The days when customers enter bank branches and talk to a bank clerk are numbered.

It is estimated that 86% of consumers use fintech products, with 46% exclusively using digital channels for their financial needs. Incumbents are trying to keep up; PWC found that 77% are increasing focus on internal innovations to improve customer retention, while 88% are concerned that they will lose part of their business to stand-alone fintechs in the next five years.

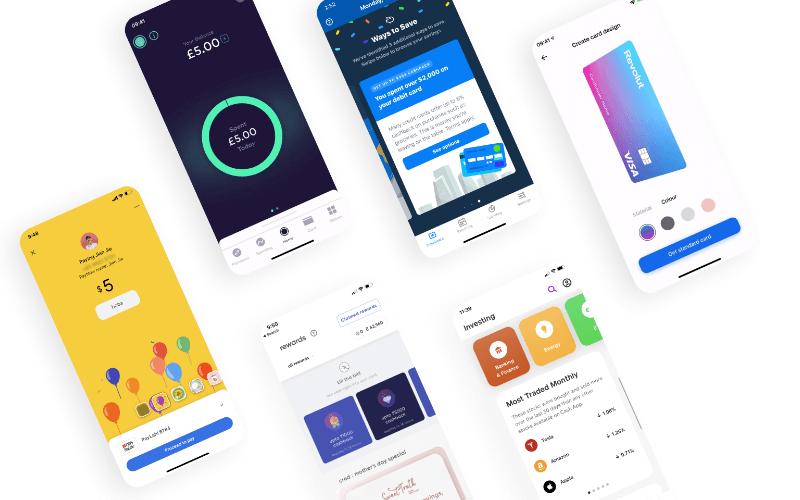

The disruption of the finance industry has happened. Digital transformation is well underway, and companies have to rely on their digital interfaces to attract and retain customers.

In this, User Experience (UX) plays a significant role. It has been found that users will take 50 milliseconds to formulate an opinion about a website. Convoluted, complicated interfaces deter users, directly impacting customer retention.

What actually is UX?

The keyword when it comes to UX is “User.” UX is user-centric, combining research and design of interface architecture to create attractive and accessible interfaces for the customer.

“We know that as human beings, we tend to make decisions based not only on logic but also on feelings,” said Federico Spiezia, UX Designer and Founder of Design Accelerator. “So you actually need to combine logic and feeling to create products that people really want to use.”

“With logic, you tend to answer questions more like, OK, does it solve a problem? And with feelings, you also solve questions like, How does it feel when you use it? Does it convey the feeling that it’s safe, that it’s something that makes you happy, or gives you a feeling of belonging? All these layers that are deeper than just solving a problem.”

Often confused with User Interface (UI) design and Graphic design, UX is focused primarily on the usability of the product and providing value to the customer and the business. Although UI and Graphic design are then combined with UX to help formulate a feel to the product, it may be possible to have a visually beautiful designed product without the ease of use that boosts customer retention if UX is not taken into account.

Due to this confusion, although making UX a part of their growth strategy, companies fail to measure the impact of their investment in UX design.

Fundamental to fintech industry success

Financial products face the challenge of including a large amount of information without overwhelming users or sacrificing usability. This makes UX essential to user engagement with products.

“The fintech industry is a front runner in the use of innovation and user experience,” said Spiezia. “Why? Because the adoption of software has basically eliminated the importance and the impact of the majority of the operation cost (the physical bank branches). Companies are competing on the offer within your pocket from a phone app.”

Part of fintech’s increased adoption rate is due to its ease of accessibility to financial products. Many of the most successful fintechs have digital interfaces which improve transparency and simplify processes for the customer.

“Now, for a lot of people, it’s rare that they enter into a physical bank branch. So your bank actually becomes the app you have on your phone to do banking,” said Spiezia. “Your whole experience with the bank, it’s the experience that you have with the app.”

“It’s important both for newcomers because it’s a chance to compete with incumbents. If they can build a bank on the Cloud, they don’t have to build all the infrastructure and operations. They can start serving users with a fraction of the cost.”

“It’s important for the large banks because they are now competing with these fintechs only on the app that they are offering.”

Gamification, data visualization, social banking, and simplification of complex functionalities such as trading are all down to UX, trends that were seen to rise in 2021. These developments have been found to improve customer engagement in financial services significantly.

RELATED: The superfluity, or necessity, of financial product video games

Going beyond visual design

Spiezia has found through research that most companies spend 6-10% of their annual budget on UX design, despite not wholly understanding its value.

“92% of the Fintech founders that I’ve interviewed have said UX is within the top three strategic goals for their company for the next 12 months,” said Spiezia. “Less than half of them have calculated the expected return on investment.”

“UX is much more than beautiful design; it’s also something that has a clear return on investment, which you can measure.”

“UX is responsible for all the key metrics that impact the user’s experience. Things like activation, retention, engagement, and monetization. Therefore you can measure the impact of UX in your priority project.”

Spiezia explained that this calculation is fundamental to evaluating whether an investment in UX is what the company needs.

“A lot of companies think they have a problem with the design, but actually, they have a problem with the whole experience of the product, which is on a higher level than that,” he explained.

“The risk with that is that if you think your problem with only is only with design, then you start, changing things like colors, you pay a designer to create a different design, you pay your developers to implement the design, and actually see that nothing changes.”

“UX is marketing. There is nothing that can convert a user better than UX. Send them as many emails as you want. You can target them on Facebook, and you can do SEO, but ultimately, the question is, do they download your app, and do they generate revenue? That only depends on UX.”

Making this distinction becomes the key to measuring the value of UX investment. As markers such as monetization and activation rate are quantifiable, increases and decreases can be easily measured.

“It’s not only about creating beautiful experiences for the user, but also to make things that make business sense,” concluded Spiezia.