In early May we learned from a press release that Wells Fargo, one of the largest banks in the United States was entering online lending. The new product, dubbed FastFlex is focused on providing loans to small businesses online. Wells Fargo has set a goal which trumps where many of the online lenders are today, aiming to lend $100 billion over five years. They are well on their way, having lent over $40 billion since setting this goal in January, 2014.

Wells Fargo has the opportunity to scale quickly due to two distinct advantages that many online or marketplace lenders simply don’t have: a large established borrower base in the form of small business clients which totals over 3 million and access to significant and stable capital.

We had the chance to speak with a representative from Wells Fargo about the new product and also were able to see how Wells Fargo is offering these loans since Lend Academy and our sister company LendIt are Wells Fargo customers.

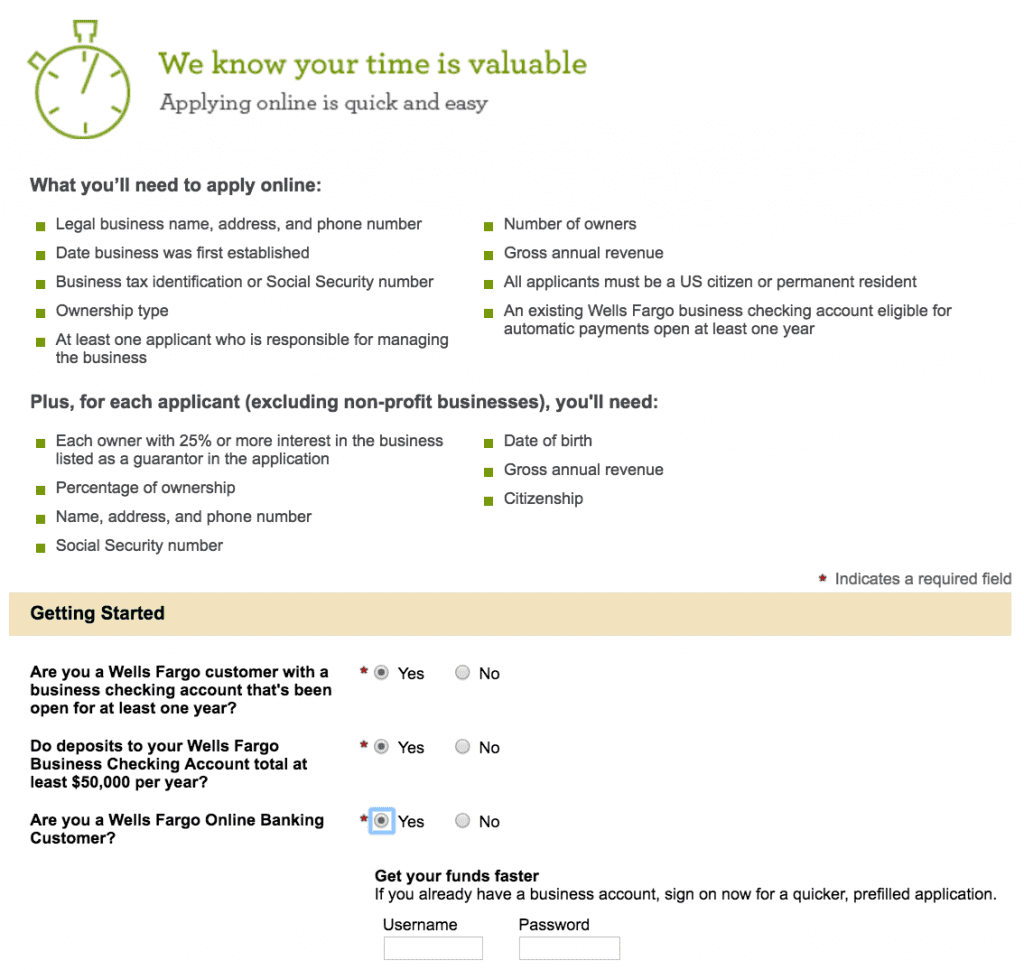

The loans are currently only available to Wells Fargo customers who have had a business deposit account for 1 year or longer. Another advantage that Wells Fargo has is that they already have the have transactional data on the small business, allowing them to make a better underwriting decision.

The representative we spoke to at Wells Fargo noted that the new product builds on what Wells Fargo already does. In addition to a loan, they want to extend support that small business owners need. A part of this is the Wells Fargo Works website which provides resources to small businesses on a variety of topics, one of which is getting them ready for credit. Small business lending is something that is not new to Wells Fargo, having lent more dollars to small businesses than any other company for 13 consecutive years.

