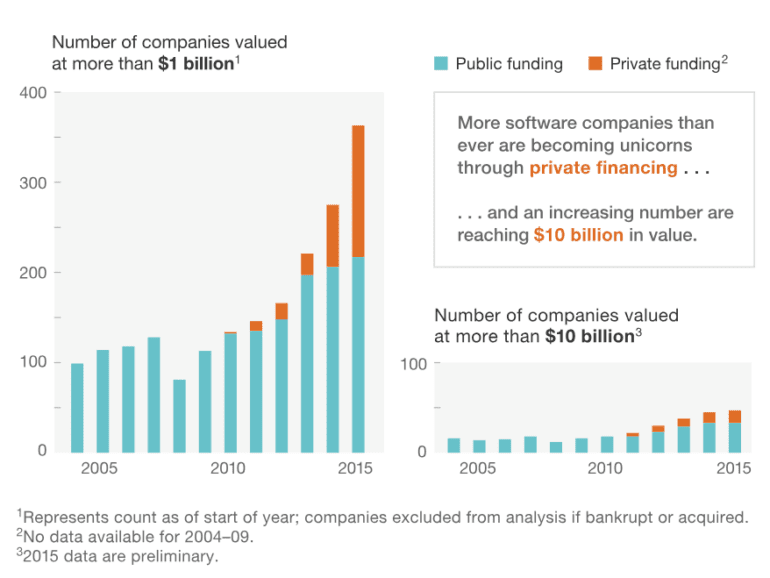

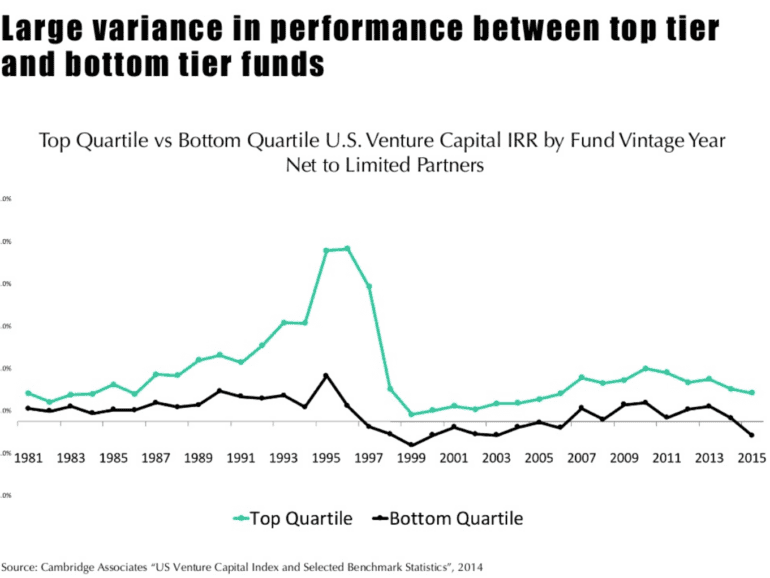

The world is on fire with talk about Uber going public. First, let's talk about who makes money and when. It is becoming a truism that companies are going public much later in their vintage, and as a result, the capital that fuels their growth is private rather than public. The public markets are full of compliance costs, cash-flow oriented hedge fund managers, and passive index manufacturers -- not an environment for an Elon Musk-type to do their best work. Private markets, on the other hand, are generally more long term oriented with fewer protections for investors. This has a distributional impact. Private markets in the US are legally structured for the wealthy by definition and carve-out. As a retail investor, your just desserts are Betterment's index-led asset allocation. As an accredited investor, you get AngelList, SharePost and the rest. I am yet to see Uber on Crowdcube. Therefore, tech companies are generating inequality both through their functions (monopoly concentration through power laws, unemployment through automation), and their funding.

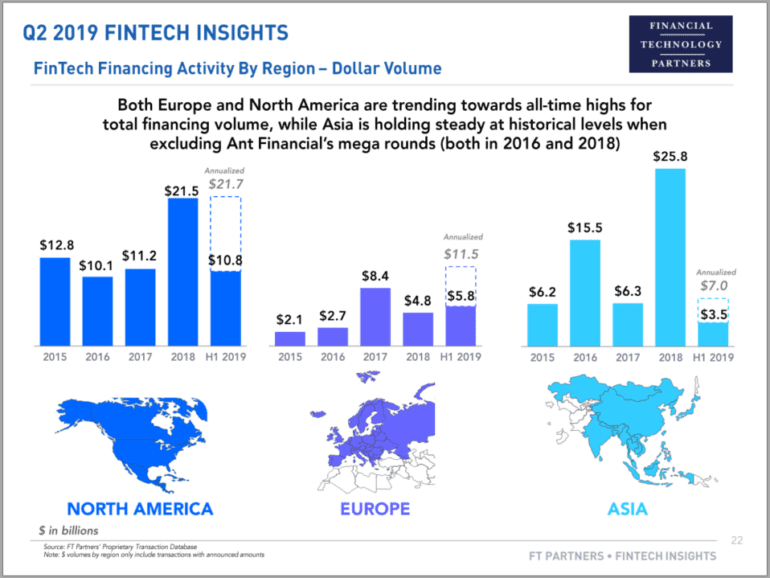

Fintech is expensive. Fintech is everywhere. If you are a thinking about starting a financial services company, and it does not have technology at its core -- don't. You will lose to someone similarly positioned building a more augmented business. Fintech is the global competition for regulation, talent, and macroeconomic supremacy. Fintech is the trade war between the US and China. Fintech is Facebook and Amazon. Fintech is the next bubble to burst. Fintech has burst already.

