The following is a guest post by Dmytro Spilka, Head Wizard at Solvid.

Following a solid start to 2023, investors are beginning to grow in confidence that a prosperous period for bitcoin is on the horizon.

However, with many market commentators anticipating rallies beyond $100k over the coming years, what has made everyone so bullish on bitcoin again?

“Professional investors are forecasting a strong year ahead for bitcoin and are confident about its long-term valuation,” reported a recent Nickel Digital Asset Management survey. “Nearly nine out of 10 professional investors predict bitcoin price rise this year. Two out of three agree $100,000 valuation is possible but only for long-term investors.”

The report suggested that bitcoin’s price is expected to rise exponentially within the next three-to-five years. As much as 65% of institutional investors surveyed agree that bitcoin could hit a value of $100k in the long term, with 58% suggesting a three-to-five-year time frame, while 25% said it would take longer than five years.

However, expectations for 2023 appear to be lower, with 23% of investors anticipating that bitcoin will exceed $30,000 by the end of the year.

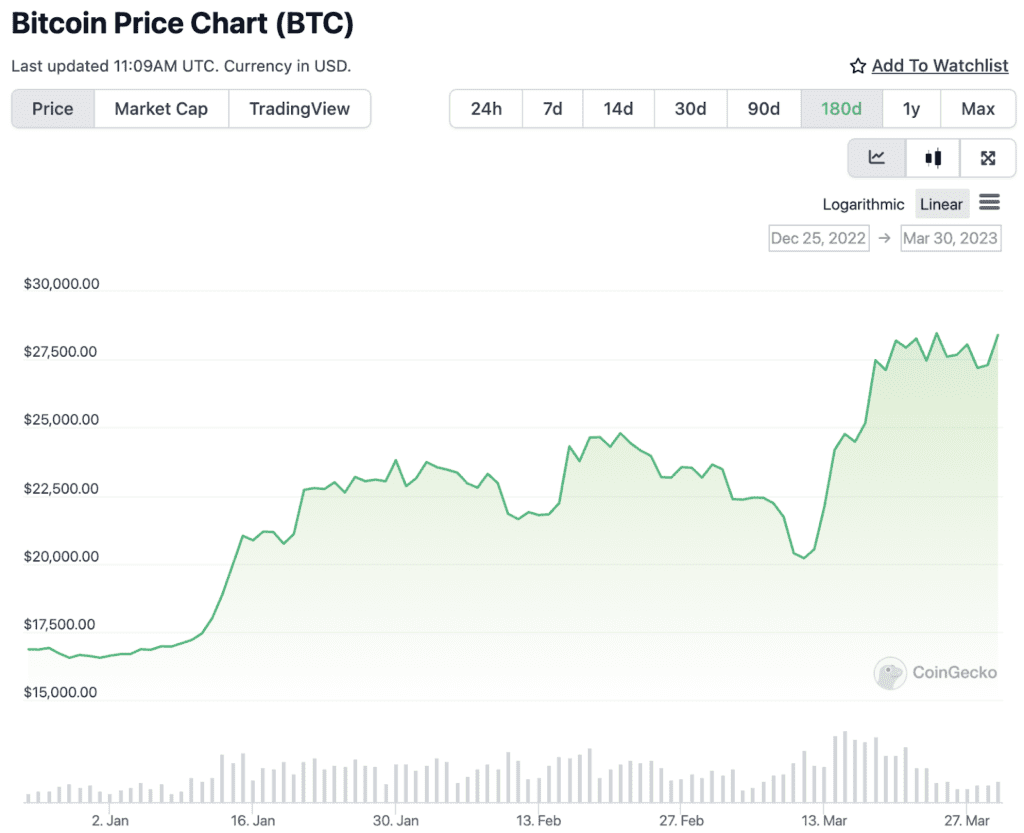

With CoinGecko data showing that bitcoin’s price has already accelerated from $16,450 towards $28,000 by the end of Q1 2023, it could yet be seen that Nickel’s survey results for 2023 expectations end up being a little more conservative than reality.

But what about expectations for exceeding $100k over the coming years? Could BTC really rally towards six-figure valuations? Let’s take a deeper look into why investors are so confident that a bitcoin comeback is on the way:

Great expectations for bitcoin’s halving

The key reason behind the optimism for bitcoin’s future price rallies revolves around the asset’s cyclical halving events. Approximately every four years, bitcoin is programmed to halve the rewards it distributes to miners by 50%.

This mechanism helps control BTC’s inflation rate and emulates the asset’s scarcity in line with precious metals like gold.

With bitcoin’s current halving reward at 6.25 BTC distributed per block, the next halving event will decrease rewards to 3.125 BTC per block mined. This actively creates a deflationary environment for bitcoin and has the power to increase its scarcity–provided sufficient demand still exists actively.

Crucially for investors, bitcoin’s previous halving events in 2012, 2016, and 2020 have all preceded seismic market-wide bull runs that culminated in a new all-time high value for the cryptocurrency.