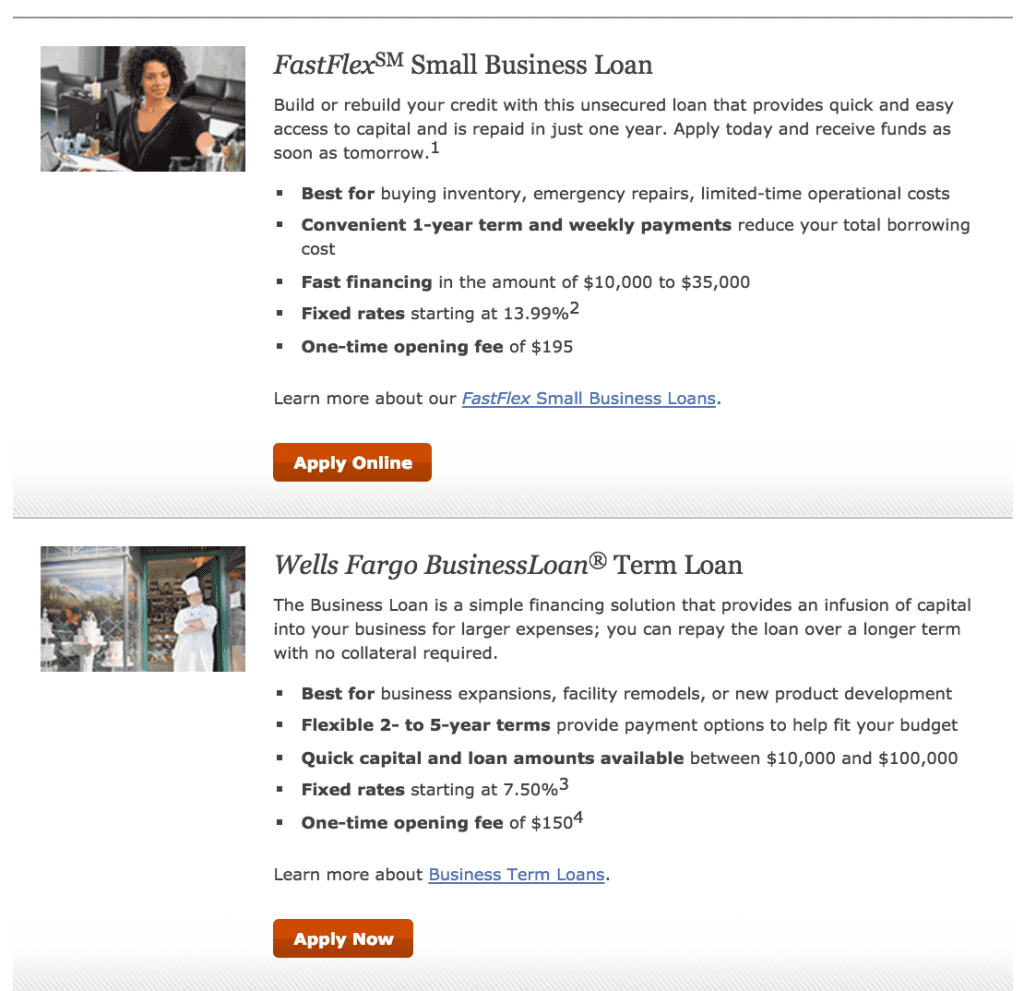

FastFlex offers loan amounts from $10,0000-$35,000 at APRs between 13.99% and 22.99%. Borrowers will pay a $195 account opening fee, which is a flat fee charged for obtaining a loan. These loans currently carry a term of 1 year with payments on a weekly basis that are automatically deducted from the small business account.

Information about the FastFlex loan is available on the Wells Fargo website and also within your small business account. When selecting the Open an Account tab there is a section titled Business Loans which outlines two products, the new FastFlex loan and the BusinessLoan term loan.

Once selecting FastFlex, the information they will need is outlined at the beginning of the online application process.

While we didn’t go through the entire process of applying for a loan, what they have built looks promising. The ease of applying for a loan with an institution that you already have a relationship with is going to appeal to many small business borrowers who may not want to spend the time to shop around.

Conclusion

It certainly has been an interesting year as many banks have announced their plans around online lending. While those who choose to build their own product have a different business model from the marketplace lenders, the goal is the same: to provide access to credit via a completely online process. Whether a borrower applies online directly with a bank like Wells Fargo or one of the marketplace lenders it’s great to see expansion in providing small businesses access to capital.

As of yet, there has been no distinct trend among the biggest banks. Goldman Sachs and now Wells Fargo have decided to build their own products while JP Morgan has decided to partner with small business lender OnDeck. It will be interesting to see how the new Wells Fargo product plays out and is received by their small business customers.