In case you missed it: over the summer, news outlets ran a story following Benyamin Ahmed, 12, who was making thousands selling pictures of whales.

His pixel art is one of many NFT collectible projects that exploded in 2021, joined recently by Tom Brady, who created his own NFT site, alongside appearing in ads for the FTXcrypto exchange.

Using Ahmed’s story as an example: How are people getting into NFTs, what are they, and what is coming next?

Plenty of whales in the sea

Ahmed is a brilliant young man who taught himself to code when most were still learning algebra.

His project, called “Weird Whales,” is a generated Non-Fungible Token (NFT) art collection hosted on the Ethereum blockchain through OpenSea.io.

NFTs, like their cousin cryptocurrency, are tokens of value recorded on blockchains.

Unlike currencies, each NFT is individual: while one bitcoin equals one bitcoin, one picture of a whale stored on the blockchain may be bought and sold at different prices than another whale.

Most NFTs function right now as digital collectibles, traded on marketplaces like the ever-popular OpenSea. The site saw $3.4 billion in trading volume in August, 10 times the trade volume in July.

In a future article within the NFT series, we will update how to access the market and create your own NFTs through OpenSea — it’s almost as easy as posting on Instagram.

LendIt has already covered a bit of the NFT collectible space when Visa announced they invested in a CryptoPunk. A lifetime ago, back in August, Visa picked up one of the original NFT punks for $150,000. Since then, bids for that punk, a woman with a mohawk, have reached half a million dollars.

Like CryptoPunks, Ahmed’s Whales were created by combining dozens of pre-drawn pixel whales with a variety of pre-drawn hats and collectibles.

Ahmed, like many open source creators, hosted all of his work on the code-sharing site GitHub and even has step-by-step guides of how he coded his art project on the blockchain.

Widescale adoption by way of trading cards

While Visa was snapping up a punk as a marketing signal that it was ready to embrace crypto, the sports world was already driving the paint.

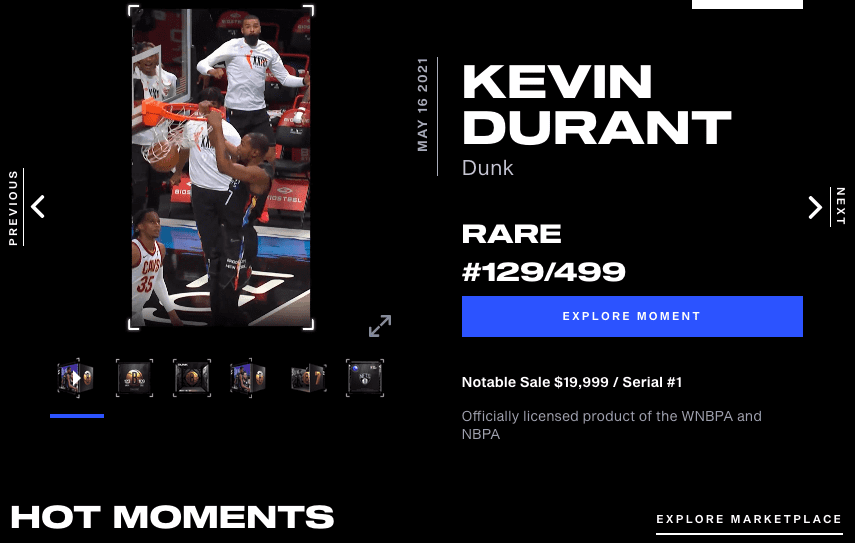

Platforms like NBA TopShot were already up and running, allowing users to trade short clips of game highlights and other collectibles.

Like Ahmed’s whales, TopShot digital collectibles are stored on the blockchain and can be traded to new owners.

The site has been up since late 2019, in a partnership with Dapper Labs. Top Shot has sold 8 million units for an all-time volume of $684.4 million, according to DappRadar. Last week Dapper raised a $250 million funding round.

But that’s old news.

