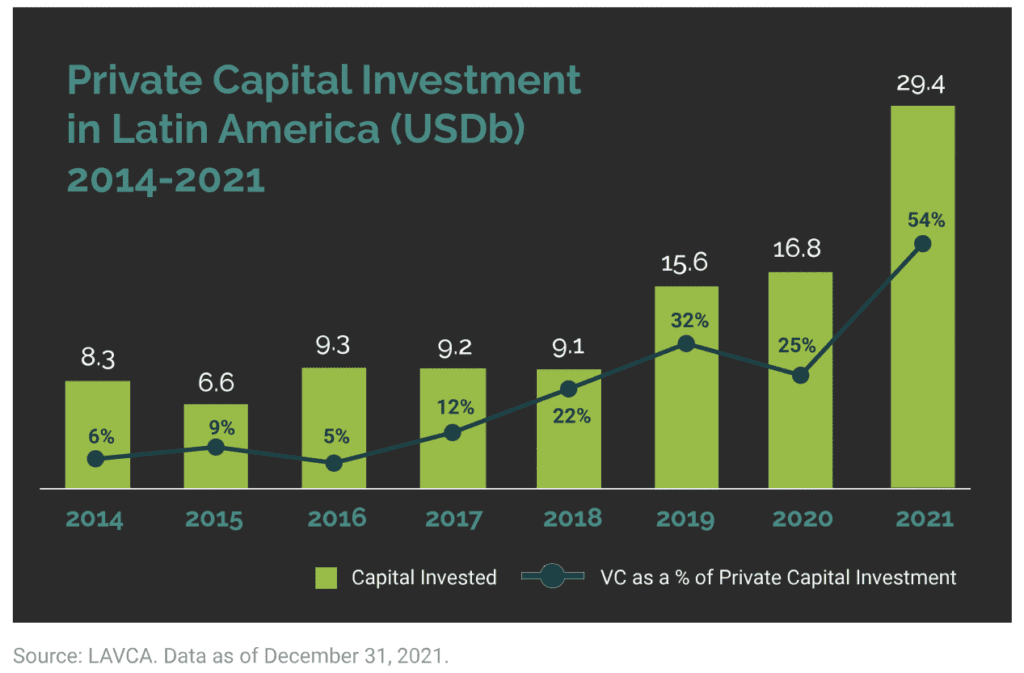

Digitization trends in Latin America drew in a slew of investors in 2021, with private capital investments more than doubling in size compared to the previous year.

Some $29.4 billion were deployed in Latin-American tech startups during 2021, up from a previous record of $16.8 billion during the last year.

The increase in funding reflects a growing interest in the regional industry and a sign of maturity among various companies that are disrupting traditional sectors such as finance.

Venture capital contributed to 54% of all private capital investments, with $15.7 billion inflows to LatAm startups reported last year.

According to a Latin American Private Capital Association report, the sum of funds in 2021 was greater than the bulk of all the previous years combined and more than tripled a previous record of $4.8 billion in 2019.

Momentum in investment flows stretches well into the first quarter of 2022. According to Lavca, established investors have over $5 billion in region-specific investment vehicles ready to be deployed.

“Growing dry powder in venture capital is poised to fuel further investment in Latin American tech companies,” the report read.

Global players

Interest in Latin American tech startups had been growing in the previous years, attracting global players to the industry such as Softbank, Tencent, or Berkshire Hathaway.

But the pace of flows accelerated dramatically over the past two years, as digitization trends during the pandemic fast-tracked various markets.

During the year, 16 new unicorns were minted. That is startups that surpassed the $1 billion valuation threshold.

These include Argentine financial app Uala, Brazilian e-commerce Madeira Madeira, Mexican digital lender Konfio, payments firm Clip, also cryptocurrency firms such as Bitso and Mercado Bitcoin.

There was also vigorous activity for well-established enterprises. Online bank Nubank, one of the flagships in the fintech sector, tapped $750 million from private investors before going public by the end of the year in the New York Stock Exchange.

The fintech industry attracted some $6.1 billion in the year, holding its place as the leading sector with nearly 40% of all capital investments. Low participation of financial services in Latin American economies is the primary driver of future growth in the industry.

Market opportunity massive

“The market opportunity in fintech is just so big,” said Chloé Novène, an investment associate at ALLVP venture capital firm. “There is a lot of space to offer products to people that were not included in the financial system before.”

There were some 258 transactions reported last year in the fintech sector, including a $250 million round by Mexican payments firm Clip. Retail lending and crypto saw the increased attraction, as Bitso and Mercado Bitcoin, together with Flink, all saw venture capital investments.

During the year, Latin America was no stranger to the rise of Buy Now, Pay Later firms. Kueski took the baton as it received some $202 million in funding last year, followed by Nelo and Aplazo, with $20 million and $5.3 million, respectively.

“There are top-tier companies in Latin America that are doing things very well,” Hanna Schiuma, a vice president of Wealth & Community at Argentine digital payments fintech Ank, said.

“Startups have revolutionized industries in recent years. In the financial sector, there have been more changes in the last five years than in the previous 20.”

She argued that very little financial inclusion is a distinctive feature in Latin America that is leading to the emergence of multiple fintech companies in the ecosystem.

“Many investors began to bet on different startups as they have come to look at Latin America with different eyes.”

Brazil continued to attract the most capital in the region, minting eight new unicorns and capturing 48% of the total money invested.

In Mexico, VC increased fourfold in 2021, driving total capital investment to a record $5.5b, according to LAVCA data.