The US is one of the leading nations globally in financial inclusion, according to the Principle Global Financial Inclusion Index 2023. However, its position is slipping, buoyed only by developments in the financial system surrounding borrowers’ protections and access to good quality fintechs.

Employer Support Damaged by Economic Challenges

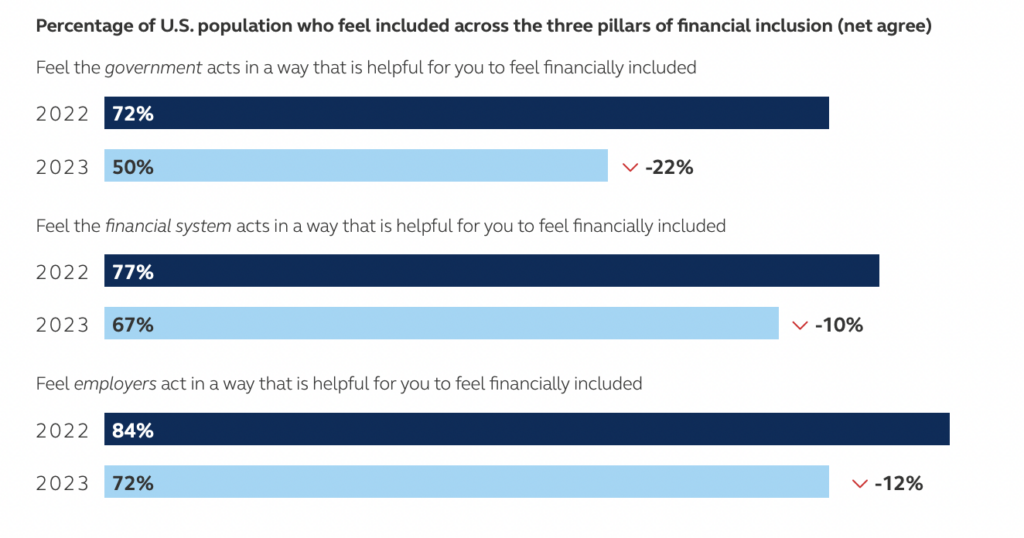

The most significant change was seen in the ranking of US employers’ support, which dropped ten positions from being ranked second globally in 2022. Despite employers remaining the strongest pillar of support for consumers to feel financially included, drops in employee pay initiatives and the provision of support around financial issues had a significant effect on the US employer support ranking.

“Tougher economic conditions – and related cost-cutting measures – may be what’s driving the lower level of support reported by US employers in the index,” said Chris Littlefield, President of Retirement and Income Solutions at Principle Financial Group.

He explained that the index had noted a decline in employer support correlated with the size of the business. SMEs, making up 99% of US firms, are significant contributors to the employment of the US workforce. Often underserved by the financial system themselves, the impact of the deteriorating economy has made its mark on balance sheets, leading to a tightening of budgets. Larger companies with more resources were found to have the capacity for higher employee support, particularly during challenging times.

In addition, the US financial system’s support ranking within the index only showed two areas of weakness. Both these areas were focused on declines in support for SME growth and enablement of business confidence, mirroring the decline in employer support.

“In an economic downturn, many companies first look to cut temporary or contract help and costs overall to help guard against job josses,” said Seema Shah, Chief Global Strategist at Principal Asset Management. “This may explain some od the declines in the Index.”

“Businesses taking actions to reduce benefits suggests we are in the middle of a labor market rebalancing. One of the most discussed topics last year was wage growth as employees were able to dictate pay in a tight labor market. As labor markets loosen, the balance of negotiating power often swings from employee to employer.”

Government support didn’t do much better than employers in terms of support, dropping in the areas of financial literacy and consumer-championing regulations. In the eyes of the consumer, the government has dropped significantly in terms of their perceived support. Many felt their access to financial products to be limited and the system itself to be unfair, unable to sustain them into retirement.

Financial System Strong Catalyst of Financial Inclusion

While government and employer support are strong catalysts for financial inclusion, the index’s study on a global scale showed that countries’ financial system support had a significant effect on their ranking. Digital dexterity and advancements in online connectivity improved financial inclusion in a number of developing economies, particularly in the Latin America region.

“Improving online connectivity and the development and adoption of digital infrastructure—especially within financial services—are helpful data points when assessing markets’ growth potential,” said Shah. “These are important components of a financially inclusive society.”

Fintechs seem to play a significant role in improving the support of financial inclusion due, in part, to their digital-native makeup. Quoting the World Bank’s Global Findex, the Principle index stated that the evolution of fintech has been critical to accelerating financial inclusion worldwide, especially in developing markets.

In the UK, with improvements in the finance sector to enable SME growth, general business confidence, and increasing the presence of fintechs, the nation improved its ranking by seven places. In the case of the US, despite drops in both government and employer support, the nation’s ranking remained high due to the strong support of the financial system.

However, the US still faces challenges to financial inclusion, and its slipped ranking is in danger of falling further. Fintech development and digital infrastructure could be key in retaining their lead.

“Financial exclusion is a real problem for maybe as much as a third of the United States,” said Jason Capehart, Head of Data Science and Machine Learning Engineering at Mission Lane. “Technology and inclusiveness from a data perspective is of the ways that we can approach that problem and improve it.”

“What fintechs do as an industry is find ways to improve that and provide services, specifically when you think about moving beyond some of these walled gardens of the legacy financial services system.”

Looking to data as a driver of US Financial Inclusion

Feeding into fintechs ability to use alternative data lies the government support. The index showed that the US government support pillar had dropped in its global ranking, dragged down, in part, by a decrease in the ranking of consumer-championing regulations.

However, in October 2023, the CFPB proposed the Personal Financial Data Rights rule aimed at improving consumer control over data sharing in a bid to accelerate open banking. If passed, the rule would protect customers from “risky” data collection practices such as screen scraping and allow them to rescind access to data as well as share data with third parties as needed.

The regulator has also initiated research into the usefulness of cash flow data in underwriting. In July 2023, the CFPB stated that “Cashflow data may help lenders better identify borrowers with low likelihood of serious delinquency, even if these borrowers’ credit scores may have otherwise prevented them from receiving credit.” While they stated that more research was needed, it gave weight to an area fintechs had been addressing for years.

“It gives us ways of providing an understanding of what someone’s credit risk or financial health is in ways that simply weren’t common practice a decade ago,” said Capehart. “The problem that a lot of Americans run into is that they are not part of the traditional prime or upper-class financial system.”

“Being able to pull things in like open banking data, and cash flow, underwriting data, give financial institutions the ability to understand who their customers are, and how they make their finances work and how they make ends meet.”

He explained that while regulation was a good thing, the area was complicated. Regulators run a risk of incurring unintended consequences that could impact consumers negatively.

“But if we get it right and find ways of promoting transparency in data and allowing people to move and evaluate, allowing consumers to evaluate their options, by making their data portable, there’s this great opportunity for improvement and competition that you just didn’t have before.”