Funding for Latin American fintechs surged in the first quarter, raising hopes that the worst for the industry may be behind it.

This week, we cover these ideas:

The difference between building a Fintech company, and building an empire to transform the world

How Warren Buffett is the best in the world at getting leverage through third party capital to grow

How Elon Musk is the best in the world at re-investing capital into his own judgment and view of the future

The $1.2B BitGo acquisition by Galaxy Digital, and the growing footprint of Alameda Research

DAOs as a way for all of us to participate

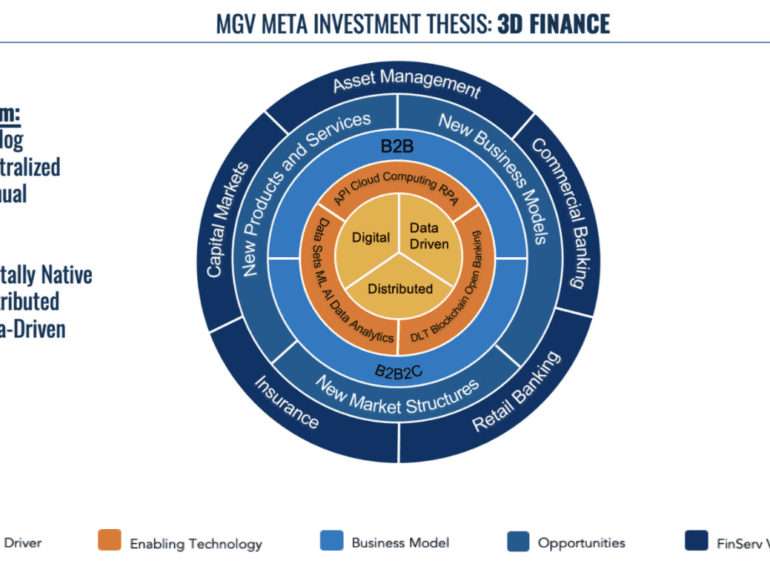

In this conversation, we talk all things Wall Street, FinTech, and Venture Capital with Patrick Pinschmidt, who's the general partner and co-founder at MiddleGame Ventures.

More specifically, we discuss the ups and downs of sell-side research in the early 2000s, the evolution of financial technology to today’s FinTech, an insight into the Financial Stability Oversight Council at the US Treasury Department, the founding of Middlegame Ventures and its impressive investment portfolio, and the transformation of financial services fueled by the rapid innovation in FinTech.

