It is difficult to talk to fintech entrepreneurs about payments without hearing about crypto, blockchain rails, and the ease of settlement with new technology.

Four months into offering an international settlement in Stellar Lumens and USDC, Tribal Credit’s Chief Product officer Arvind Nimbalker said the firm is enjoying a lot of demand from firms worldwide for crypto tech and aims to build more crypto native partnerships.

The corporate credit card and general b2b fintech SaaS firm added crypto payments in December ’21. He said they want to add more, including DeFi lending to crypto native firms.

“We had a launch announcement late last December where we spoke about cross-border payments, facilitated by USDC on the Stellar blockchain,” Nimbalker said. “But now we’re working on a few more ways to attract companies funded in crypto, underwrite them, and give them access to our platform in a purely crypto native manner.”

Why Tribal is going Lat Am

Nimbalker, a 20-year fintech veteran and head of global Amex Online Payment and lending, said Tribal was happy to jump into settlement and underwriting business credit in stable coins and crypto, a cheaper, faster option with only regulation worries to disrupt adoption. He said Tribal is excited to announce crypto native partnerships soon, from North America and Latin America specifically.

Nimbalker said he came to Tribal specifically to bring new tech to SMBs in Latin America. Without betting on coincidence, Nubank’s startling rise to stardom in the neo banking world is why a fintech needs to explain Lat Am is where the action is.

“I joined tribal to focus on bringing new technologies to small businesses in Latin America. So when we started, we focused primarily on Mexico for our initial strategy. Still, we have expanded into Colombia, Peru, Chile, and in the next one month, we will expand into Brazil,” Nimbalker said.

Why crypto?

He said the intention is to offer traditional banking products through their embedded Visa card services but differentiate themselves through the ability to settle and pay in crypto. Like the Coinbase Crypto Credit that enables consumers to spend in USDC and earn rewards in Stellar Lumens, SMBs (SMEs) can settle international payments and underwrite credit in USDC and Lumens.

“The focus is to get them to use USDC. We work with Stellar blockchain to facilitate these kinds of cross-border payments. But in the future, we intend to expand it into potentially a token issued by Tribal, so they can use the Tribal token to make these kinds of payments. And that could be very beneficial for the whole ecosystem you’re trying to build.”

It was not all of a sudden, Nimbalker said, the demand on the ground in Lat Am, just like in North American tech centers, has been for more crypto products. The only hesitation has been around regulation, or the lack thereof: business is easier when there isn’t fog.

“It’s actually surprising: all these companies are very eager to embrace crypto technologies. The hesitation that they may have is around regulation, which is unclear. That’s where we’re trying to help them figure out the impact of regulation, why it varies from market to market,” he said. “In terms of taking advantage of these new technologies and competing in the global market, they are extremely interested in working with us to make that happen.”

It is now about education

Education is the name of the new game because Nimbalker said the speed, cost, and ease of use of crypto made payments plain easier.

“It would help them with their own cross-border payments because they spend four to five days with high fees to just make that kind of payment,” he said. “On crypto and blockchain rails, all of that can happen extremely quickly.

Nimbalker said SWIFT and ACH payments are relatively slow to settle and costly ways to move cash compared to a near-instant, and cheap blockchain. He also pointed out that in Latin America, the local currency is still highly volatile, and using a USD pegged stable could be a far better option.

