One of the problems with making loans like BNPL such a standard part of the checkout is that they are SO easy. One may lose track of the payments and the amount of loans one has on the go.

Fifty dollars every two weeks for those sneakers may not sound like a lot, but then times that by five… or ten… things can start to get out of hand. This could be particularly problematic for those who already have low credit scores, BNPL’s most prolific users. Not only could a late payment drive their score down even further, but for those who are already “financially fragile,” losing track of the amount of loan installments could create a worsening cycle of debt.

Already, more than half of BNPL users have fallen behind on payments. As the sector is set for 157% growth by 2027, the situation could get a lot worse and quickly.

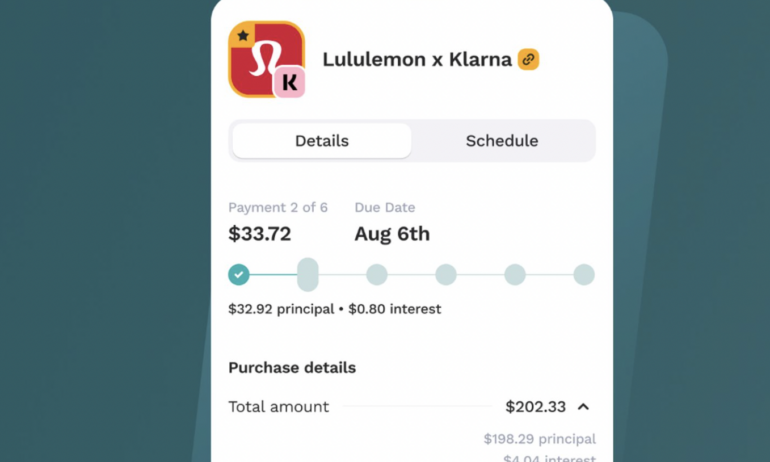

So Cushion has come up with a novel idea – instead of adding to the rising number of BNPL providers, why not create a platform to organize the ones consumers already have?

Now, this sounds simple, but most BNPL providers use phone-based authentication instead of accounts, making them difficult to scrape. Many of them also don’t report to credit bureaus, creating a false view of the consumers’ credit profile. So, how does one get an understanding of what BNPL loans and where?

Consumers’ inboxes – which in itself requires a whole other set of audits. So today’s featured article is not only a story of innovation and perseverance to try to help consumers make sense of the varied payment options they have today, but also can be seen as a comment on the BNPL sector’s approach to consumer protection.

Yes, its ease of access has opened credit out to a whole new demographic of people who are often left out of the credit system – fantastic. But as the use of BNPL evolves into a payment option for everyday purchases, perhaps the ease of access without many guardrails is creating a worsening issue for the consumers the sector seeks to serve.

FEATURED

Keeping track of multiple BNPL loans? There’s an app for that.

Cushion CEO Paul Kesserwani felt overwhelmed when he tried to keep track of several BNPL loans at once, so he shifted his fintech’s focus to help others in the same boat.

FROM FINTECH NEXUS

Amidst Market Turmoil, Fiat Advisory Marketplace is Born

Long Take: How Decentralized Physical Infrastructure (DePIN) impacts finance and the machine economy

When do the robots take over, we are ready already

PODCAST

Podcast: MoneyLion’s evolution from neobank to finance super app, with CMO Cynthia Kleinbaum Milner

Listen now (43 mins) | Hi Fintech Architects, Welcome back to our podcast series! For those that want to subscribe in your…

EDITORIAL CARTOON

WEBINAR

Trends in digital lending for 2024: AI, automation, embedded finance and more

Oct 10, 9am EDT

As we begin to look to 2024, we can expect technology to continue to have a profound impact on consumer lending. While there…

ALSO MAKING NEWS

- Global: Apple’s Next Big Play: PFM Meets Payments.Apple recently announced the soft-launch of a new feature allows users to view their current account, or checking account for all the Americans, balance.

- Asia: Ant Group creates an everywhere Asia mobile payment ecosystemI haven’t written about Ant and Alipay for a while, but did notice this press release the other day which is significant. The company is is now creating a payment ecosystem for Asian e-wallets. It’s not just Chinese. It’s everywhere Asia.

- Global: Twitter And Ticks, Payments And PersonsSince there is no IS-A-PERSON credential that X can ask for, banks can’t charge them for it. But suppose there was such a credential? Then it would be a win-win.

- USA: How banks are using augmented realityAlly Financial and Workers Credit Union say they’ve successfully infused marketing campaigns with AR to hype their brands and communicate their corporate values even as skeptics question whether customers are clamoring for the technology.

- Global: Coinbase Rolls Out Futures Trading for Retail Crypto Traders GloballyThe crypto exchange has set its sights on global expansion amid ongoing legal challenges from the SEC in the U.S.

- USA: OCC taps agency insider to head new fintech officeDonna Murphy, who is also the deputy comptroller for compliance risk policy at the OCC, took over the unit in September. An OCC spokesperson declined to comment on the former CFTO’s exit.

- UK: PayPal and financial super app Curve are partnering to enable users to use PayPal in brick-and-mortar stores.Curve has teamed up with PayPal to offer customers the ability to spend with their PayPal account everywhere Curve Mastercards are accepted.