Why are high valuations bad? You've heard me talk about how the trend of Fintech bundling, and the unicorn and decacorn valuations led by SoftBank and DST Global, are creating underlying weakness in the private Fintech markets. Of course, they are also creating price compression and consolidation in the public markets (e.g, Schwab/TD, Fiserv/First Data) across sub-sectors. But public companies are at least transparent and deeply analyzed. Private companies have beautiful websites, charismatic leaders, and impressive sounding investors. Often when you look under the hood, it's just a bunch of angry bees trying to find something to sting.

Feelings and emotions at industry events matter. The narrative at the more traditional conferences is that Fintech innovation is just incremental improvement, and that blockchain has struggled to bring production-level quality software and stand up new networks. This isn't strictly true -- see komgo, SIX, or any of the public chains themselves -- but the overall observation does stand. Much of Fintech has been channeled into corporate venture arms, and much of blockchain has been trapped in the proof-of-concept stage, disallowed from causing economic damage to existing business.

F-Prime released their latest State of Fintech report and it shows an industry back on the upswing but with still a lot of work to do.

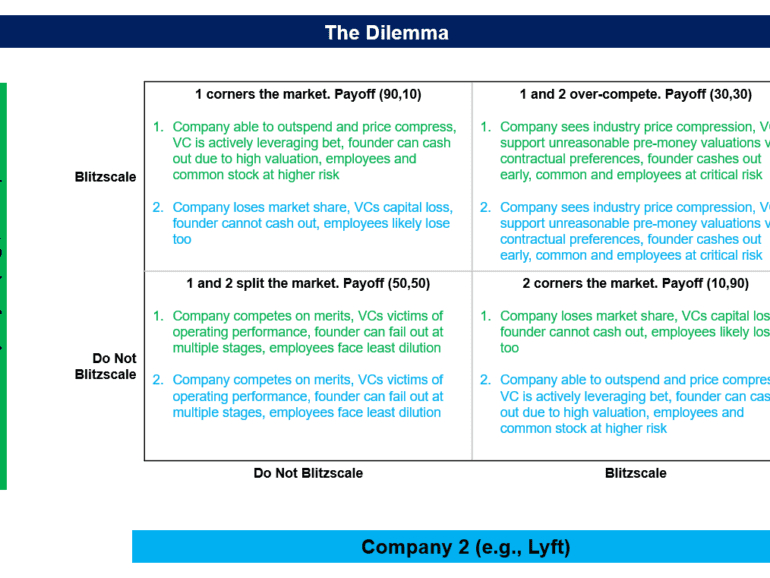

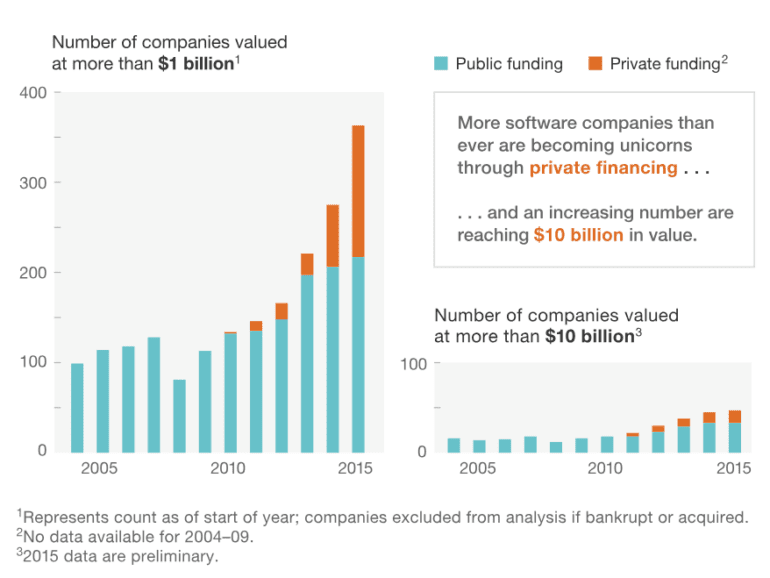

The world is on fire with talk about Uber going public. First, let's talk about who makes money and when. It is becoming a truism that companies are going public much later in their vintage, and as a result, the capital that fuels their growth is private rather than public. The public markets are full of compliance costs, cash-flow oriented hedge fund managers, and passive index manufacturers -- not an environment for an Elon Musk-type to do their best work. Private markets, on the other hand, are generally more long term oriented with fewer protections for investors. This has a distributional impact. Private markets in the US are legally structured for the wealthy by definition and carve-out. As a retail investor, your just desserts are Betterment's index-led asset allocation. As an accredited investor, you get AngelList, SharePost and the rest. I am yet to see Uber on Crowdcube. Therefore, tech companies are generating inequality both through their functions (monopoly concentration through power laws, unemployment through automation), and their funding.

