In response to the Ukraine war, as the international community maneuvers to block Russia from the global bank settlement system SWIFT and sanctions trade, alternatives to the system are on everyone’s mind.

As a result, the Ruble has crashed to pennies on the US dollar, and Russian stocks were decapitated.

At the same time, crypto markets pumped more than 10% at the beginning of the war. As Russia had its international banking arms shackled, the idea sprang up that Russians may be able to settle funds through bitcoin exchanges with looser purse strings than trad institutions. If unproven, the idea was out there, and investors took note.

Unfortunately for crypto fans, so did regulators.

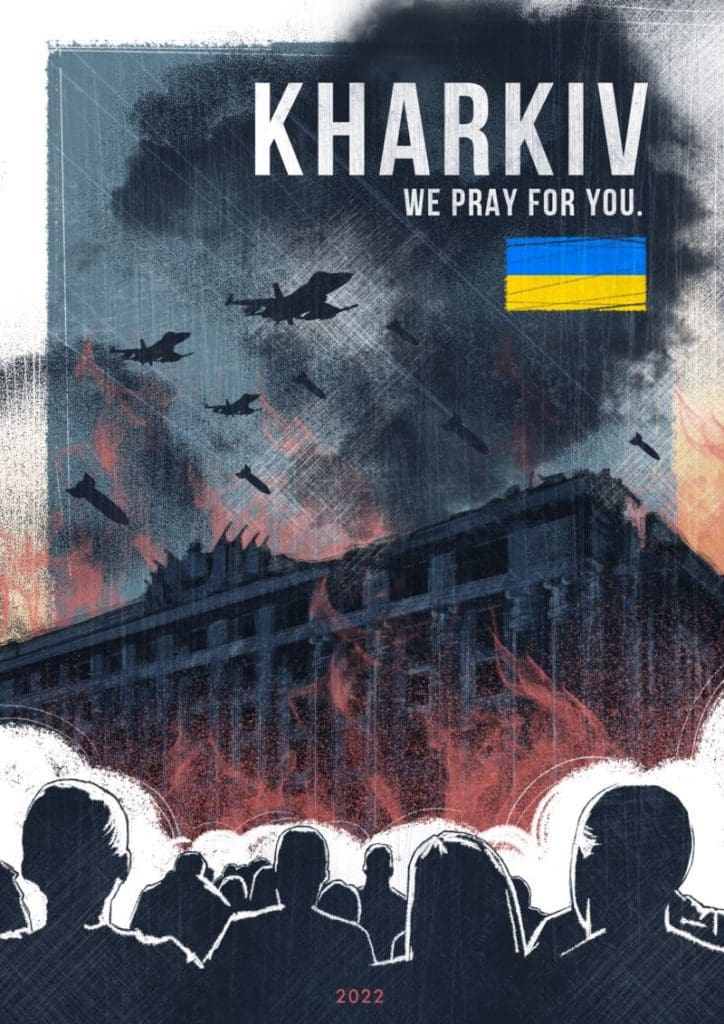

As the bombs drop in Kyiv at the tail end of a two-year bull run for alternative currencies, this is the first crypto war. Fueling a renewed bull run, Ukraine used crypto to raise funds, while Russians bought crypto to evade the pain of a currency collapse.

Crypto war: funds for Ukraine defense

A crypto war, not only in the name of avoiding an economic throttling from NATO: the Ukrainian military reported more than $85 million in bitcoin and Ethereum in donations to the official defense fund.

Crypto cash rained in from the Ukrainian dysphoria worldwide and compatriots after the official Twitter launched the donation link on Feb. 26.

The Kyiv-based crypto exchange Kuna managed the crypto transfers, according to founder Michael Chobanian, who live-tweeted an audit of the funds on his Twitter every three hours.

Chobanian said the money is already going to support evacuees and defense, including drones with heat-vision sensors.

There are two funds, The Crypto Fund of Ukraine for medical supplies and civilian firearms, and a second run by the Ministry of Digital Transformation. Alongside Bitcoin, Ethereum, and USDT, Ukraine accepted other coins, like Doge and DOT, but the audit showed those only made up 2% of transfers.

“We have two funds. First, we launched our fund, and then the government saw that it’s been working well. We’ve been approached by the Ministry of Digital Transformation to help them create a government fund, so we created a government fund as well,” Chobanian said.

Ukraine has also announced the launch of state-supported NFT sales to fund the defense and offered high-interest war bonds to investors. To some, the war bonds are an attempt to capture retail investor frenzy, with an 11% return guaranteed by a stake that may fall in the next few weeks, opines Bloomberg analysts Allison McNeely and Paulina Cachero.

War, what is it good for? Crypto

Russian troops swarmed in and were met with heavy resistance in the first week of fighting. While one million evacuated the country, millions more stayed to fight, as the Ukrainian government armed thousands of citizens, settling in a battle for their homeland.

