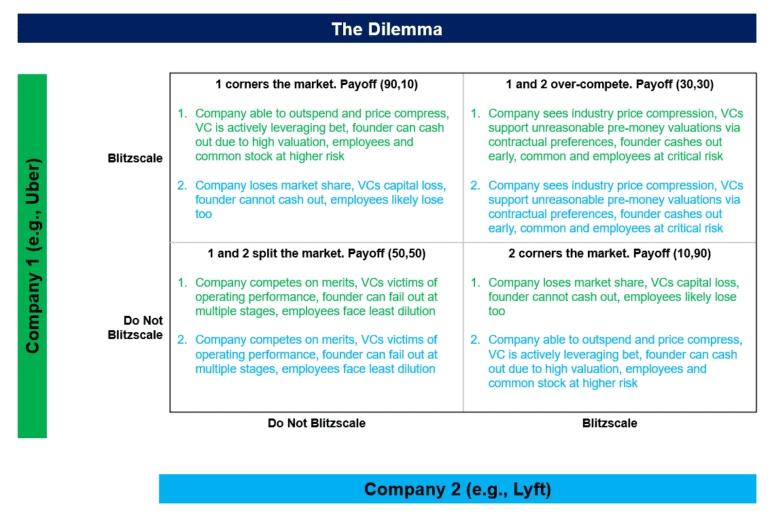

Why are high valuations bad? You’ve heard me talk about how the trend of Fintech bundling, and the unicorn and decacorn valuations led by SoftBank and DST Global, are creating underlying weakness in the private Fintech markets. Of course, they are also creating price compression and consolidation in the public markets (e.g, Schwab/TD, Fiserv/First Data) across sub-sectors. But public companies are at least transparent and deeply analyzed. Private companies have beautiful websites, charismatic leaders, and impressive sounding investors. Often when you look under the hood, it’s just a bunch of angry bees trying to find something to sting.

exc-60ea05a9085b1c120fa1a187