Things seemed to be looking up for Upstart. Stocks were soaring through June and July as interest in AI piqued, and the headwinds to the lending space seemed to be abating.

However, the company’s Q2 2023 earnings call was not as positive.

Revenue was low in the last quarter, dropping to $135.7 million, down significantly from Q2 the year before. Net income, while an improvement on Q2 2022, was down too, at a loss of $157.3 million for H1 2023, compared to a positive net income of $2.7 million for H1 2022.

Total cash and restricted cash had dropped $410 million YoY, and total assets had slipped to $1.7 billion, a decrease of $172.3 million YoY.

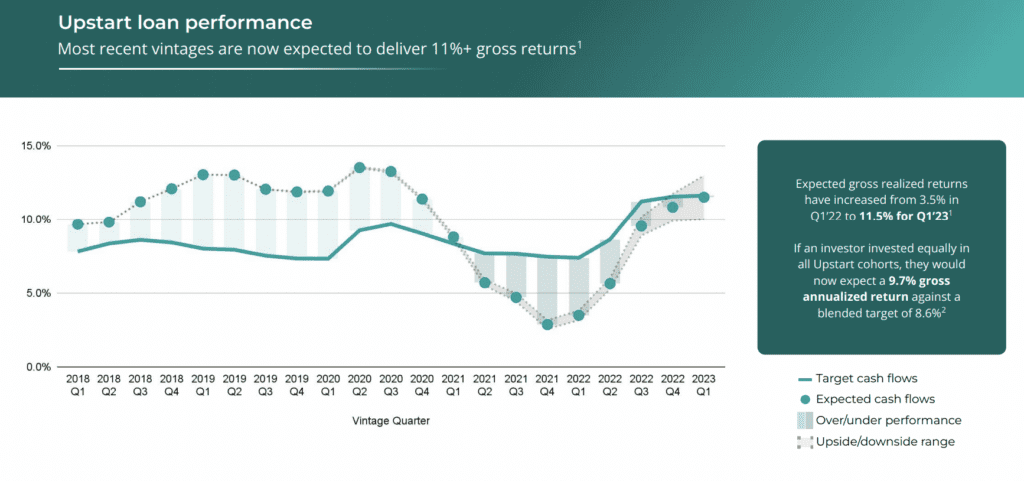

The results did, however, tentatively show some hope. For the first time in a year, Upstart reported quarter-to-quarter growth and a high contribution margin. Adjusted EBITDA had also jumped from -$31.1 million in Q1 2023 to $11 million in Q2, up $5.5 million in the same period in 2022, and loan performance was improving.

“This is despite an environment where banks continue to be super cautious about lending, interest rates are as high as they’ve been in decades, and capital markets remain challenged,” said Dave Girouard, co-founder and CEO of Upstart.

In addition, the company’s focus on AI seems to be paying off. The company reached a record full automation of 88% of unsecured loans, inching Upstart further toward the company’s desire to provide customers with enhanced access to credit.

Stalled by Macroeconomic Headwinds

The lending environment featured greatly in the earnings call, as Girouard highlighted the context of the disappointing results. He stated that the macroeconomic pressure would continue to shape the company’s strategy going forward into the second half of 2023.

“We’re not yet certain the economy is headed to a better place. So we continue to be cautious while investing for the long term,” he said.

This echos the sentiment in the wider market. Although encouragement was found in signals of easing inflation, recent events indicate the economy is not out of the woods yet.

Earlier this week, rating agency Moody’s downgraded the credit ratings of several small to mid-sized lenders. Moody’s said that “Many banks’ second-quarter results showed growing profitability pressures that will reduce their ability to generate internal capital. This comes as a mild U.S. recession is on the horizon for early 2024, and asset quality looks set to decline.”

They warned that other, larger lenders may also face downgrades in the coming months.

Other analysts, including data from the Federal Reserve, have reported weaker loan demand throughout the ecosystem, signaling lenders like Upstart may still be in for a squeeze.

AI focus may drive success

Given the ongoing challenges and disheartening results, Girouard moved to focus on the company’s future position once the macroeconomic environment (eventually) starts to shift. Future guidance was lower than analysts’ expectations, reflecting the wider environment.

However, Girouard highlighted the launch of new products and increased approval rates while introducing the company’s strategy for improving loan model calibration.

He stated that the continuing “maniacal” focus on improving efficiency had started to pay off, citing the improved contribution margin. With this approach, he hoped to position the company well to take advantage of the easing conditions.

“While the economic environment continues to be challenging, Upstart has the opportunity to grow quickly and profitably when we return to a normalized economy,” he said. “We’re in the pole position to lead the industry to an AI-enabled future that dramatically improves access to credit for hundreds of millions of Americans.”

RELATED: Upstart’s 2022 was ‘a gift’ full of slipping financials