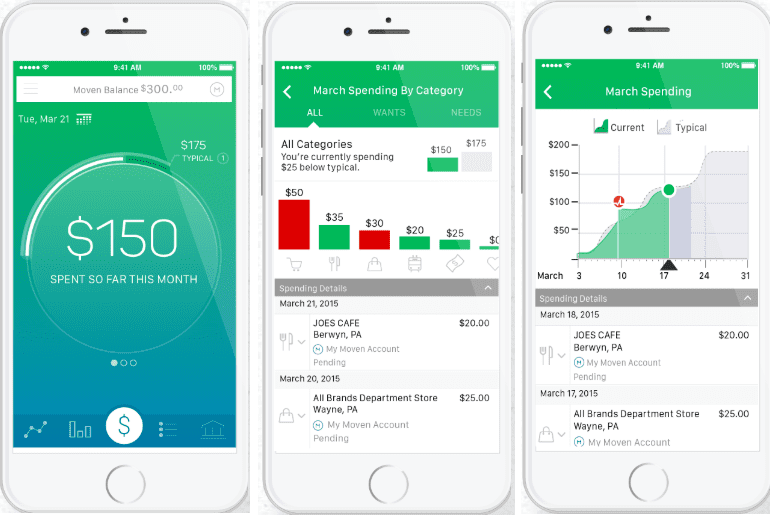

Today we're joined by Brett King, founder and executive chairman of Moven, one of the world's original digital banks, and Lex Sokolin, global head of fintech at ConsenSys. Lex and I discussed Moven's recent announcement to shutter its B2C business on episode 170 of Rebank. And we're happy to have the opportunity to connect with Brett directly to discuss the decision in more detail.

This week, we look at:

PayPal and Square being larger than Bank of America and Goldman Sachs

The SoftBank $4 billion in tech oligopoly call options, and why people feel uneasy

Uniswap vs. SushiSwap, and Bitcoin vs. Litecoin, and why these forks felt wrong

How understanding signalling can help make better decisions

Colombian fintechs have been very active in the VC space in 2024, with a number of startups raising over $150 million in funding so far.

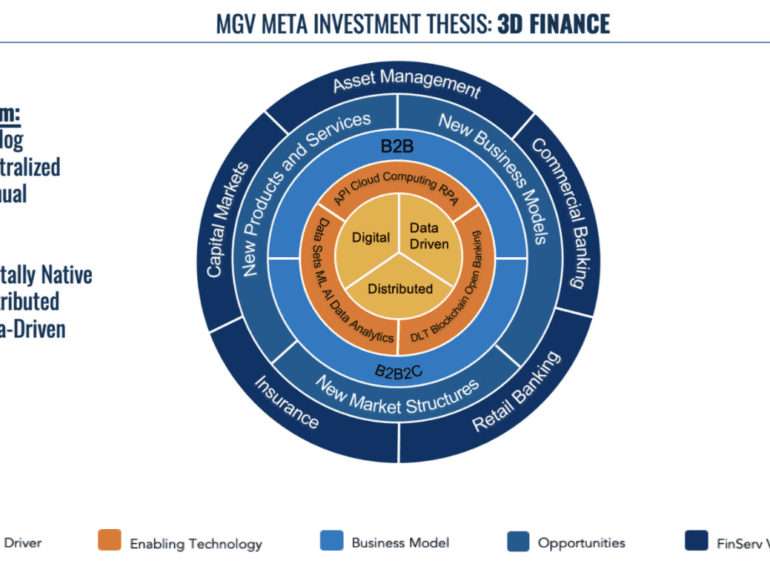

In this conversation, we talk all things Wall Street, FinTech, and Venture Capital with Patrick Pinschmidt, who's the general partner and co-founder at MiddleGame Ventures.

More specifically, we discuss the ups and downs of sell-side research in the early 2000s, the evolution of financial technology to today’s FinTech, an insight into the Financial Stability Oversight Council at the US Treasury Department, the founding of Middlegame Ventures and its impressive investment portfolio, and the transformation of financial services fueled by the rapid innovation in FinTech.

Instead of modifying decades-old transaction infrastructure, Spade provides better fraud protection by creating a new system. Customers like Sardine, Mercury, Unit and Ramp have improved their fraud models by more than 15% using Spade's real-time merchant intelligence for the card ecosystem.

The startup community is facing a mismatch of venture debt supply to their demand - digital lenders are stepping in.