The world watched, in mobile horror, as camera phones caught it all. Planes dropped bombs, tanks caught fire, and men and women on both sides were cut down in graphic detail. Miles of military convoys snaked back east to Russia while the international community began shipping anti-tank weapons and cheap drones to the outgunned home-landers.

While Ukrainians built Molotov cocktails, giving Putin more than he had bargained for, and Russians took control of a 50-mile east, south, and northern border, crawling closer to the capital city of Kyiv, digital natives were trying to help.

Ukraine uses crypto, retail to raise funds

On Tuesday, March 2, the Ukrainian government announced an airdrop that would reward something like a token back to the donators. It was standard procedure for crypto startups to raise funds by dropping free coins to crypto addresses to build a word-of-mouth community.

In 2022, a nation-state uses the same technique to encourage international donations to fund its wartime defense. Later on Thursday, the government took back that statement and said there would no longer be an airdrop, with rumors citing security concerns and botting.

Still, the power of crypto as an immutable ledger and international payments was undeniable. Moreover, Chobians’ work highlighted that the publicly searchable Ukrainian crypto address made donations blatantly auditable.

Other platforms sprouted alongside the two funds, like Ukraine DAO, to help Ukrainians defend themselves. In addition, crypto entrepreneurs like Polkadot co-founder Gavin Wood, Tron’s Justin Sun, and Ethereum creator Vitalik Buterin publicly donated millions toward the cause.

Fintech, big tech help too

Fintech companies, either based in Ukraine or with Ukrainian employees, were moving to keep their people safe.

Timothy Li, CEO of Alchemy and longtime LendIt community member, posted updates on his team members stuck in Ukraine. A team of engineers was stuck in the country, and Li raised funds from the fintech community to help them escape. By March 8, Li said all team members were safe and accounted for.

“We finally got the last person out of Kharkiv two days ago; everyone is out of the most critical war zones, for now,” Li said.

One person and her family had been stuck in Kharkiv while the city was under attack, while Li and the team raised funds and orchestrated their escape from the country.

Dmitry Norenko, CEO and Founder of upSWOT, a fintech that does customer cloud-based banking, is based in Ukraine.

From his home in North Carolina, Norenko raised money to help their 81 employees in Ukraine. Half decided to get out while they could, and the rest stayed to fight or protect their families. Norenko said upSWOT paid for their plane tickets and travel housing upfront, without question.

“I will fight for you even by sitting in my room in front of my laptop,” Norenko told WorkWeek. “Obviously, I’m safe. It’s incomparable to what is happening and what those people are facing in Ukraine.”

At the same time, international donations came in from outside the crypto space. For example, Elon Musk sent over Starlink modules to keep Ukrainians connected to the satellite internet service, while power and landlines went down from Russian interference.

It’s all fun and games until the ‘bad guys’ mention crypto

Still, as Ruble denominated crypto sales popped off, many in the EU and US began to worry that crypto, for its strengths in border-less exchange, could be used to get around sanctions meant to punish those responsible for the invasion.

According to the Paris crypto researcher Kaiko, ruble-denominated bitcoin volume reached 1.5 billion RUB on Feb. 24, its highest level in nine months. Not only that, but the tether Ruble pair was twice as high as the bitcoin volume.

Clara Medalie, a research director at Kaiko, told CNBC that stablecoins could play a more important role in circumventing sanctions than other, more volatile assets. She said governments could target these stable coin insurers to limit bad actor transactions.

“Most dollar-pegged stablecoins such as Tether or USDC are issued by centralized companies that could be targeted by sanctions, which could force them to monitor transactions,” she said. “There is precedent to centralized stablecoin issuers’ blacklisting’ certain addresses, so it will be interesting to see how the role of stablecoins evolves throughout the crisis.”

The crypto stable coin tether is incorporated in the Bahamas and claimed a backing of 1-1 USD to each tether for years while eluding any third party or governmental audit. However, in a self-performed audit last year, tether reported 97% of its treasury backing was actually in “commercial paper” or lent out to unknown parties.

The duality of crypto found citizens of Russia possibly leveraging bitcoin to escape monetary punishment. At the same time, Ukraine used the same blockchain network to raise funds to defend itself, independent of a banking system Russia may be able to damage. So which is it, good or bad, or the ugly in-between?

Regulaltion and sanctions: Follow the money

On March 1, President Biden pledged to dismantle Russian oligarchs the world over, targeting yachts and shell accounts in the states, while working with the international community to block seven major Russian banks.

In addition, private industry giants like MasterCard, Amex, Visa, Apple, Boeing, and more have moved to block their services to Russia; even Apple announced it would stop offering products to the country.