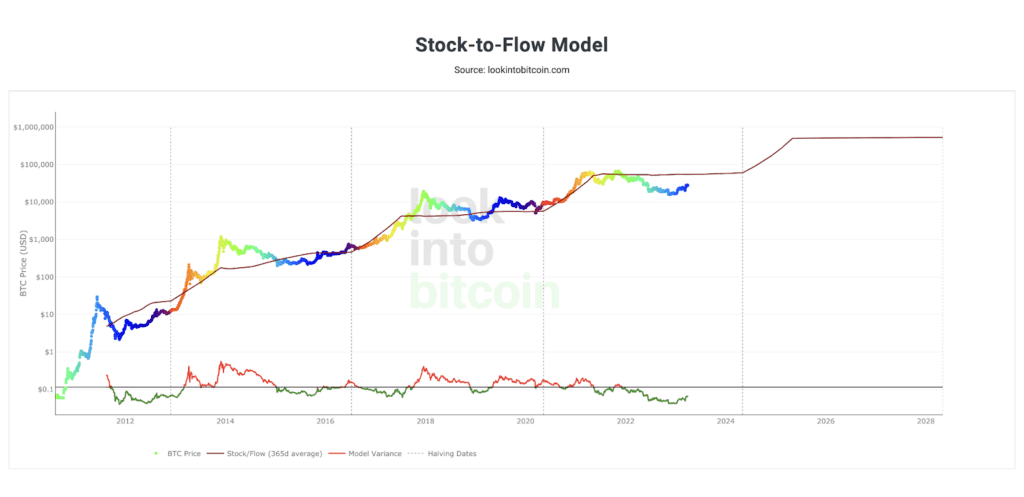

One of bitcoin’s most heavily-used visualizations when anticipating the coin’s halving cycles is the coin’s stock-to-flow model. This assesses how BTC has performed with its halving events, with each event drawn into the chart.

In the wake of bitcoin’s 2016 halving, the asset climbed to a new all-time high value of $19,783.21 in December 2017. Following the coin’s 2020 halving event, an eventual all-time high of $69,044.77 was reached in November 2021.

With bitcoin’s next halving event likely to occur in April 2024, much of the cryptocurrency market will be firmly braced for action throughout 2025 in anticipation of a similar all-time high-breaking bull run.

Anticipating regulations

Even bitcoin’s most avid supporters will likely agree that the regulatory landscape will play a key role in deciding the scale of any future rally.

The recent collapse of FTX has caused more key players to call for stronger cryptocurrency market regulations to protect investors. While this can be difficult for cryptocurrency investors who believe in the power of genuinely decentralized assets that operate independently of external influences and regulators, the move may positively affect the market.

“The industry is steadily moving towards regulations globally. Country-specific laws are being drafted to protect investors from market uncertainties, obliterate security risks, and prevent any impact on the monetary system should the crypto industry go through a rough period,” says Rajagopal Menon, vice president of cryptocurrency WazirX.

While the demise of FTX has hurt many investors, a new regulatory environment could be a reliable means of whittling out the industry’s less sustainable players.

However, the cryptocurrency landscape could benefit from innovating its way to greater stability alongside implementing calming regulatory measures.

One such solution is SKARB, an institutionally-focused trading terminal that enables widespread change in how institutions navigate the cryptocurrency ecosystem.

SKARB helps mitigate the prospect of institutions facing future events like FTX by unifying multiple exchanges and market makers within one UX.

This unified approach comes with vast benefits and helps institutions to avoid the risks associated with liquidity issues among cryptocurrency exchanges. This will actively aid institutions by minimizing the dangers of counterparty risk by allowing you to diversify your exposure across multiple counterparties while keeping your trade workflow unified.

Related:

SKARB’s unified platform allows institutions to trade effectively across multiple venues while consolidating their trading and reporting experience and establishing a more effective trade monitoring, compliance, and overall trade workflow.

This tool carries significant ramifications for the crypto regulatory landscape because it can provide far greater levels of institutional trust, which can help to ensure that organizations are better prepared against the prospect of troubled exchanges.

Dealing with unpredictability of economic landscape

Perhaps bitcoin’s biggest challenge relates to the ongoing difficult economic conditions throughout global economies. Although the coin’s halving cycles can generate plenty of momentum, it’s worth acknowledging that the path to bitcoin’s most recent all-time high in November 2021 coincided with a significant growth period for global tech stocks, particularly those on Wall Street.

These links with traditional financial markets historically follow bitcoin, meaning that the risk of recessions in 2023 could negatively impact BTC and the broader crypto market.

“If concerns about growth intensify, then crypto assets might struggle to sustain this recovery,” said Fawad Razaqzada, market analyst at City Index, in an interview with Markets Insider.

However, Nasdaq has reported that bitcoin has begun to show a negative correlation in comparison to the S&P 500 Index in recent weeks for the first time since the FTX collapse, indicating that these market links may be weakening.

While it’s undoubtedly worth exercising caution when investing in cryptocurrencies, signs of growing market sentiment towards bitcoin ahead of next year’s halving event seem familiar when remembering the events of 2020 and 2021.

Although the relationship between BTC and the S&P 500 could be gradually decoupling, it’s worth assessing how the cryptocurrency markets respond to upcoming economic challenges in traditional finance.

Whether investors are right to be optimistic about bitcoin reaching $100,000 remains to be seen. Still, in a market where unpredictability reigns supreme, it’s always safe to brace for the unexpected.