Feelings and emotions at industry events matter. The narrative at the more traditional conferences is that Fintech innovation is just incremental improvement, and that blockchain has struggled to bring production-level quality software and stand up new networks. This isn't strictly true -- see komgo, SIX, or any of the public chains themselves -- but the overall observation does stand. Much of Fintech has been channeled into corporate venture arms, and much of blockchain has been trapped in the proof-of-concept stage, disallowed from causing economic damage to existing business.

This week, we cover these ideas:

That absurd Paul Krugman article about Bitcoin. Also Jim Cramer has things to say about financial regulation.

If all the prices are down, which they are, does that mean that everything is bad and wrong?

How timing is a personal financial planning problem, not a market value problem

While VC funding to Latin American startups saw a year over year decline, the fact that it is stabilizing offers hope to the industry.

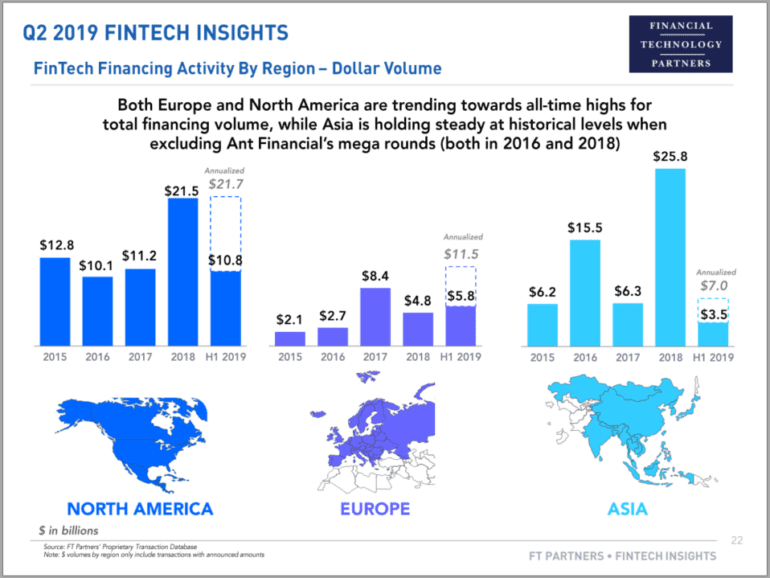

Fintech is expensive. Fintech is everywhere. If you are a thinking about starting a financial services company, and it does not have technology at its core -- don't. You will lose to someone similarly positioned building a more augmented business. Fintech is the global competition for regulation, talent, and macroeconomic supremacy. Fintech is the trade war between the US and China. Fintech is Facebook and Amazon. Fintech is the next bubble to burst. Fintech has burst already.

From a financial incumbent point of view, if you are going to mutualize infrastructure, you need to actually mutualize the infrastructure. This means solving the game theory problem of accidentally giving away the value of your back office systems to your biggest, best-funded bank competitor -- not a competitive equilibrium. To that end, technology companies are a natural place for maintaining crypto systems. However, note that public chains today already have the benefit of billions of dollars in cyber-security spending (i.e., mining) and the dedicated engineering of thousands of open source developers. By choosing to use a public chain, you get this out of the box. With a proprieraty solution, even if the end-results are open-sourced, community is impossible to replicate. Maybe this is why IBM bought Red Hat for $34 billion, and Microsoft bought GitHub for $7 billion.

Instead of modifying decades-old transaction infrastructure, Spade provides better fraud protection by creating a new system. Customers like Sardine, Mercury, Unit and Ramp have improved their fraud models by more than 15% using Spade's real-time merchant intelligence for the card ecosystem.

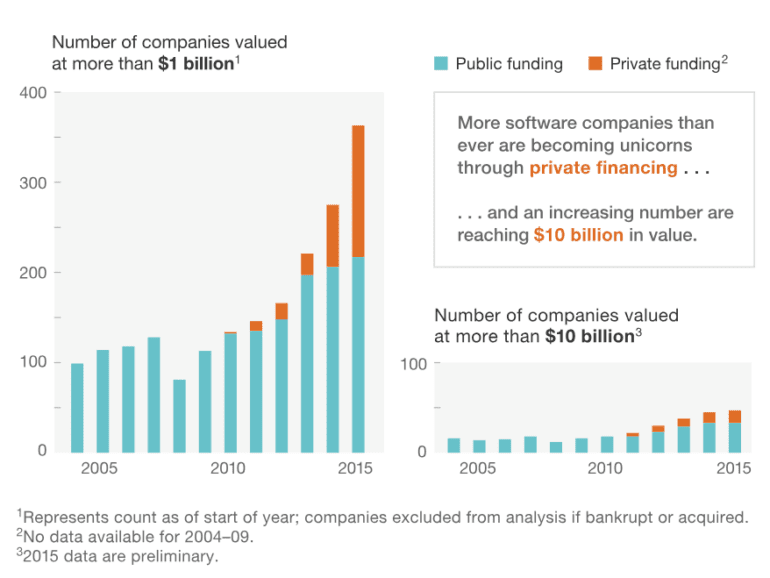

The world is on fire with talk about Uber going public. First, let's talk about who makes money and when. It is becoming a truism that companies are going public much later in their vintage, and as a result, the capital that fuels their growth is private rather than public. The public markets are full of compliance costs, cash-flow oriented hedge fund managers, and passive index manufacturers -- not an environment for an Elon Musk-type to do their best work. Private markets, on the other hand, are generally more long term oriented with fewer protections for investors. This has a distributional impact. Private markets in the US are legally structured for the wealthy by definition and carve-out. As a retail investor, your just desserts are Betterment's index-led asset allocation. As an accredited investor, you get AngelList, SharePost and the rest. I am yet to see Uber on Crowdcube. Therefore, tech companies are generating inequality both through their functions (monopoly concentration through power laws, unemployment through automation), and their funding.

F-Prime released their latest State of Fintech report and it shows an industry back on the upswing but with still a lot of work to do.

This year has seen new lows for VC funding, while some success stories have emerged, the path may continue into 2024.

The startup community is facing a mismatch of venture debt supply to their demand - digital lenders are stepping in.