Regulators are taking opportunities; some used the crypto war talk to revamp anti-crypto conversations.

Biden’s new ‘kleptocapture’ task force will scour the world for Russia’s hidden transactions, including crypto. The task force will monitor how Russia spends its war chest of saved-up funds through its relationship with China.

They will also ensure crypto exchanges like Coinbase and Binance keep sanctioned actors from transacting in crypto for the first time.

Kleptocapture

Coinbase has already announced they blocked 25,000 accounts related to “illegal activity” in Russia. Paul Grewal, Chief Legal Officer in a blog post on March 6, said that no sanctions program is perfect, and money laundering through tax havens is the more significant issue.

“By contrast, digital asset transactions are traceable, permanent, and public,” Grewal said. “As a result, digital assets can actually enhance our ability to detect and deter evasion compared to the traditional financial system.”

Grewal said the majority of blocked accounts were flagged as bad actors before the invasion and that “we have not seen a surge in sanctions evasion activity in the post-invasion context.”

He pointed out that in the future, Coinbase would only sanction specific accounts handed to them by the US government, outside of maintaining their illegal activity safeguards.

If a single crypto address is linked to a sanctioned name, there are fears that all transactions related to that address will be shut down or scrutinized, even if they have nothing to do with oligarchs or terrorism.

How crypto leaders can help

Yan Zhao, president of NYDIG, a provider of institutional crypto exposure for banks, credit unions, and fintechs valued at $7B, told LendIt that they were not worried bad actors could slip through their KYC program.

“We’ve always done a very rigorous transaction monitoring program. So essentially, we use chain analysis like many others to track where the bitcoin is coming from and look at AML KYC of counterparties very rigorously,” Zhao said. “We are generally comfortable with our compliance program, and I feel pretty good about that.”

Zhao said crypto and bitcoin are not tools for bad actors, but not for good: Bitcoin is a store of value and a powerful payment and transaction tool. Such a powerful tool will naturally bring the good and bad out of people, and it is up to industry leaders like NYDIG to maintain best practices.

“I don’t think there’s an inherent thing about crypto that says ‘hey, this is a particularly good tool for crime.’ I think the larger part of the story is why bitcoin is valuable as a store of value in a particularly volatile time, and a store value at a time during inflation and as a digitally native way of payments and transferring value that is incredibly valuable” Zhao said.

“But any technology has good and bad, right: The Internet has good and bad. We, for our part, try to do what we can to keep our clients safe and in a good regulatory space, and we hope that over time, others will do the same.”

Regulators may leverage the Ukraine opportunity

Sitting Fed Chair Jerome Powell said that the Russian invasion emphasized the need for crypto regulators to prevent bad actors from skirting sanctions. He even went further to describe all coins without backing as speculative products that need to be sorted out.

None of this is new but merely revised under the lens of war. It has been evident to crypto industry natives that drastic changes to the order of trad banking are underway, and regulators in the U.S. and abroad have been slow to act. Weeks before the tanks began rolling. Consumer advocates pointed to the Crypto Bowl and what it represented.

However, instead of clear guidance on the two trillion dollar crypto industry, regulatory giants like the SEC handed out massive settlements. At the same time, lawmakers last year argued over cryptos’ future in either all-or-nothing wrangle.

Suddenly, a week after the bombs dropped, there was a genuine fear that crypto was more than a product for investing apps in commercials: it may be an escape for oligarchs out there looking to hide their money from international watchdogs.

While some are arguing crypto must be muzzled, others take the opportunity to edit their proposals.

For example, perhaps because bitcoin is used as a cross-border payment helping the Ukrainians, legislators removed the proof of work ban from the latest version of the EU crypto bill.

Exchanges letting Russian citizens buy bitcoin

During the great canceling of Russia, even while IKEA announced it would pull out, the world’s biggest crypto exchanges said they would still let Russians trade.

Binance, Kraken, and Coinbase, while adhering to KYC and large-scale sanctions targeting specific oligarchs, by and large Russians are still allowed to play.

In response to specific requests from the Ukrainian vice-Prime Minister Fedorov to halt Ruble pairings, Binance and Coinbase said that a halt would hurt ordinary Russian citizens.

Patrick Haggerty, Director of Klaros Group advisors, and Klaros Partner Jonah Crane said that exchanges were going the cautious route, only complying to the letter of the current laws, not going ahead and blocking all Russians if they don’t have to.

“The industry is taking the position, ‘if there’s a law that says we shouldn’t do business with certain people, we won’t, but we’re going to be somewhat hesitant going beyond what the law says we have to do.'” Crane said.

“I think that’s because they’re wary about putting themselves in the position of being the arbiter of who’s good and who’s bad in these situations. You’ve seen that play out in all kinds of other contexts, whether it’s Spotify, as a platform, or whether it’s Visa, MasterCard, deciding whether they’re going to process porn transactions.”