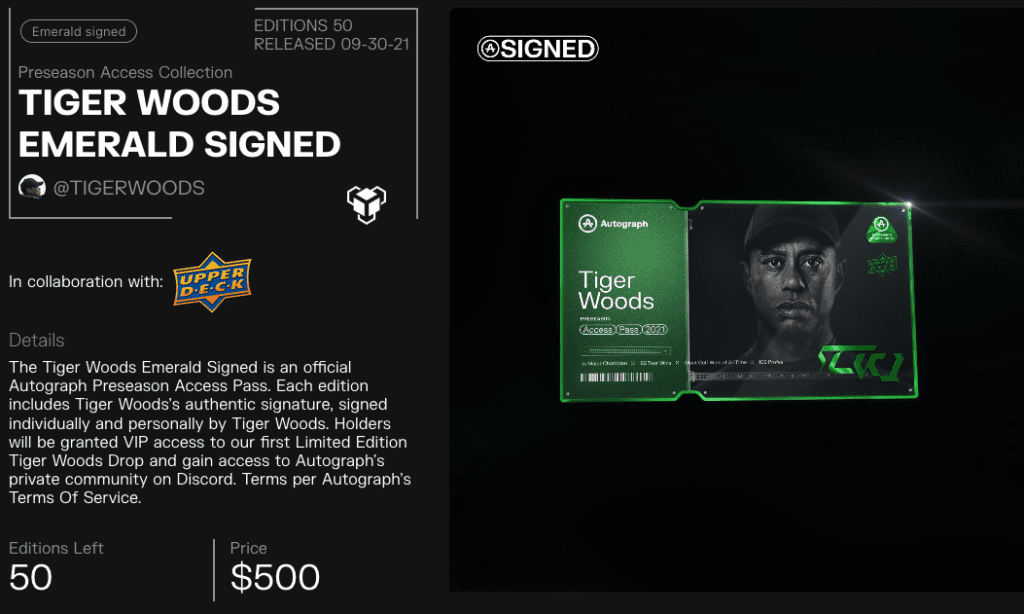

This past week, Tom Brady started advertising his new site, Autograph, at the beginning of the NFL season.

Partnering with the best of the best, the site features NFT collectibles in autographed virtual trading cards, featuring names like Tiger Woods, Derek Jeter, Naomi Osaka, and Tony Hawk.

Seeking piece of immortality

Philipp Blom, historian, and journalist, and author of “To Have and To Hold: An Intimate History of Collectors and Collecting,” wrote that people amass stuff because it guarantees immortality.

Blom said we believe memorabilia, trading cards, and signed baseballs are holy relics that touched the genius and excellence of their likeness: Maybe some home-run slugging power will rub off a $5.64 Babe Ruth Yankees jersey.

“Collected objects have shed their original function and become totems, fetishes. No true devotee would buy a T-shirt worn by Mick Jagger during a concert, chuck it in the washing machine and wear it. A Mick Jagger T-shirt is no longer a T-shirt, it’s a connection to the world of Sex and Drugs and Rock ‘n Roll, a form of genius, a dream,” Blom said.

“Collected objects are like holy relics: conduits to another world. They have shed their original function and become totems, fetishes. Collecting by its very nature is animist and transcendental.”

Can immortality pass through the blockchain? Tiger Woods believes so. As of Tuesday, 10,000 Woods trading cards launched on Autograph and Draft Kings, starting at $25.

It has already proven to be lucrative — lines of trading cards repeatedly sell out shortly after launch and go for more than 10-times their price on resale — but fans would say it’s not just a complete cash grab.

If anything, NFT collectible trading cards are just more liquid stamp collections without the restraints of being bound to a physical form.

The partnership between Brady, a future football Hall of Famer, and DraftKings fills a familiar economic niche, updated to the digital age. Each purchase also gives users access to “a-lister events” and the Autograph Discord.

Why are we like this?

For the uninitiated, Discord is a texting and community app like Telegram, Slack, or even Microsoft teams. Though created for video game friends to hang out, talk, and message about DnD campaigns, it has launched into the realm of the new Myspace or AIM.

Nearly every NFT collectible project, crypto group, and stock betting forum has a moderated discord, with sections for discussion, hanging out, and swapping ideas.

Even Ahmed encourages members to join new discords, and use the whales as profile pictures on crypto Twitter.

James L. Halperin, collector, writer, and co-owner of one of the world’s largest auction houses, said people collect things to learn, reduce stress, for nostalgia, and the accumulation or diversification of wealth.

“One fervent collector of historical documents refers to his own collecting propensity as “a genetic defect.”

More likely, collecting is a basic human instinct; a survival advantage amplified by eons of natural selection,” Halperin wrote.

“Those of our ancient ancestors who managed to accumulate scarce objects may have been more prone to survive long enough to bear offspring.

Riches and the fountain of youth

Even today, wealth correlates to longer life expectancy — and could any form of wealth be more basic than scarce, tangible objects?”

Halperin said we might collect things to signal to others our value in the tribe, from picking berries that aren’t poisonous in 10,000 BC to snagging a BoredApe drop.

Collecting scarce items is an exertion of control in an uncaring, chaotic universe. Even the Egyptian pharos were buried with their treasures, their wealth and power immortalized in a final act of control.

Is it any more than a coincidence that NFT, crypto, and retail stock trading blew up in the past two years?

During a global pandemic, most of the world is stuck inside, and millions of people seek connections online.

In the case of NFTs, people are not just buying jpgs of Derek Jeter or Ahmed’s whales: they’re buying into an online community.

There has been a whirlwind of discussion over the “great pivot” of the pandemic: how fintech exploded due to a sudden need for innovation to take over legacy in-person banking, payments, and lending.

The ongoing crypto and NFT collectible boom is likely a more realized acceleration, one that some say brings us closer to the metaverse, a Ready Player One-styled reality.

While most fintech is an implementation for the flesh-and-blood world, enhancing the ability to get loans and buy things, NFT progress brings us closer to a living, breathing digital reality. Or at least, that’s what those at the top of the industry say.

Read more about NFTs and Crypto through Lendit Fintechs new series on the metaverse.