From a financial incumbent point of view, if you are going to mutualize infrastructure, you need to actually mutualize the infrastructure. This means solving the game theory problem of accidentally giving away the value of your back office systems to your biggest, best-funded bank competitor -- not a competitive equilibrium. To that end, technology companies are a natural place for maintaining crypto systems. However, note that public chains today already have the benefit of billions of dollars in cyber-security spending (i.e., mining) and the dedicated engineering of thousands of open source developers. By choosing to use a public chain, you get this out of the box. With a proprieraty solution, even if the end-results are open-sourced, community is impossible to replicate. Maybe this is why IBM bought Red Hat for $34 billion, and Microsoft bought GitHub for $7 billion.

Feelings and emotions at industry events matter. The narrative at the more traditional conferences is that Fintech innovation is just incremental improvement, and that blockchain has struggled to bring production-level quality software and stand up new networks. This isn't strictly true -- see komgo, SIX, or any of the public chains themselves -- but the overall observation does stand. Much of Fintech has been channeled into corporate venture arms, and much of blockchain has been trapped in the proof-of-concept stage, disallowed from causing economic damage to existing business.

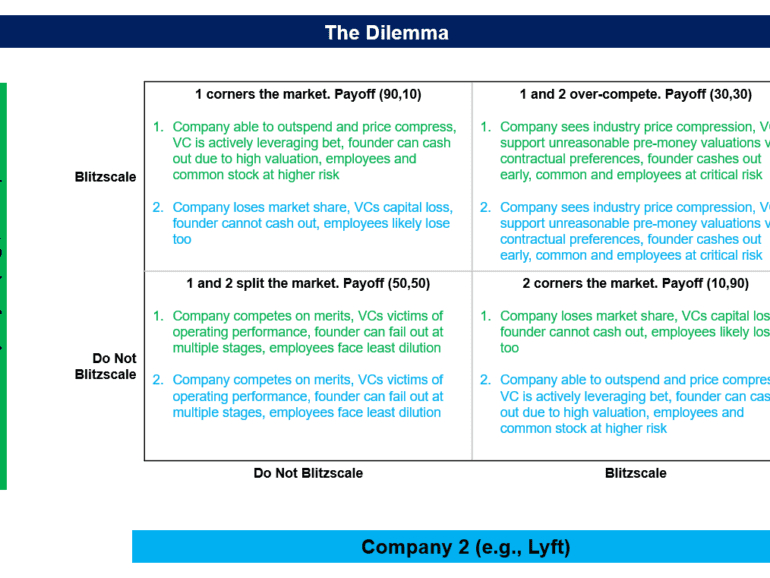

Why are high valuations bad? You've heard me talk about how the trend of Fintech bundling, and the unicorn and decacorn valuations led by SoftBank and DST Global, are creating underlying weakness in the private Fintech markets. Of course, they are also creating price compression and consolidation in the public markets (e.g, Schwab/TD, Fiserv/First Data) across sub-sectors. But public companies are at least transparent and deeply analyzed. Private companies have beautiful websites, charismatic leaders, and impressive sounding investors. Often when you look under the hood, it's just a bunch of angry bees trying to find something to sting.

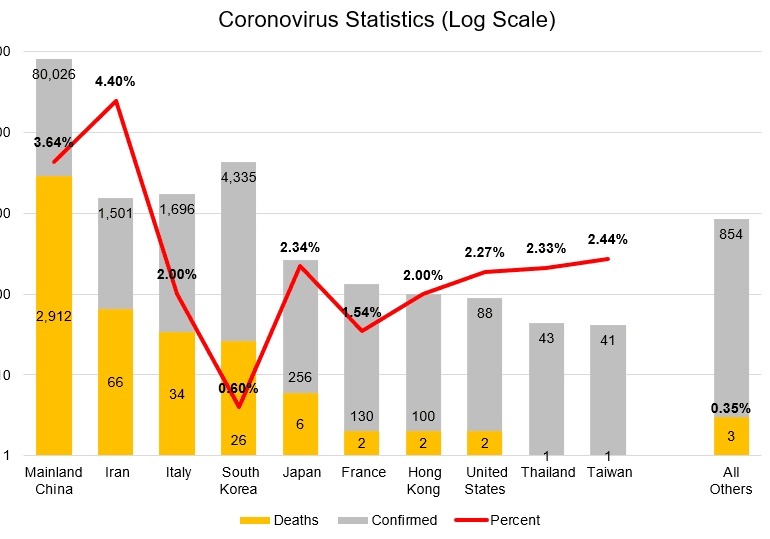

I look at how the news about the spread of the coronovirus are cracking the global economic machine. Some may argue that the number of people effected is still low -- but that misses the entire point. The shock of a global pandemic has revealed weakness in the financial machine, sending the stock markets falling 10% year-to-date. Gross domestic product growth is expected to slow by billions of dollars, governments and central banks are unable to implement policy to compensate with rates at historic lows and borrowing at historic highs, public market valuations will tumble arithmetically, and private Fintech companies will lose a path to exit. At least that's what the conspiracy theorists want you to think!

