In 2011 the World Bank released the first ever Global Findex Database as “the world’s most comprehensive data set on how adults save, borrow, make payments, and manage risk”. A new database was release based on 2014 data and last week the 2017 edition was released. The full database (in Excel format) and the summary and detailed report are all available for download here.

This is important work because it is the only in depth research of its kind that reaches to all corners of the globe. Here is the methodology quoted from the report:

Compiled using nationally representative surveys of more than 150,000 adults age 15 and above in over 140 economies, the 2017 Global Findex database includes updated indicators on access to and use of formal and informal financial services. It has additional data on the use of financial technology (or fintech), including the use of mobile phones and the internet to conduct financial transactions.

The Most Important Findings

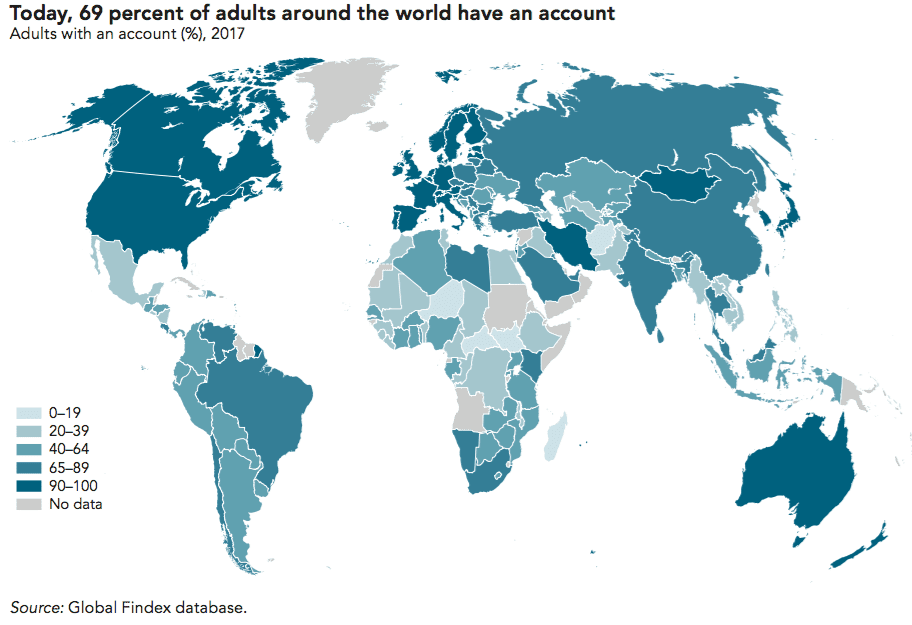

One of the most interesting findings is that an additional 515 million people have opened some kind of financial services account between 2014 and 2017. This means that 69% of adults globally (around 3.8 billion people) now have an account, up from 62% in 2014 and 51% in 2011. This is an astounding change and one, I believe, that speaks to the growth of fintech around the world. Over the last six years it has become much easier to open an account digitally with both banks and non-banks.

What is even more interesting is that of the 1.7 billion adults who remain unbanked around two-thirds own a mobile phone. Now, this would not be a smartphone in most circumstances but many financial services are available on text-only flip phones. In China 82% of those people who are non-banked have a mobile phone, in India and Mexico it is more than 50%. This does speak to the potential to continue to increase the numbers of people with some kind of bank account in the coming years.

Half the respondents to the survey reported borrowing money in the past year. But the way they did so differed widely between developed and developing economies. As you can see in the graph above most consumers in developed countries borrower money through the formal financial system whereas in developing countries the biggest category was through family and friends.

The use of cash is still prevalent throughout the world. Globally, a billion adults who have an account still use cash to pay utility bills. This includes large swathes of people in the developed world where cash is still surprising popular (except in the Nordic countries).

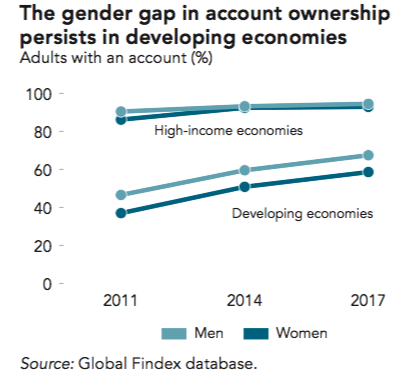

One other important issue this report tackles is gender equality when it comes to access to financial services. There is definitely still a gender gap with 72% of men and 65% of women having some kind of financial account. As you can see in the graphic the gap is much higher in developing countries. Interestingly, this gap has not changed meaningful since the 2014 report.

Fintech is One of the Keys to Financial Inclusion

While the subtitle for this report is “Measuring Financial Inclusion and the Fintech Revolution” the authors make it clear that fintech, while an essential ingredient in the progress towards better inclusion, is not a panacea. Broader use of mobile phones helps a great deal but more is needed. From the report:

To ensure that people benefit from digital financial services requires a well-developed payments system, good physical infrastructure, appropriate regulations, and vigorous consumer protection safeguards.

I look at the work that fintech companies like Lenddo, Juvo, Tala, Branch and many others are doing around the world to attack financial inclusion head on and I am encouraged. They are looking at complex problems in new ways and working to make a real difference.

While we have made tremendous strides there is a still a big opportunity to expand access to financial services for the unbanked. This report from the World Bank highlights both how far we have come as well as how much more needs to be done.