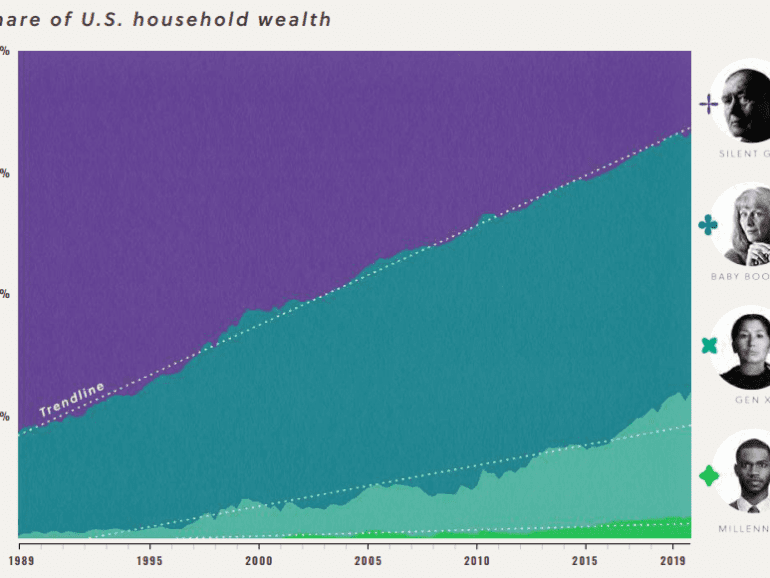

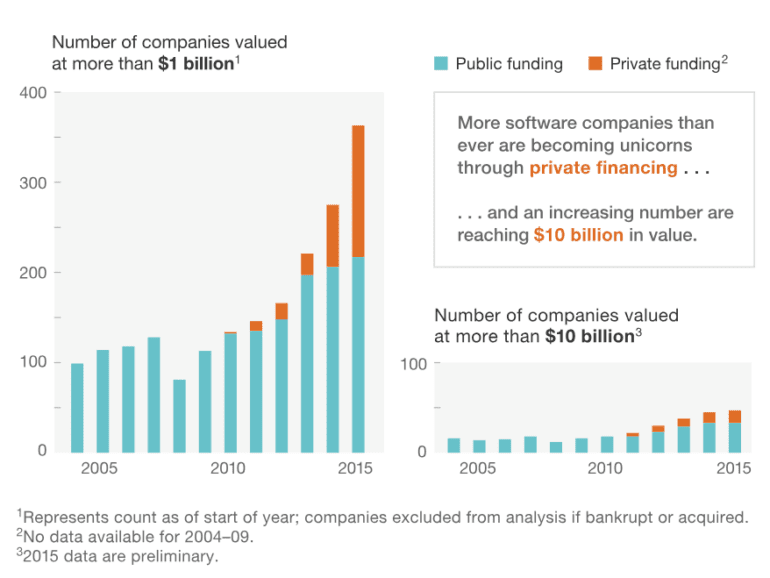

The world is on fire with talk about Uber going public. First, let's talk about who makes money and when. It is becoming a truism that companies are going public much later in their vintage, and as a result, the capital that fuels their growth is private rather than public. The public markets are full of compliance costs, cash-flow oriented hedge fund managers, and passive index manufacturers -- not an environment for an Elon Musk-type to do their best work. Private markets, on the other hand, are generally more long term oriented with fewer protections for investors. This has a distributional impact. Private markets in the US are legally structured for the wealthy by definition and carve-out. As a retail investor, your just desserts are Betterment's index-led asset allocation. As an accredited investor, you get AngelList, SharePost and the rest. I am yet to see Uber on Crowdcube. Therefore, tech companies are generating inequality both through their functions (monopoly concentration through power laws, unemployment through automation), and their funding.

Deployment of capital may be down this year but VCs have shifted gear, bringing extra focus to founders and their ability to adapt.

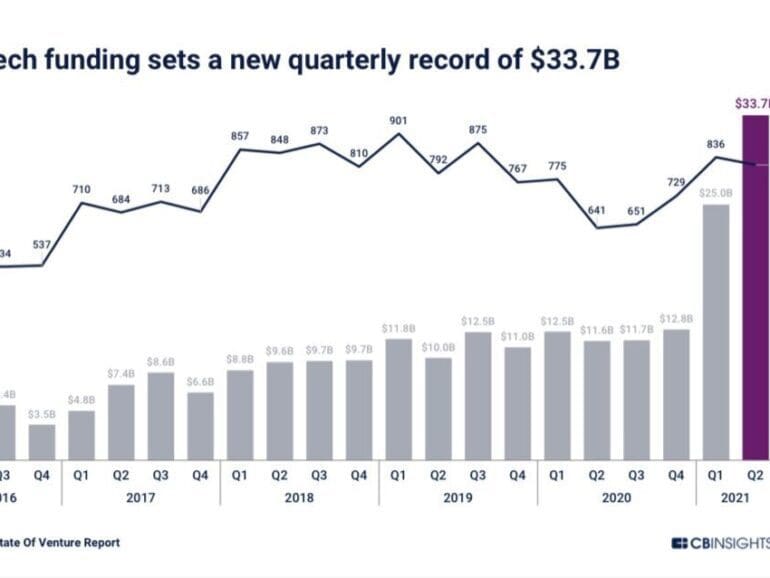

Last quarter, fintech funding rose to $30 billion, the highest on record. $14 billion of SPAC capital is waiting to take these companies public. Robinhood and Circle are about to float on the public markets, via SPAC and IPO. In this analysis, we explore the fundamentals of both companies, as well as the unifying thesis that explains their growth.

This week, we look at:

What it means to ask questions and find answers

From asking simple questions that result in neobanks and roboadvisors. Who will win — Schwab or Robinhood?

To asking macro questions about the finance / high-tech competition. Who will win — Goldman Sachs or Google?

To asking profound questions about the nature of the work, and the art of finding your own questions.

We can't formulate the questions for you. But we can give you a framework of needs for both the individual, and the organization.

The questions that you ask are the answers that you will get.

A new report from company builder and venture group Team8 shows it’s a good time for fintechs to pursue unicorn status, provided they do the groundwork.

This year has seen new lows for VC funding, while some success stories have emerged, the path may continue into 2024.

This week, we look at:

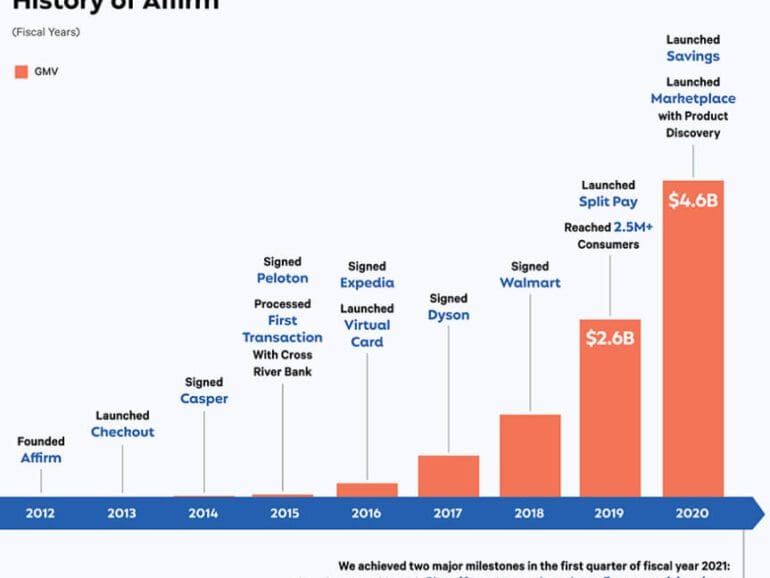

Over $1 billion in raises announced last week, and over $10 billion in Fintech company value creation: Checkout.com with $450 million at a $15 billion valuation, Affirm more than doubling after its IPO to $30 billion, lending enabler Blend raising $300 million, and payments enabler Rapyd raising $300 million.

A systems theory framework that explains the stocks and flows of goods and services, and what monetization strategies are available to fintechs

How transactional models are thriving and creating 50-100x revenue multiples