We look at why venture capital investors are slowing down, and the dynamics of how their portfolios work under duress. We talk about the incentives of limited partners to derisk exposure, the implication that has on cash reserves, new deals, and fundraising. We also touch on how the various Fintech themes are responding to an increase in digital interaction while seeing fundamental economic challenges. Shrewd competitors will be able to consolidate their positions and gain share during the crisis, but that will have to come from the balance sheet, not intermittent growth equity checks.

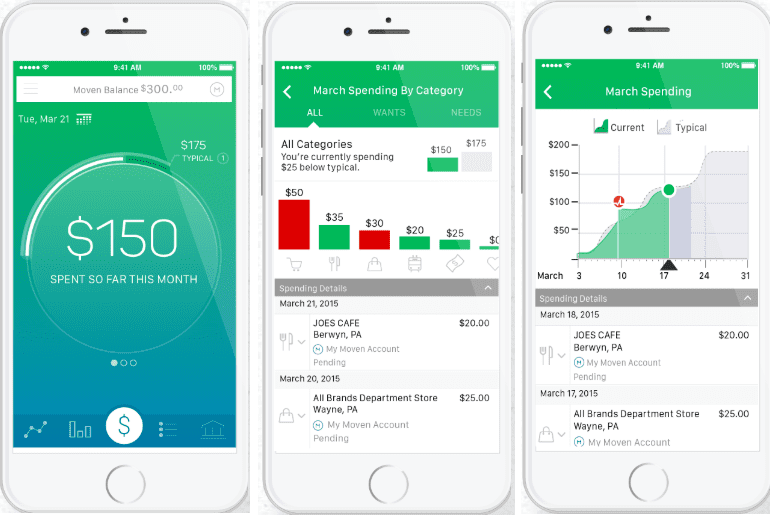

Today we're joined by Brett King, founder and executive chairman of Moven, one of the world's original digital banks, and Lex Sokolin, global head of fintech at ConsenSys. Lex and I discussed Moven's recent announcement to shutter its B2C business on episode 170 of Rebank. And we're happy to have the opportunity to connect with Brett directly to discuss the decision in more detail.

This week, we look at:

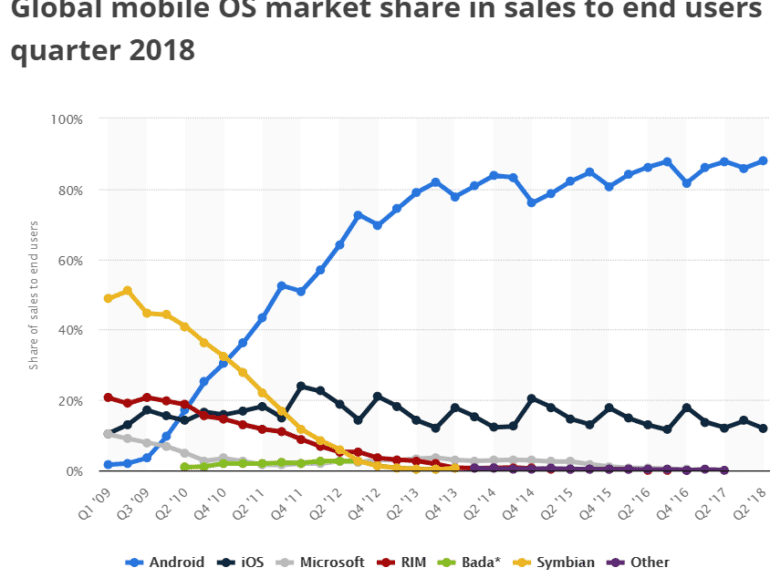

PayPal and Square being larger than Bank of America and Goldman Sachs

The SoftBank $4 billion in tech oligopoly call options, and why people feel uneasy

Uniswap vs. SushiSwap, and Bitcoin vs. Litecoin, and why these forks felt wrong

How understanding signalling can help make better decisions

This week, we look at:

What it means to ask questions and find answers

From asking simple questions that result in neobanks and roboadvisors. Who will win — Schwab or Robinhood?

To asking macro questions about the finance / high-tech competition. Who will win — Goldman Sachs or Google?

To asking profound questions about the nature of the work, and the art of finding your own questions.

We can't formulate the questions for you. But we can give you a framework of needs for both the individual, and the organization.

The questions that you ask are the answers that you will get.