They said that in all their years advising firms on crypto and working at regulators like the OCC. It takes events like sanctions or government overreach to “teach” young companies what the regulatory ‘scape is really like.

Banks have been the police

“The banks since the ’70s have been the police on the street, reluctantly, but that’s the role that Congress has given them, and that’s not just true of banks. That’s true of anybody that’s handling the flow of money in the United States: you have obligations, almost quasi-police-like obligations, and they’re going to have to get comfortable with that,” Haggerty said.

“What I’ve always seen is that people that are new to the space that doesn’t have much of a context for the anti-money laundering requirements, they need something to happen to put it in perspective.”

Haggerty said the Ukraine crisis is one of many examples and pointed back as far as the anti-terrorism controls of post 9/11 that suddenly introduced a host of new .com companies to the omnipresent world of state-mandated AML.

“For a lot of people, 9/11 did that very clearly. But, I think we’ve seen many of other many other instances where sanctions can all of a sudden become the forefront, as they are now or concerns about terrorist financing and financing of illicit activities,” Haggerty said. “They pop up now and then, and I think this gives a good lesson to folks that may not have had that like bridge to why these regulations matter.”

Crane pointed to the anti-money laundering campaign of 2013’s Operation Choke Point and said industry leaders and conservatives called out government overreach. Back then, Congress had mandated new reforms to limit laundering in the payday loan industry, but the controls spread further than police wanted.

Similarly, the crypto exchanges are the next up on the block to become the private police. After the ‘operation’ launched, Haggerty said that banks had to de-risk themselves from unscrupulous lenders.

Is it crypto’s turn to fight crime?

Crypto is now being forced into the same situation Crane said, and if they play it right, they may emerge from this at least as strong as they were before coming under the spotlight.

“Crypto was meant to provide greater financial freedom for people across the globe,” Binance told Reuters on Feb. 28. On Monday, the CEO of Kraken said that they, too, were not blocking Russians but only following specific KYC requests.

Binance accounts for over 40% of all crypto trades in Rubles, analyst Crypto Compare said. A Binance spokesperson did not respond to numerous requests for comment by LendIt.

So even while Apple, Visa, and the world’s largest companies are cutting off the flow of goods, are crypto exchanges holding the door open for the free flow of trade?

Not exactly. While sanctions are built to affect Russia saved up siege chest, none are posted on the outgoing flow of funds and, more importantly, oil: you can’t put money in Russian goods, securities, or stock, but they can still sell Europe Gas and Oil.

As Reuters reported, the sanctions on just about everything else made Russian oil an unpopular choice right now. Although, as Comply Advantage’s Charlie Delingpole can attest, trad fi is flying toward KYC measures to distance themselves from Russian assets, the valve wasn’t wholly screwed shut.

President Biden, alongside the UK, plans on blocking the purchase of Russian energy on March 8, shutting out the cash cow that makes up 63% of Russian exports.

Crypto can’t take the Ukraine volume anyway

Even if Russia tried to save oligarch funds through crypto, the infrastructure of centralized exchanges cannot possibly handle the volume.

The US and allies’ reserves froze after Russia invaded Ukraine through loans and gold reserves held worldwide, totaling about $600 billion or more.

According to the WSJ, 80% of that was held in the US and is now freezing over after sanctions landed.

Without going into the impossibility of wash trading that amount through centralized exchanges and how traceable it would be on the blockchain, the total crypto market cap was $1.8 billion. Not big enough for a genuine attempt to wash funds.

“Crypto is not at a place where it’s a really scalable option for evading sanctions at the sort of nation-state level, Crane said. “I mean, even imagining an oligarch moving material amounts of money if they wanted to exit rubles and use crypto to do it; It’s just hard to imagine a being done at scale in a way that would be effective at evading sanctions.”

Haggerty said crypto is not big enough yet, but policymakers and regulators are worried that it may be big enough to circumvent their controls one day.

“The crux of that argument is that cryptos’ just not big enough yet, but from the seat of a policymaker, they’re not thinking about right now, they’re thinking long term,” Haggerty said.

“‘Well, if this thing does become big enough, which you all say it will eventually, then we need to put in strong code.’ So I always caution the industry to be more thoughtful beyond saying ‘it’s not big enough,’ because that’s not a long-term fix to the problem that policymakers are worried about.”

Russia will likely look toward alternative exchange layers outside of centralized crypto exchanges.

One avenue could be through state-supported stable coins without worries about real-world backing, or by building their own, like their rumored ‘digital Ruble’ announced in a research paper last year.

Until the violence ends, Crane said that crypto would be the forefront of exchange, focused on a greater degree than it should be based on the adoption and market share of total payments.