On April 6, TransUnion added firms that make lending decisions to its Strategic Alliance Distribution Partner Program, like the fintech Provenir and GDS Link.

The new partners expand on TU’s existing Strategic Alliance Distribution Partner Program, including leading providers within Collections, Loan Origination Systems, Data Analytics, and Core platforms. The firm said adding “decisioning” providers to that list will meet customers’ rapidly evolving needs for complex credit decisions.

Aaron Smith, TransUnion VP of Global Platform Partnerships, said that Provenir was backed by a solid commitment to R&D and ongoing product development, offering the flexibility and scalability TransUnion clients say they need to respond quickly to changing market conditions.

“Provenir is a valued long-term business partner,” Smith said. “Now our customers can leverage TransUnion data in more ways as it is integrated within the Provenir platform.”

AI for better credit

Provenir launched Provenir AI last month to provide, you guessed it, AI-powered credit decisions to clients.

With Transunion data, Kathy Stares, EVP of Provenir North America, said they can make smarter decisions that lead to deeper insights and auto-optimization. The Provenir platform can eliminate development costs and enable customer organizations to see a return on investment in as little as 60 days, Stares said.

“We’re excited to expand our relationship with TransUnion and help clients of all sizes and complexity benefit from our AI-powered platform,” Stares said. “While organizations may understand the transformative power of AI-enabled risk decisioning, they often struggle with mounting the resources needed to develop, deploy and maintain AI initiatives.”

The expansion was driven by TransUnion’s extensive research on how to best meet long-term decisioning needs within the financial services industry. More on that below

Leveraging TransUnion data

“The announcement will ensure financial institutions—both large and small—gain access to world-class data and analytics solutions rapidly,” Smith said. “In selecting partners for the program, we engaged in a rigorous evaluation that included 130 categories and 20 sub-categories. Based on their assessment and our customers’ current and future needs, we partnered with industry-leading decisioning platforms such as GDS Link, Provenir, and others.”

GDS Link is a credit risk manager, providing tailored software solutions and analytical and consulting services.

Paul Greenwood, CEO of GDS Link, said that together, business users could use TransUnion data while they build, test, and deploy risk strategies through GDS Link in real-time without the need to rely on IT resources.

“As a global leader in credit risk management, we are thrilled to join TransUnion’s Strategic Alliance Distribution Partner program for decisioning,” Greenwood said. “Our customer-centric decisioning automation platform, Modellica, coupled with TransUnion’s world-class data and analytics, provides a better experience for lenders and borrowers alike.”

The Credit Study

The study, “Empowering Credit Inclusion: A Deeper Perspective on Credit Underserved and Unserved Consumers” released on April 7, found that more than 45 million consumers are considered either credit unserved or underserved in the United States.

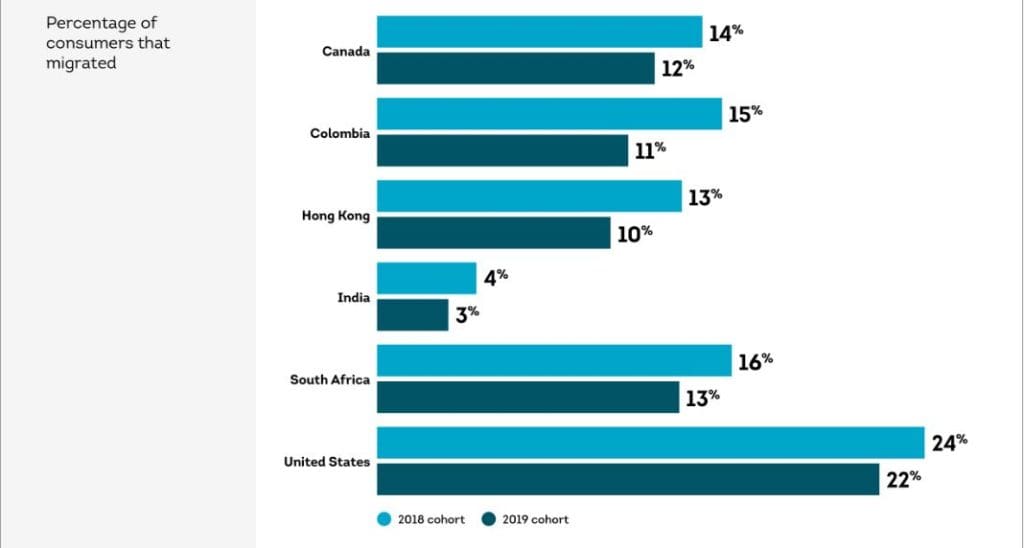

According to the study, one in four consumers who started as credit underserved migrated to becoming credit-active in a two-year window before the pandemic. During the height of the pandemic, the same group decreased to about 22% of all consumers.

In addition to the United States, the study observed consumer credit behavior in Canada, Colombia, Hong Kong, India, and South Africa to understand better the market size of these unserved and underserved consumer segments.

“Our study points to hundreds of millions of consumers around the globe being credit unserved or underserved,” Charlie Wise, senior vice president and global head of research and consulting, said. “These disadvantaged credit consumers are often unable to access financial products and services because they have no, or little, credit history.

Unserved and underserved

The study explored the characteristics and behaviors of credit unserved and underserved consumers and their overall sentiments towards credit, with insight into the credit journeys of the consumers. Unserved consumers are defined as those who have never had an open traditional credit product, such as a credit card, personal loan, or auto loan, reported in the TransUnion consumer credit database.

The underserved population has minimal credit participation, is limited to a single type of credit product and no more than two open accounts of that type, and has been active in the credit market for at least two years.

“This study served to understand better how many people are truly under- or unserved from a credit perspective,” Smith said. “While also determining paths for them to gain more credit opportunities.”

TransUnion experts included two cohorts of consumers, each over two years – the first during the pre-pandemic period beginning March 2018 through March 2020, and the second beginning in June 2019. They studied through the pandemic time of June 2021 to determine if there were any pandemic-related shifts in consumer credit migration trends.