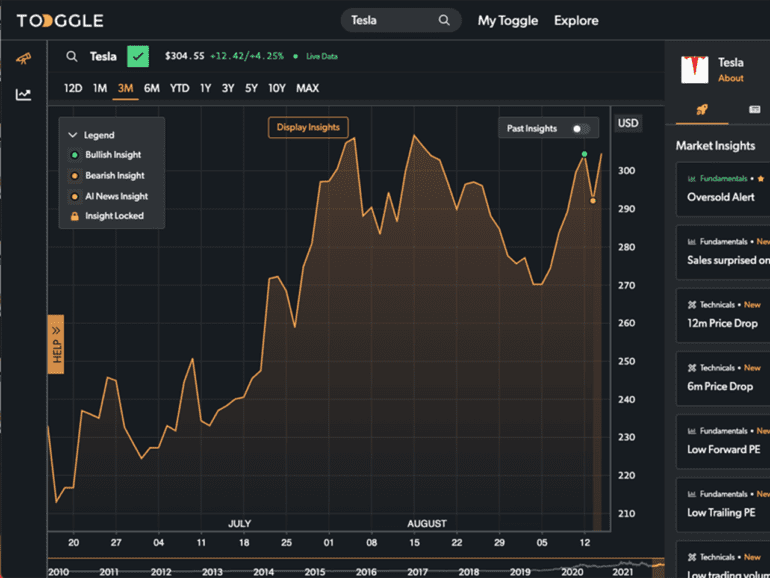

Toggle is a company lowering barriers to investing while providing greater access to financial information and market insights.

Founded in 2019, Toggle doesn’t make specific recommendations, but it gives investors information and analysis that allows them to make more educated choices on their own.

While completing his undergraduate degree in Mathematics at Yale, Szilagyi received an interview with Druckenmiller. After three minutes, Druckenmiller offered him a job.

Toggle’s origins in macro data struggles

For the next decade, Szilagyi forged an impressive career in macro investing. Over time he and Toggle co-founder Giuseppe Sette were challenged to make efficient use of the growing amount of data they had access to. It accumulated much faster than it could be processed. Szilagyi likened it to surfing the Internet from a dial-up connection.

Their answer was Toggle, which initially was an engine they developed to help them corral this data. Alerts were sent when meaningful linkages were established.

Unlike Robo-advisors and automated investing services, Toggle doesn’t execute trades. It doesn’t tell you to buy or sell. It shows you what has happened during similar points in a company or sector’s history. Perhaps in five out of seven similar situations in the past, the stock price has moved in the same direction.

“We want to give you a tool that you as an investor can rely on to know that you will, at a minimum, have consumed the kind of you’ve got more time, you can spend it reading the Federal Reserve minutes or reading an equity report from Morgan Stanley if you want, but that’s after you’ve kind of taken that minimum diet of the essential nutrients that you need to have a healthy portfolio.”

Toggle considers often overlooked factors

Fundamentals and context both matter, Szilagyi said. Markets don’t function in isolation but operate within the context of their times.

For example, the bearish trend in January was driven by actions the Federal Reserve took to combat inflation.

“All these businesses didn’t suddenly suck,” Szilagyi said.

Toggle’s engine monitors those reports, analyzes data on individual securities, and considers other important macro sources. The information is presented in a simple format on an investor dashboard. Investors can run scenario analyses.

You don’t have to be Stanley Druckenmiller to understand that information. Technical terms are explained, along with their relevance to the current price of a stock.

“(Say) the yield curve has inverted, and we’re talking about housing stock,” Szilagyi said. “Often, that has meant that the housing market might also slow down. It tends to do poorly in the early days of the recession.

“So you might be well-advised to get out of some portion of your portfolio because the business cycle currently doesn’t favor the sector to which these stocks belong. That’s how we hopefully quite seamlessly draw on this different technical information, which will give you as good of a picture as possible about what might be driving your particular stock or an entire portfolio.”

Leveling the playing field

Insights aren’t tailored to risk profiles. Szilagyi said that information is better left to wealth advisors for several reasons. Investors can read the report and decide for themselves.

That approach responds to a disparity between the available resources to professional investors and those targeting others. On one end, the pros have all the tools. On the other, hands-off investors have Robo-advisors and wealth managers.

Szilagyi said that active participants want to act on trends they see in the marketplace. He wanted to provide them with more than raw data; more of a finished product than an IKEA box.

Cryptocurrencies bring challenges, opportunities

Because cryptocurrencies are so new, Szilagyi said there aren’t those historical patterns to identify. Toggle is working on technical solutions to make comparisons between similar assets.

At the same time, that novelty brings opportunity. Cryptocurrencies, by their nature, are digital and produce volumes of data.

“There’s so much that’s being recorded for cryptocurrencies,” Szilagyi said. “The hash rate you have, the mining fees you have… You can construct supply and demand curves for these cryptocurrencies in a way that people who trade foreign exchange would love to have been able to do.

“In a few years, when enough history is available, and all of these data points continue, I think the analysis there will be incredibly fruitful.”

Toggle is perfectly positioned to deliver value to crypto investors, Szilagyi said. With many new participants, and new data sources like on-chain analytics, there is a need for education on simple terms and which variables are likely necessary.

There’s plenty of utility for the pros, too, Szilagyi said. Pension funds must make regular allocation decisions, even with a longer-term horizon. If they need to rebalance, where are the opportunities?

The importance of knowledge graphs

What is Toggle’s strategy for identifying essential correlations within the volumes of data the industry will continue to produce? At the core are knowledge graphs, Szilagyi said. Knowledge graphs tell the system which data sets to link to specific assets. They control for bias and, over time, can eliminate once-promising links that proved irrelevant.

“You have a framework that allows the system to load up any amount of data you want,” Szilagyi said. “There is no real limit, except for computational, but that has gotten cheaper and cheaper with all cloud providers.”