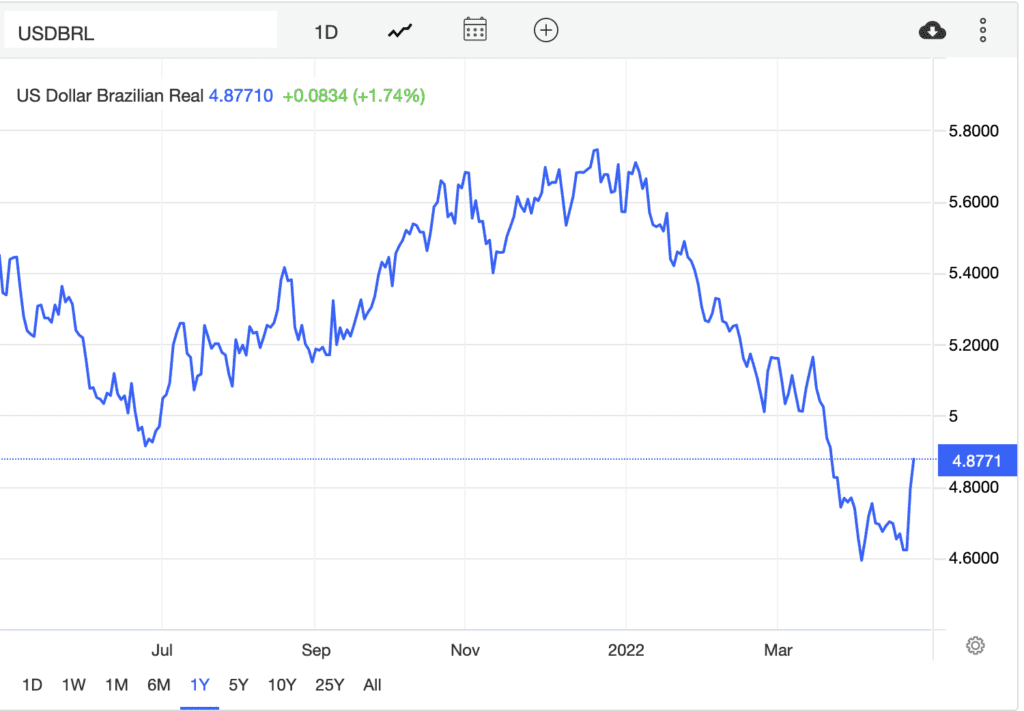

“Just look at the Brazilian rial: In the last four months, it’s fluctuated 25%, So just trading with the help of cryptocurrencies and specifically stable coins, it makes their life a lot easier,” he said. “And we can bring a lot of stability in their business.”

Data by the Site Trading Economics shows Rial that has dropped in price since the start of 2022

Comparatively, USDC has leveled around 1 USD. Analysts at Trading Economics, a record-keeping service, said the reserve currency has only gone up in index value. Investors feared dropping stock, securities, and commodities prices, and fear over inflation and rising Fed rates softened bullish markets.

Payments make crypto sense, but underwriting?

Payments are very natural in the crypto ecosystem, and it is something most people can understand, but how could you use crypto to underwrite SMB lending or credit? Nimbalker said crypto native firms would be easier to underwrite because of the transparency of storing financial data on a blockchain ledger.

“Underwriting is based on an idea of how the company has been using its funds to stipulate how successful it will be in the future,” Nimbalker said. “If a company has crypto assets, those transactions are typically recorded on a public blockchain. We can easily get access to how they’ve been managing their finances, how they’ve been using those funds, and how much funding they already have access to.”

He said the firm wants to build out a typical decentralized financial lending model to offer a marketplace of deployable crypto capital to firms. He wants to enable firms that hold stable coins or crypto on their balance sheet to “lock-up” a portion of those coins in exchange for lending, like a consumer staking Defi with their wallet.

“That’s very powerful because not only do they get to hold on to whatever assets that they have, but they can also use that to get access to credit and run their business,” Nimbalker said. “Those are the kinds of benefits that are very hard to deploy in the traditional banking system. You can collateralize a loan, but it’s such a tedious process for small businesses, specifically in Latin America, to go through that. If they start embracing crypto, they can do all of this super fast.”

Fed stable coin would make things easier

As Tribal builds out its crypto options, the only thing that could help more than clear regulations would be state-sponsored stable coins. Nimbalker said he sees an actual decline in the use of traditional currencies.

“When fintechs like us facilitate this transaction settlement in crypto, you’ll see a slow and steady decline in the way traditional currencies are used,” he said. “There is a lot of trust for USDC, and we see very high daily trading volumes; it’s probably the most traded crypto out there. If any of these local governments come up with their own stable coins like if the Fed issues a fed coin in the future, that’d be fantastic.”

Related:

Instead of waiting, Nimbalker said Tribal is already showing their initiative to go it their own.

‘Not enough hours in the day’

The firm has closed two funding rounds, a $34.4M Series A April 2021 with QED and a $60M Series B round led by Softbank Latin America. They plan on partnering with the wealth of fintechs in Lat Am to grow their offerings, and Nimbalker said the most challenging part is the lack of hours in the day.

“One thing we realized is that there are a lot of other fintechs and startups in Latin America that are strategically very important to us in helping us grow and expand in those markets.

“There’s so much that we would like to do in the time we have. It’s been exciting, you know, the kind of growth we’ve had over these last years,” Nimbalker said. “I joined when they were around 50 employees, and now we are around 400 employees: that was less than a year ago. We are growing extremely fast and looking to do some really exciting stuff, especially in the crypto space.”