As part of a multi-year, global agreement, HSBC will make AWS technology available across the bank’s lines of business, starting...

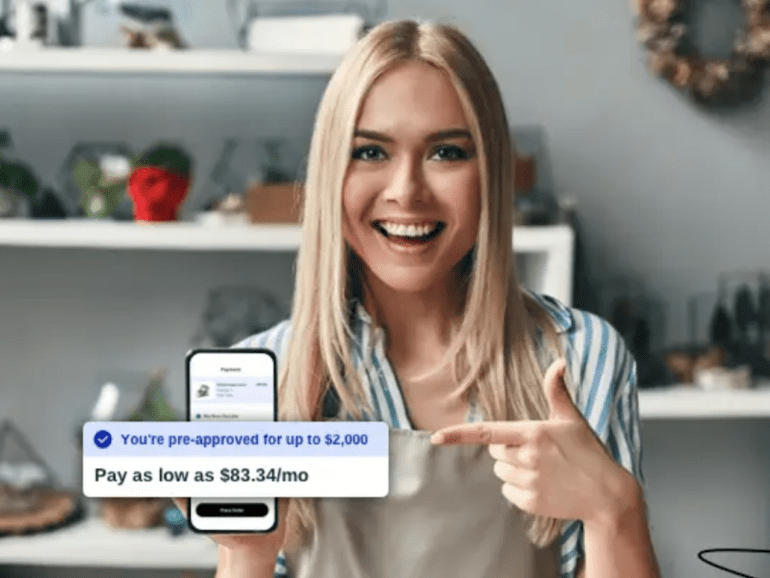

This year has already seen some major shifts in focus for the BNPL market- should banks be concerned about the B2B focus?

Card conglomerates, including Visa, Mastercard and American Express, grabbed multiple headlines in 2018 centered on their adoption of commercial cards as well...

In 2016 the online consumer lenders had an unexpected downturn; platforms experienced a capital markets crunch as well as concerns over credit quality; this panel with some of the largest consumer online lenders explores their expected growth going forward; despite the pullback, the major lenders continued to underwrite a significant amount of loans and believe growth for their businesses will return albeit in a more measured way; panelists discuss changing platform strategies and the focus on profitability. Source

In an op-ed in American Banker the CEO and Founder of Promontory Financial Group, Eugene Ludwig, talks about the growing...

Digital asset services fintech Bakkt has raised a $300mn series B from Microsoft’s venture capital arm M12 and fintech PayU;...

Ebury is a payments platform which is now 50.1% owned by Banco Santander; the bank paid $453 million; Ebury’s platform...

Japanese e-commerce giant Rakuten first applied for an ILC charter last year before withdrawing the filing and refiling this May;...

This week’s PeerIQ Industry Update covers earnings reports from Citi, JPM and Wells Fargo, a review of Lendit Fintech USA 2018 and the latest version of the PeerIQ Valuation Report. Source.

In this week’s PeerIQ Weekly Update the company covers the recent spate of bank earning reports, securitization news and issues another round of hiring updates; banks have seen a continued drop in fixed income and commodities trading revenue, picking up the slack has been lending and wealth management; Citigroup and Morgan Stanley had strong reports while Goldman Sachs and American Express missed the mark; SoFi is issuing a $720mn securitization deal, Moody’s rated the A classes AAA; PeerIQ also lists five new hires stemming from the $12mn round last summer. Source.